Capital One has some of the best credit cards out there. The only problem is that sometimes you are not given a credit limit big enough for your spending needs (or desires).

When this happens, all is not lost and you still have an opportunity to request a credit line increase.

But there are certain things you need to know about this process in order to maximize your odds of getting approved, especially when it comes to Capital One.

In this article, I will tell you everything you need to know about getting a Capital One credit line increase, including things like hard pulls/inquiries, phone numbers, and what to do if denied.

Table of Contents

How to request a Capital One credit line increase

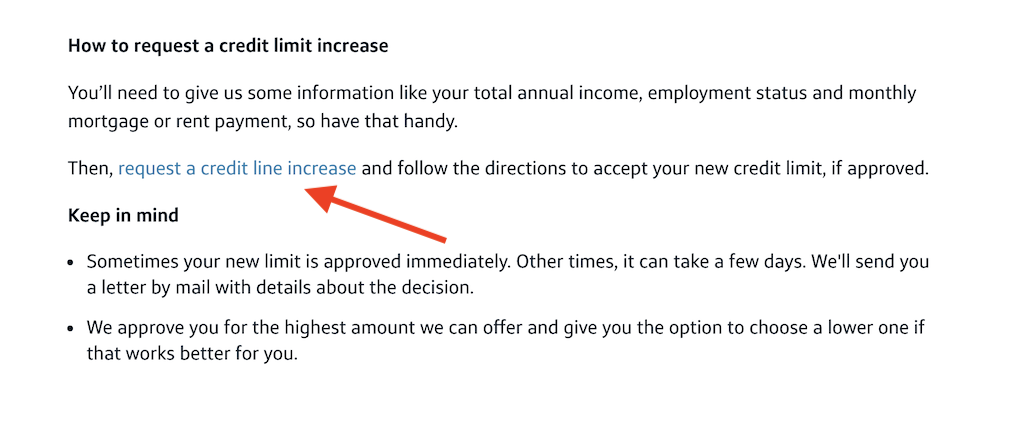

You can request a Capital One credit line increase online by going here.

Once you follow that link, click on the link shown below and you will be prompted to sign in to your Capital One account and input the details discussed further below.

After submitting your details, you might receive a decision immediately or your application might go under manual review.

If your application goes under manual review and you’ve signed up for paperless documents, you’ll receive a letter in the Online Document Center (ODC) in three to five days. If you haven’t signed up for paperless documents, you’ll receive a letter via mail within seven to ten days of your request.

Also, note in some cases (usually not common) you might have to send in your information for verification and that can add another seven to ten days to the process.

Tip: Use the app WalletFlo to give you auto-reminders of when to request credit limit increases!

If you want to request a Capital One credit increase via phone then you can call the phone number: 1-800-955-7070. I’m not sure if there’s a backdoor number for credit line increases but that number should do the trick.

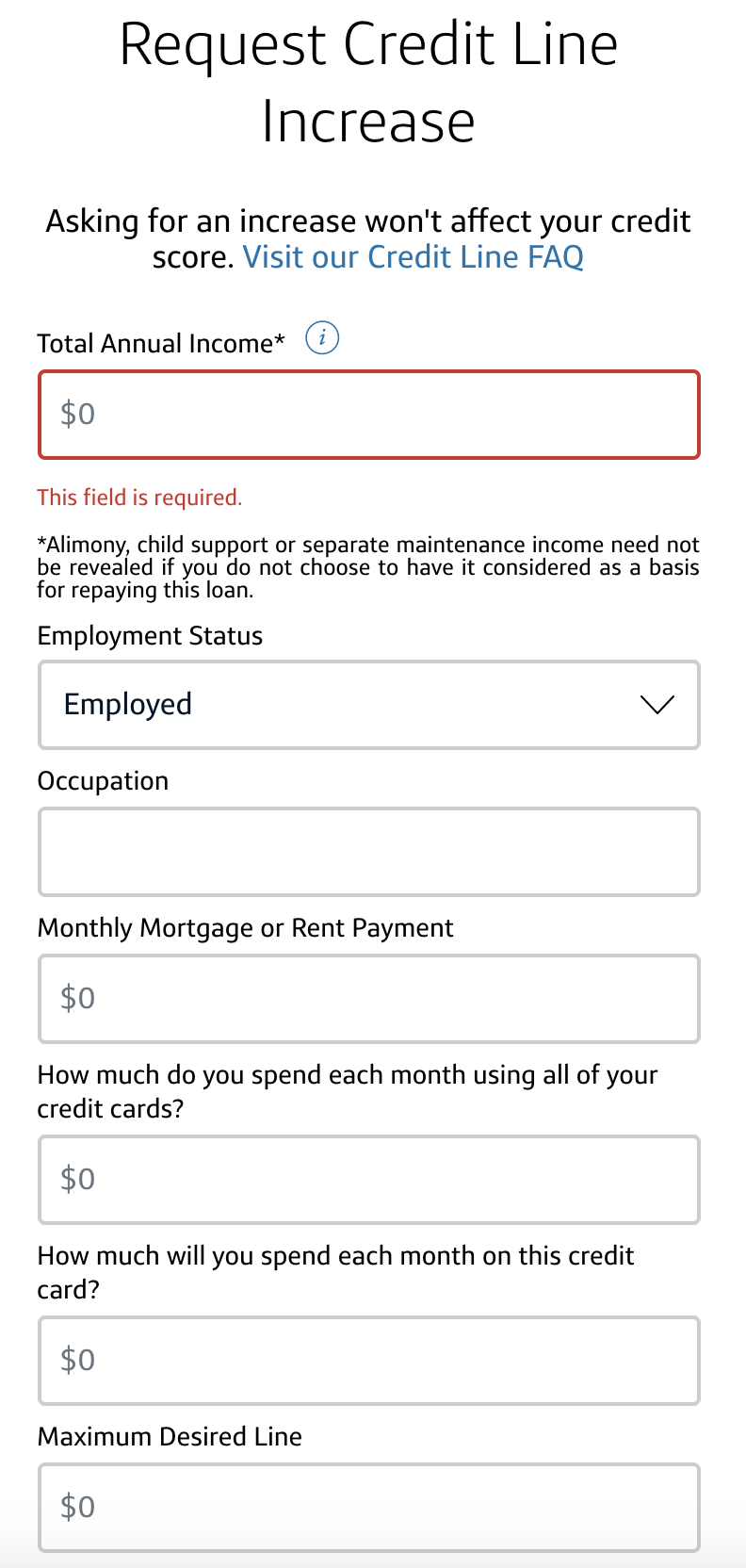

Capital One credit line increase application

After signing into your account, you should see the pop up for entering in your information for a credit line increase request. The pop-up will ask you to input the following details:

- Total annual income

- Employment status

- Occupation

- Monthly mortgage or rent

- How much you spend on all of your credit cards each month

- How much you will spend on your Capital One card in a month

- Maximum desires line of credit

Keep in mind that in some cases Capital One might request for you to verify the information that you’ve input, so consider that when inputting details like income and rent.

Income

Income is one of the biggest factors when it comes to credit limit increases. Yet, many people are not aware of how they can include income from other people in order to increase their approval odds. This is known as “accessible income” and you can read more about it here.

Capital One is very transparent about accessible income and here is what they state you can include:

- Personal income, which is income you have earned, including full-time, part-time, or seasonal jobs, self-employment, interest or dividends, retirement and public assistance.

- Shared income, which is money from somebody else that is regularly deposited into your individual account or into a joint account that person shares with you. If you are 21 or over, you may also include somebody else’s income that is regularly used to pay your expenses.

- Optional Income: Alimony, child support or separate maintenance income doesn’t need to be included, unless you want it to be considered.

If you’re applying for a credit line increase for your Spark business credit card, you’ll need to provide your total annual income.

Employment status

You will have the option to choose from the following:

- Employed: You work full or part time for a company or business you don’t own.

- Self-Employed: You own a business where you work full-time or part-time.

- Unemployed: You aren’t currently employed full-time or part-time and don’t own a business, even if you’re collecting unemployment benefits or public assistance.

- Retired: You no longer work full-time or part-time, but currently have a source of income or are living off of savings or other retirement benefits.

- Student: You’re enrolled in classes full time (even if you have a full-time job).

- Other: None of the above apply, or you’re unemployed but do have regular access to income from somebody else.

I don’t have hard data on how these categories affect your odds but obviously choosing something like unemployed, where you may not have an income stream, could raise some red flags to a bank that is trying to lend you credit. So be truthful but also aware of how your chosen options will affect your approval odds.

Occupation

Again, I’m not sure how relevant your occupation truly is to your credit line increase.

Monthly mortgage or rent

This information is very important to banks because it will tell them more about your monthly financial obligations. If you have a lower income with a high monthly mortgage or rent, then your odds of getting a good credit limit increase will begin to go down. If you don’t have a monthly mortgage or rent payment, you can enter $0.

Monthly spend

Capital One will ask you to input the estimated monthly spend for all of your credit cards and for the card that you are requesting a credit line increase with.

This is important data for Capital One because they want to see if it will be worth it to grant you a credit line increase based on your estimated spend and how profitable of a customer you will be.

If your estimated monthly spend is at the same level as your current credit limit, then that will not tell Capital One that you have a crucial need for a credit line increase. However, if your current credit line is only 50% of your proposed spending then that will be a trigger for Capital One that you probably need a credit line increase.

Maximum desired line

This is where you will enter your maximum desired credit line. So if your current credit limit is $5,000 but you desire a $10,000 dollars credit line, then you will input $10,000. Capital One will approve you for the maximum amount of credit that they can and then you will have an opportunity to choose a lower credit limit if you wish.

Eligibility

Certain people will not be eligible for a credit line increase with Capital One.

Three months old

If your account is not at least three months old, chances are you will not be eligible for a credit line increase with Capital One. Many other banks have minimum time requirements and it is often a good rule of thumb to wait six months until after you have been approved for a credit card to request a credit line increase.

Change in credit limit over last six months

If you have had a credit line increase or decrease in the last six months, you will likely not be eligible for a credit line increase. This includes if you merge/consolidate Capital One credit card accounts, so keep that in mind.

At the same time, if you were denied for a credit line increase, you don’t have to wait six months. In that case, you might put in a request every 90 days or so.

Secured credit cards

If you have a secured credit card you may not be eligible for a credit limit increase.

Automatic increases

There is something known as the “Capital One Credit Steps program” that offers you a credit limit increase after you make a certain amount of on-time payments.

Typically, you’ll start off with a very low credit line (maybe of like $300 with a card like the Capital One Platinum Credit Card) and then the credit limit will be automatically increased if you meet the requirements.

Tips for a Capital One credit limit increase

If you want to increase your odds of being eligible for a Capital One credit line increase, there are certain things that you can try.

Spend big on your card

One of the biggest tips I have is for you to put spend on your credit card. And by spend, I don’t just mean buying a stick of gum every five months.

If you want a credit limit increase, Capital One will want to see that you are using their credit card on a regular basis. So in the months leading up to your request, you should be putting as much spend on your card as you possibly can.

Pay off a high balance

Another factor that Capital One is going to look at, is how often do you pay off high balance. For example, it will look really good if you constantly run up your credit line up to 80% or 90% and then pay off that entire balance for each month.

This is the best way to show Capital One that you truly need a credit line increase based on your spending and this is something that other banks often look at as well. It might also help give you a little nudge if you set up auto pay to pay off your balance in full.

Merge your credit limits

Some people struggle to get a credit line increases and so what they do is simply combine credit limits. So for example if you had a Capital One Quicksilver Cash Rewards Credit Card and a Capital One Venture Rewards Credit Card , you might be able to move the credit over from your Quicksilver over to your Venture card. You find many online reports of people doing this like this person who combined a $6,000 and $10,000 credit limit.

Update: Capital One might be restricting merged credit limits now.

How much of an increase to request?

You might be wondering how much of a credit line increase you should request. Should you go big and ask for something like a 200% increase or should you play it more conservatively and go with the request around 25% of your credit limit?

I typically recommend for people to request an increase of around 25% to 35% of their current credit limit. However, if you have a low credit line such as $1,000 or $2,000 then you might want to go much higher than that. I will say that based on my research and personal experience, Capital One seems to be one of the slower-moving issuers when it comes to credit line increases.

If you make your request online and want a lower amount, you’ll be able to tell them the amount you would like before accepting the increase. So my advice would be to go higher rather than risk going lower.

Capital One should NOT conduct a hard pull

Capital One will not conduct a hard pull on your credit report when requesting a credit line increase.

What to do if denied for a credit line increase

If you are not approved for a Capital One credit line increase then there are some steps you might want to take. The first step is to review your denial letter, and see the reasons for why you were denied a credit line increase. In some cases, you can actively work to address these things or simply wait for the necessary amount of time to pass.

Here is some insight into what the different letters might mean.

Your Capital One account is too new

This just means that you need to wait at least three months to request a credit line increase. Typically, you should wait approximately 6 months to make your credit line increase request.

There has recently been a change to the credit line on this account

This means that you have waited less than six months from the time of the last change to your credit line. Again, you must wait at least half a year to make your request.

This Capital One account was recently past due

If you have made a late payment in the last 12 months, chances are you will not get approved for a credit limit increase. Also, this might depend on the severity of your late payment. If you miss a late payment by 30 days you won’t have to wait as long as someone who missed a payment by 60 days.

You can use Capital One Credit Wise to check your credit report to see if you have late payments.

Your average monthly payment has been too low

Capital One may not want to increase your credit limit if you are not going to be able to pay off your balance. If you see this reason and your rejection letter, it just means that you were not paying off enough of your monthly bill. Ideally, you would be running a lot of charges on your card each month and paying them off 100%. If you are only making minimum payments then your odds of getting an increase go down dramatically.

Recent usage of this account’s existing credit line has been too low

As pointed out for, Capital One wants to see that you are using a lot of your credit line. Try to come close to maxing it out each month and paying the entire balance off (ideally before the card reports your balance to your credit report).

The credit reporting agency has reported a recent credit delinquency

This just means that you messed up somewhere and have a late payment with another creditor on your credit report. Again, if this delinquency came in the last 12 months, you may have difficult issues trying to get a credit line increase.

Your current credit score is too low. Please see the back of this letter for determining factors.

This is pretty straightforward, it just means that your credit score is too low. You should look into different ways to increase your credit score if this happens. Read more about these rejection reasons here.

Have a good reason for requesting a higher limit

Although it is not always necessarily required for you to have a legitimate reason for requesting a credit limit increase (especially when doing it online) it won’t ever hurt your odds to have a good reason. A common reason for wanting a higher credit limit is if you have a major purchase coming such as a:

- Honeymoon

- Wedding

- Family vacation, etc.

This just helps to get the bank added confidence and assurance that this is a planned out move and that you have thought out your request. You could also just tell the bank you’re trying to improve your credit score, since that’s a pretty reasonable reason for wanting more credit.

Credit line increases with other issuers

You might also be interested in reading about getting credit limit increased with other issuers.

Final word

Overall, the process for getting a Capital One credit line increase is pretty simple. You first need to make sure that you are putting substantial spend on your card and ideally you would be paying off a high percentage of your credit line in full every month.

Make sure that all of your employment/income information is up-to-date and that you’re including as much income as necessary. And finally, be sure to wait the sufficient amount of time necessary to get an increase.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

New DP:

As of today, per phone rep at C1, the option to Merge/Shift existing CLs between cards is no longer available.

Maybe it’s a COVID thing.

But. I just tried and was told you can’t do it.

Thanks for the dp!

I applied for a credit limit increase on my Quicksilver card this past week. I was denied for not using much of my credit. I turned around and applied for the Savorone card after the Quicksilver denial and was approved for the new card I don’t see why I am denied the credit limit increase yet approved for a new card.