Amex Platinum Lounge Access Guide (Global Lounge Collection) [2024]

Offers contained within this article maybe expired. The Platinum Card from American Express is the best credit card for lounge access, at least in my opinion. Many people only think

Offers contained within this article maybe expired. The Platinum Card from American Express is the best credit card for lounge access, at least in my opinion. Many people only think

Advertiser Disclosure: UponArriving has partnered with affiliate partners and may receive a commission from card issuers. UponArriving does not display all credit card offers and affiliate relationships may impact how offers

Advertiser Disclosure: UponArriving has partnered with affiliate partners and may receive a commission from card issuers. UponArriving does not display all credit card offers and affiliate relationships may impact how offers

The Southwest Rapid Rewards® Priority Credit Card is loaded up with some interesting benefits like a travel credit, upgraded boardings, and right now it comes with a very solid limited-time

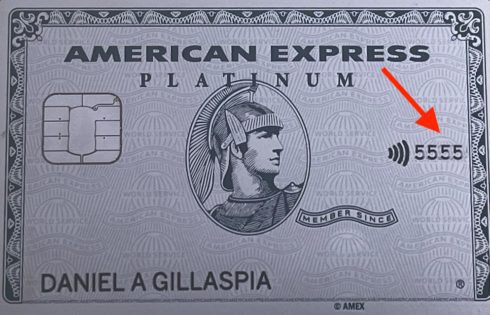

When it comes to finding your security code for your American Express card, things aren’t always so straightforward, especially if you are used to other cards like those from MasterCard

Capital One has some of the best credit cards out there. The only problem is that sometimes you are not given a credit limit big enough for your spending needs

At some point you might consider downgrading, product-changing, or cancelling your Chase Sapphire Preferred card. There are a number of factors that you want to consider before deciding which route

Getting an Amex credit limit increase is pretty straight forward. However, there are a few things you should know like how big of an increase you should request and how

Sometimes you get to a point where you just no longer need a credit card. In those instances, you might be very tempted to proceed with canceling your card. However,

The Chase Sapphire Reserve is one of the hottest premium credit cards with a number of solid perks, including Priority Pass airport lounge access. I’ve used its Priority Pass membership

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |