What Are the Best Bonus Earning Rates for Hotel Programs?

I sometimes get emails asking me about the best hotel loyalty program, which is really hard to answer because there’s so much that goes into answering that question. One aspect

I sometimes get emails asking me about the best hotel loyalty program, which is really hard to answer because there’s so much that goes into answering that question. One aspect

The Citi Hilton Reserve and Amex Hilton Surpass are two of the most valuable hotel credit cards. They offer two different, yet very valuable bonus offers and either one could

Air New Zealand recently offered passengers the “chance of a lifetime” to see the Southern Hemisphere’s version of the aurora known as the “southern lights.” Led by Otago Museum director Dr

Update: Some offers are no longer available — click here for the latest deals! If you’ve been sitting back on the Amex Hilton cards and waiting for the best time to

A “Platinum status challenge” is a promotion that Marriott offers to select members to allow them to obtain Platinum status from Gold by hitting a specific number of stays within

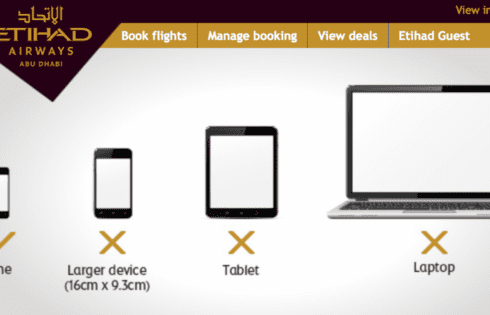

The UK and the US will both be imposing bans on certain electronics starting March 25th, 2017, for flights departing from certain airports in the Middle East and North Africa.

This article contains an expired offer. A new targeted offer for the Marriott Rewards Credit Card is making its way around via email and it’s offering an upgraded sign-up bonus

Mobile Passport Control is the new kid on the block everyone is trying to find out more about. It’s a new program launched by U.S. Customs and Border Protection (CBP)

The IHG Rewards Credit Card probably doesn’t get as much attention as it deserves but that shouldn’t stop you from applying. As you’ll see, it comes with a solid sign-up

British Airways’ parent company, International Airlines Group (IAG), launched its new low cost carrier called “Level” that will serve a number of transatlantic routes. This is IAG’s fifth major airline in

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |