Sometimes you just need a little bit more spending power on your credit cards and a credit line increase is a perfect way to get that.

The thing is, it’s not always clear how much to ask for with a credit line increase and sometimes you don’t know if your request will result in a hard inquiry or soft inquiry on your credit profile.

In this article, I’ll break down everything you need to know about getting a credit line increase with Barclays.

Table of Contents

Barclays credit line increase rules

Before requesting a credit line increase, you likely want to wait six months from the date of account opening.

This is because Barclays, just like most other banks, likes to get a sense of your spending and payment habits before issuing a credit line increase.

However, there are data points out there showing people waiting only one month and successfully getting a credit line increase.

If you requested a credit limit increase but were rejected, you can request one again in as soon as one month although it might be better to wait until your credit score has improved.

If your credit line was decreased you may have to wait six months from that time to request an increase.

Tip: Use the app WalletFlo to give you auto-reminders of when to request credit limit increases!

How to request a Barclays credit line increase

There are three ways to request a credit line increase with Barclays:

- Online

- Phone

- Chat

I’ll detail how to request an increase online below but if you want to request a credit line increase via phone, the customer service phone number is 1-866-928-3075.

If you can’t get through immediately, you may also try: 1-866-603-7217 or just simply called the number on the back of your card.

The benefit of requesting a credit line increase over the phone is that you might be able to speak to a supervisor and convince them to perform a soft pull on your credit for the increase.

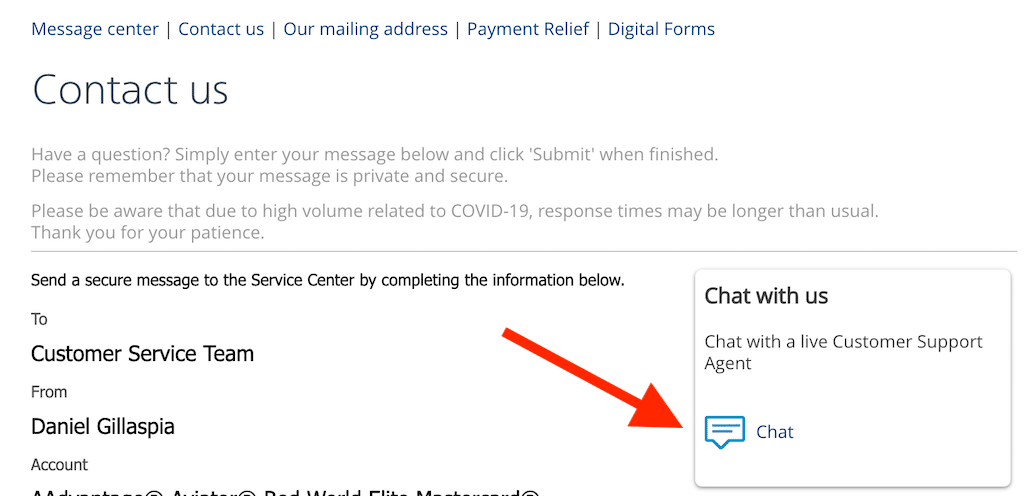

If you want to request a credit line increase via chat, simply log into your account and then click on “contact us” located at the top of the screen. Then just simply click on “chat” and that will prompt the chat box.

You can enter “I would like to request a credit line increase” and an agent should respond shortly to help you with your request.

You can also pull up the chat feature via the Barclays mobile app.

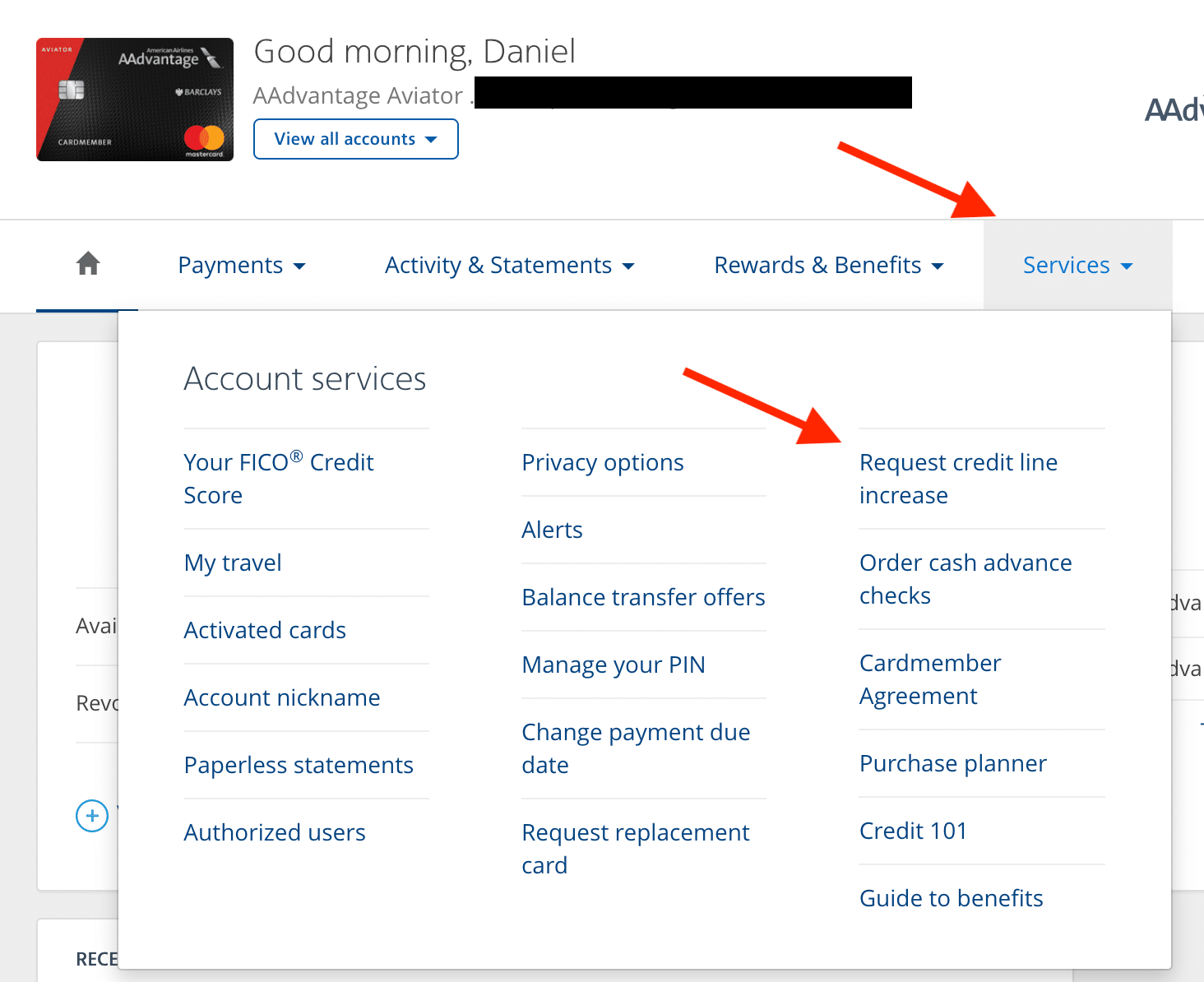

To request a credit limit increase online, simply log into your account and then click on “Services.” A drop-down menu will appear and simply click on “Request credit line increase.”

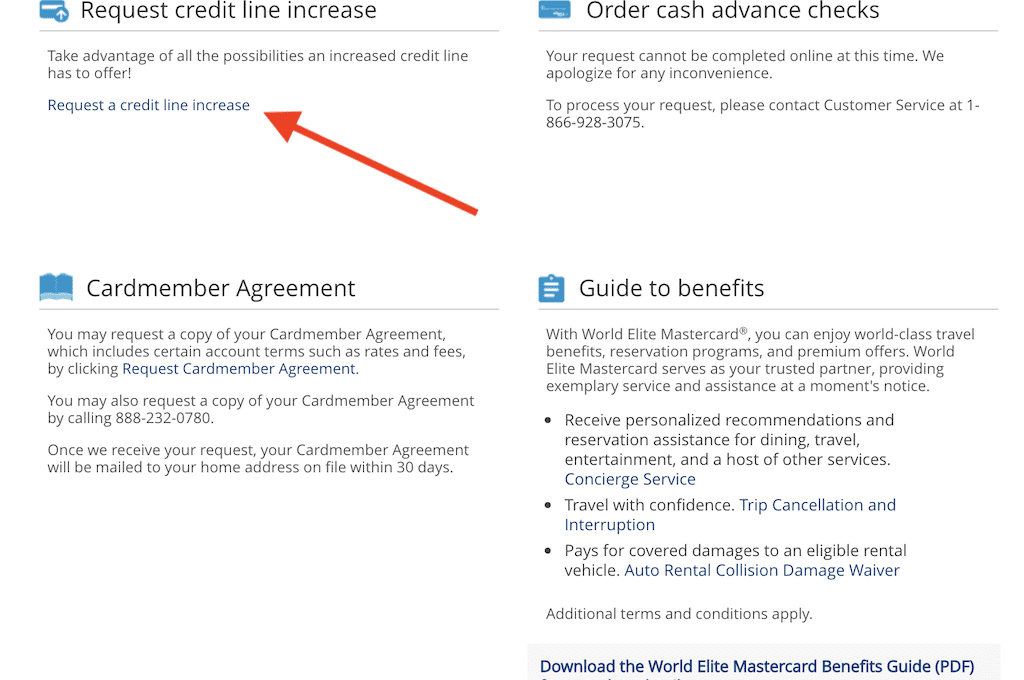

Once you click on that, you will need to click on one more button to access the online application form. The page should automatically re-position and you just need to click on “Request a credit line increase” one more time.

After that, you will have access to the online application form where you can finalize your request.

Barclays credit line increase online application

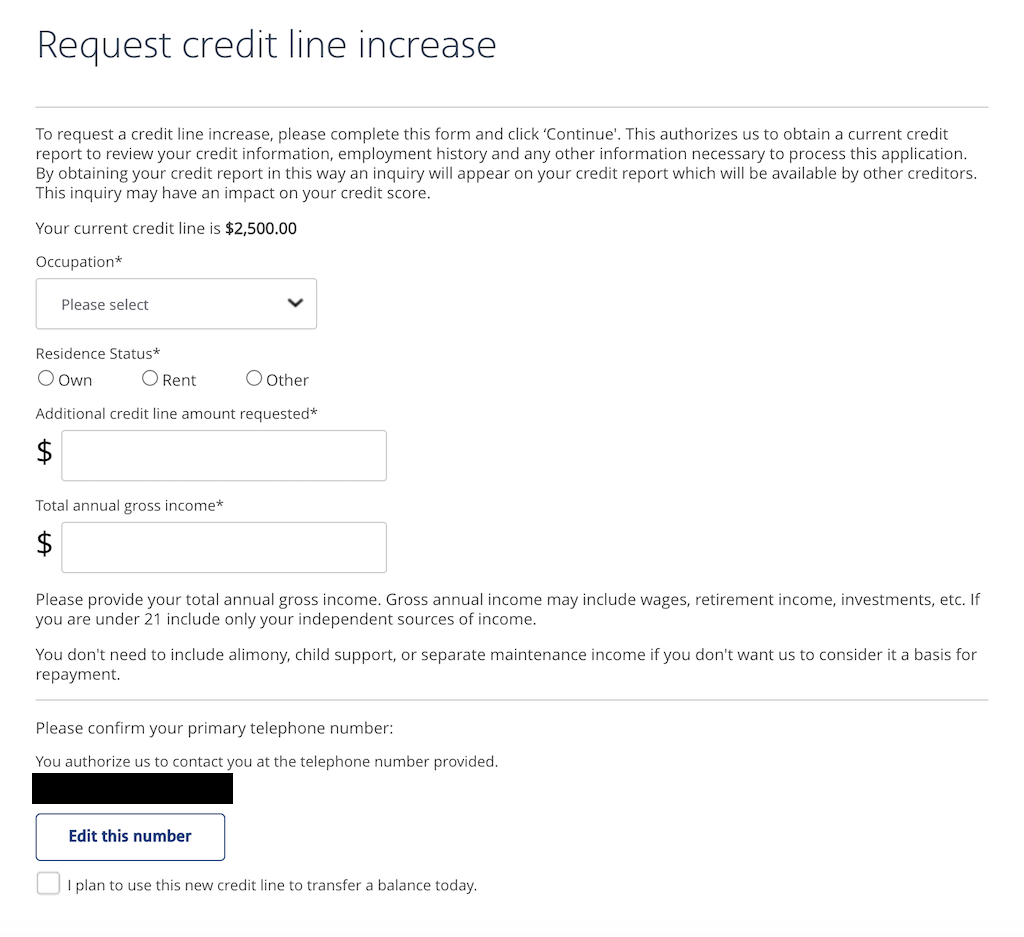

The credit line application form will ask you to fill out the following information:

- Occupation

- Residence Status

- Additional credit line amount requested

- Total annual gross income

Occupation

You simply need to select an occupation that fits you best from the drop-down menu.

There is an “other/not listed” option if you can’t find your occupation or are not sure what to select.

Residence Status

You will need to select whether you rent, own, or have a different type of set up. Unlike some other applications, they do not ask you to input the amount of monthly rent or mortgage payments.

Additional credit limit requested

This is where you will input the additional line of credit you are interested in. If your current credit limit is $2,000 and you want to be increased to a total credit limit of $3,000, then you would input $1,000 here.

Income

It’s very important to remember that you can include accessible income if you are 21 years or older.

Accessible income is basically income that is reasonably available to you such as income from your parents that is regularly used to help you with bills or that goes into your account.

Gross annual income may include wages, retirement income, investments, etc. If you are under 21 include only your independent sources of income.

You don’t need to include alimony, child support, or separate maintenance income if you don’t want Barclays to consider it a basis for repayment.

After you submit your details, you might instantly receive a credit line increase or your request might go under review. If it goes under review, it could take several business days for you to get a response.

Generally, I would follow up by calling one of the customer service phone numbers above if I did not hear anything in one week.

Hard pull or soft pull?

The standard seems to be that if you request a credit limit increase, that will result in a hard pull. But if you receive an automatic credit limit increase that will come from a soft pull.

The language on the credit line application form seems to suggest that you should be prepared for a hard inquiry:

To request a credit line increase, please complete this form and click ‘Continue’. This authorizes us to obtain a current credit report to review your credit information, employment history and any other information necessary to process this application. By obtaining your credit report in this way an inquiry will appear on your credit report which will be available by other creditors. This inquiry may have an impact on your credit score.

However, there are mixed data points out there regarding whether or not a credit limit increase will be a hard pull or a soft pull.

For example, here is someone reporting that they requested a credit line increase and after their limit was increased (from $2,500 to $3,500) they did not receive a hard pull.

Sometimes banks will not do hard pulls for credit limit increases in lower amounts such as $500 or $1,000. But if you wanted a significant increase such as $5,000 that could result in a hard pull.

Again, if you are very concerned with avoiding a hard inquiry, consider calling customer service and asking about soft inquiry credit limit increases.

How much of a credit line increase to request?

The million dollar question is always how much of a credit limit increase should I go for?

I think requesting a ~25% increase is generally a conservative approach. If you want to be more aggressive you can shoot for something closer to 50%.

Here are some self reported data points of prior credit line increases with Barclays:

- $2,500 to $3,500

- $500

- $1,500 (auto)

- $500, $2,000, $2,500

- $5,000 to $7,200 (auto)

Many people feel like Barclays is stingy with credit limit increases. Therefore, you may want to lower your expectations, especially when it comes to your first credit limit increase request.

Credit line increases with other issuers

You might also be interested in reading about getting credit limit increases with other issuers.

Barclays Credit Line Increase FAQ

Yes, you can be instantly approved for a credit limit increase.

You can request a credit line increase for any card issued from Barclays including popular cards like the Aviator Red, Wyndham Rewards Visa, Uber Credit Card, etc.

Yes, it is possible that sometimes Barclays will automatically increase your credit line after you have had the account open for a while.

Final word

As you can see, it’s pretty easy to get a credit line increase with Barclays. You can do this in a matter of minutes online, over the phone, or via chat.

If you are requesting a credit limit just be prepared for a potential hard inquiry on your credit report. Also, be mindful of the minimum waiting time periods so that you are eligible for an increase.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.