Getting an Amex credit limit increase is pretty straight forward. However, there are a few things you should know like how big of an increase you should request and how long you need to wait before requesting your increase.

This article will walk you through everything you need to know about American Express credit limit increase requests.

Table of Contents

What is an Amex credit limit increase?

An Amex credit limit increase is an easy (and sometimes instant) way to increase the spending limit on your credit card by increasing the amount of available credit you have access to.

Tip: Use the app WalletFlo to give you auto-reminders of when to request credit limit increases!

Why would you want an increased credit limit?

There are a few reasons why you might want to increase your credit limit.

Increased spend power

An increased credit limit has the obvious benefit of increasing your spending power.

With a higher credit limit, you will obviously be able to make larger purchases and spend more on your card. This is great if you have spending discipline and will not be tempted to spend more than you can pay back.

Increasing your credit score

Getting a credit limit increase is also a great way to decrease your utilization and therefore raise your credit score. Utilization is 30% of your FICO credit score and it is based on how much of your total credit limit that you are using.

So for example if you have a $10,000 total credit limit and you are using $5,000 of that $10,000 limit, then your utilization is 50%. You typically want your utilization to be under 30% although I recommend to keep it under 10%.

By getting a credit limit increase you can decrease the percentage of your credit limit that you are using (i.e., your utilization) and therefore lower your utilization and improve your credit score. This is one of the easiest ways to instantly boost your credit score.

How do you get an Amex credit limit increase?

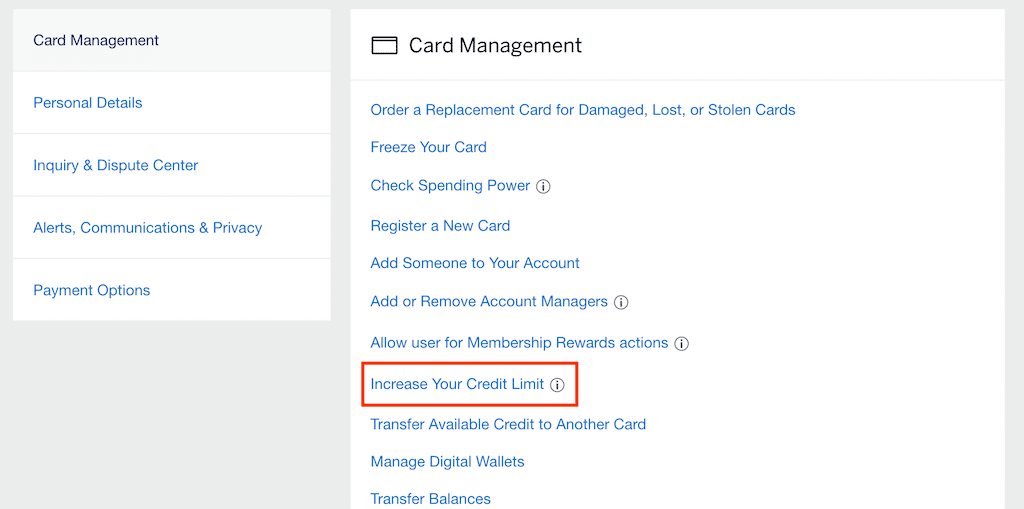

To request an Amex credit limit increase, log-in to your online account and click on “Account Services.”

Next click on “Increase Your Credit Limit.”

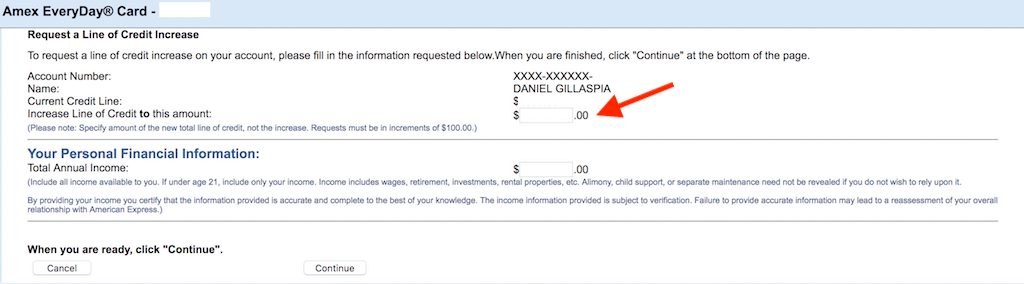

You’ll be taken to a screen where you’ll need to enter in details to process your request.

Verify your card

On this screen, first verify that you’re requesting a credit limit for the right Amex card. You’ll see the name of the card and the last five digits of the card in the top left corner of the screen, as well as in the middle of the screen.

Enter your new proposed credit limit

You’ll be able to see your current credit limit for that card and then there will be a field for you to enter in your proposed new credit limit. Note that you are entering the amount for your desired total credit line for that card not the amount of the credit limit increase.

So for example if you have a $5,000 credit limit and you would like it increased to $10,000 then you should enter $10,000 in that field.

Related: What Does Amex’s “Member Since” Date Really Mean?

Verify your income

You’ll also be asked to verify your annual income. You usually will not be required to submit verifying documents for your income but once you start requesting higher credit limits, the odds of being forced to send in tax documents increase, so keep that in mind. This is especially true if you don’t have a long history with American Express.

(Typically, you may need to start submitting documents when your credit limits approach $25,000 and beyond.)

Also, note that income includes wages, retirement, investments, rental properties, etc. Alimony, child support, or separate maintenance need not be revealed if you do not wish to rely upon it.

If you are 21 years or older you can include all income available to you. This is known as “accessible income” and you can read more about that here.

When you are finished, click “Continue” at the bottom of the page.

You might be instantly approved for a credit limit increase or you might have to wait to hear back from Amex.

How soon can I increase a credit limit increase?

You can request a credit limit increase once your account has been opened for at least 60 days. There are some reports of people having to wait 90 days now so you might need to wait a little longer if you want to be safe.

However, if you’ve had a card with American Express for at least six months, you might be able to request a credit limit increase as soon as you’ve been approved for your new card — some have been able to request a credit limit increase within 60 days of opening their cards.

How much of a credit limit increase can I get?

Typically, the maximum you’ll get from a credit limit increase is 3X your current credit limit. You can find many reports online of customers receiving 3X increases on their credit limit (or near 3X increases). So if you have a $5,000 credit limit, the max you will likely be allowed is a $15,000 credit limit (or a $10,000 increase).

Generally speaking, it is better to ask for more than you need because a lot of times banks will meet you in the middle. So if you have a $2,000 credit limit and you would like to be increased to $4,000 then I would probably ask for an increase to a $6,000 credit limit, while being completely prepare to only get an increase to $4,000.

How often can I get credit limit increases?

If you were approved for a credit limit increase you can try to request another increase six months later but note that getting approved for a second credit limit increase is often more difficult the second time around.

If you’ve had a substantial rise in your income then you’ll probably stand a much better chance of having success. So be sure to update your income appropriately when you make your second request.

What Amex cards can I request a credit limit increase for?

Credit limit increases for charge cards

Credit limit increases are for credit cards and not charge cards. In case you are not familiar, American Express has several cards that they issue known as “charge cards.”

These are cards that don’t have a preset spend limit and are intended for you to pay off the entire balance each month.

Examples of American Express charge cards are:

- The Platinum Card

- The Business Platinum Card

- The Gold Card

- The Business Gold Card

- The Green Card

The interesting thing about charge cards is that sometimes American Express grants something called “Pay Over Time.” This is a perk that allows you to carry a balance on a charge card much like you could carry a balance on a credit card.

With Pay Over Time, you get an “effective credit limit” aka a “spend limit” and that spend limit can grow over time. The best way to increase the credit/spend limit for a charge card is to simply gradually increase your spend over time. Eventually, American Express will note your spending habits and recognize that you are in need of a spend limit increase.

You can also pre-pay your purchases on a charge card and that will free up your credit limit for that card. So for example, if you have been limited to $10,000 for your spending limit, you could make a $5,000 payment before you make any purchase and your new effective credit limit would be $15,000.

Credit limit increases for personal and business credit cards

Credit limit increases can be requested for both personal and business credit cards. Here are some popular Amex cards that you might request a credit limit increase for:

- American Express Cash Magnet Card

- Amex EveryDay Credit Card from American Express

- The Blue Business Plus Credit Card from American Express

- Blue Cash Everyday Card from American Express

- Blue Cash Preferred Card from American Express

- Gold Delta SkyMiles Credit Card from American Express

- Gold Delta SkyMiles Business Credit Card from American Express

- Hilton Honors American Express Surpass Card

- The Hilton Honors American Express Business Card

- Platinum Delta SkyMiles Business Credit Card from American Express

- SimplyCash Plus Business Credit Card from American Express

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Amex Credit Limit Increase FAQ

After requesting your credit limit increase, you might receive a 7 to 10 day message. This often means that you will be denied your requested credit limit increase but not always.

If you’d like to call in to check on the status of your credit limit increase you can call 800-567-1083 or 866-314-0237. They may or may not be able to tell you conclusively about the decision.

If Amex does not honor your request for a credit limit increase, all of your hope is not lost. You’ll just need to wait 90 days to try the process again.

They should tell you why your request was denied and those reasons will usually be the same type of reasons for denying a normal credit card application (e.g., too many hard inquiries, too high of utilization, etc.). So pay attention to why you were denied and try to adjust those factors before you apply again.

Amex will perform only a soft-pull on your credit report when you request a credit limit increase.

This is great because a hard pull would result in a temporary drop in your credit score but a soft pull will have no effect on your credit score. Because of this, many people request these credit limit increases without thinking too much about it.

Yes, Amex, like some other issuers, will automatically increase credit limits from time to time. If you regularly use a lot of your credit limit and then pay off that balance, you might be increasing your odds of getting an auto credit limit increase.

The trick here is to come very close to your credit limit each month and pay off that entire balance. Spending habits like that send a clear message to the bank that you need more credit and that you can responsibly manage your credit by paying off your balance each month.

Because Amex will not conduct a hard pull on your credit report, you really have nothing to lose by requesting a credit limit increase.

The only people who have anything to worry about are those people that fabricate their income because Amex could request them to verify that income and that could lead to an interesting situation where credit limits could be lowered.

So it goes without saying, never lie about your income on a credit card application.

Yes, many other issuers will allow you to request a credit limit increase and you can read about their policies below:

Barclays

Capital One

Chase

Citibank

Final word

Amex credit limit increases are easy to request and I would recommend people consider getting them in order to increase their spending power and also lower their utilization. Just make sure you’re aware of all of the timing restrictions since there are several of them.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

thks for the informative input on cli req i feel more at ease now to req a cli on my american exp acct like you said i have nothing to lose well except mayby they might lower my credit limit because of income should i be worried its worth a try thks