Keeping up with your credit score and report is crucial given all of the different ways that your credit score can impact your daily life. But it can be a tiring task and many get confused in the the process. Luckily, there’s a few different ways that you can keep tabs on your credit score and report.

One way to do this is to utilize the free service known as Capital One Credit Wise. In this article, I’ll tell you everything you need to know about Credit Wise, including why you may want to NOT use this service. I will also cover other come questions like whether or not it is accurate and what special features it comes with.

Table of Contents

What is Capital One Credit Wise?

Capital One Credit Wise is a free online tool you can use to check your credit score and monitor your credit report for changes. The service is provided by Capital One but you don’t have to be a Capital One customer to use it.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Is Credit Wise accurate?

Capital One Credit Wise does NOT provide you with a FICO score. Instead, it provides you with a TransUnion Vantage 3.0 score. So Credit Wise is accurate; it’s just that it won’t necessarily give you an accurate idea of where your FICO score stands since it’s a different model.

Vantage 3.0 score is the same type of credit score provided by Credit Karma and by similar programs like Chase Journey. Vantage calculates their credit scores differently from FICO (though there are a lot of similarities). Sometimes the scores can be the same or similar but in many cases, the credit score differences can be quite extreme.

I know that based on my own personal experience I have seen discrepancies as much as 100 points. This is especially the case if you have been very active with opening new credit cards. Typically, the Vantage Score is much lower in these situations than the FICO score.

For this reason, you want to use some caution before relying on the Capital One Credit Wise credit score. Remember, most banks out there will use the FICO model. Thus, if you are applying for a credit card you can expect that they are utilizing the FICO model. Below, I’ll show you how you can check your FICO credit score.

Where can I get accurate FICO credit scores?

There are a few ways that you can get a FICO score. Many find it easy to sign-up for Experian.com and utilize that to get their FICO score (they offer a free 30-day trial membership). If you are just in it for the free score, make sure that you cancel your membership.

Sometimes MyFICO offers a free trial so be on the lookout for that. You can also get one free credit report from each of the three major credit bureaus (TransUnion, Equifax, and Experian) once every 12 months from annualcreditreport.com.

How to log-in and use Credit Wise

If you are already a Capital One customer and you have a login ID then you can go ahead and use that information to login here. Otherwise, you will need to sign-up by providing some basic information such as your contact details and your full Social Security number. You may also have to answer some questions to verify your identity.

Credit Wise features

In addition to viewing your credit score and report, you can also take advantage of some other special features.

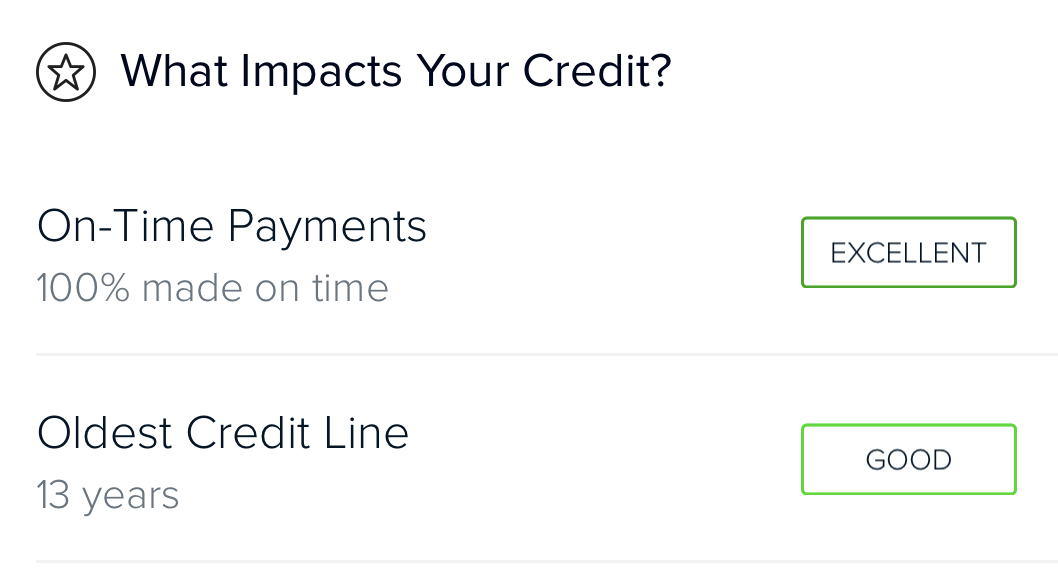

What impacts your score

Whenever you sign in you can go to the homepage and view a lot of different factors that are affecting your credit score. Credit Wise will tell you if your factors are excellent, good, average etc. If you are new to credit scores this can be a nice and simplistic way to see which factors you might need to improve.

The factors that you might see are:

- On time payments

- Oldest credit line

- Credit used (Utilization)

- Recent inquiries

- New accounts

- Available credit

Score improvement

If you click on “Score Improvement” at the bottom of the screen you should be shown some different ways that you could improve your score. These little bits of advice should be ranked in the order of the most impactful factor. But that’s not always the easiest factor to fix it so don’t think that you have to attack that factor first.

You can get these suggestions even if you have an excellent score since they strive to help you get the perfect credit score. However, keep in mind is that you don’t typically even need a perfect credit score after you get to the 750/760 range.

Your suggestions get updated each week along with your credit score, but they could stay the same if there aren’t any significant changes to your credit report.

Credit report

When you click on the credit report section you will be able to view all of the accounts listed on your TransUnion credit report. This can be a way for you to calculate your Chase 5/24 status or to simply make sure that you have no unrecognizable accounts.

By clicking on your accounts you can view some of the specific information related to your opening dates, balances, payment history, etc., making it a perfect way to set up your WalletFlo account (the new digital smart wallet).

You can also view your recent inquiries. Just remember that only the inquiries that pulled your TransUnion credit report will show up so it is possible that your other credit bureaus have more inquiries.

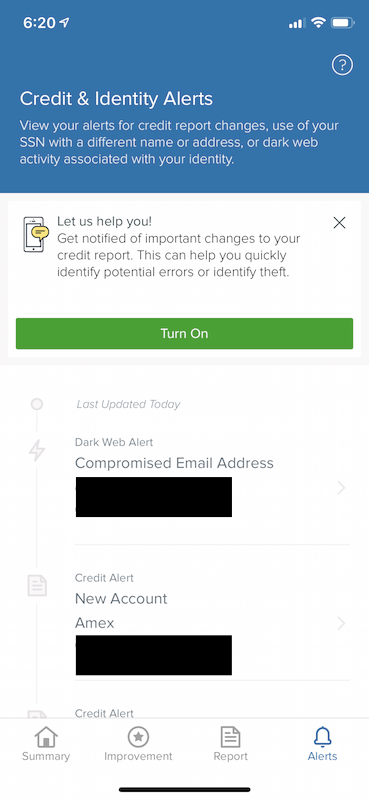

Alerts

Credit Wise will alert you whenever there is notable activity related to your account or your identity.

One way that they do this is to scan the dark web for activity related to you. According to Capital One:

The dark web is a network of websites that are hidden from search engines and only accessible with special software. Hackers and fraudsters use the dark web to sell stolen personal information on the black market, which could lead to identity theft.

In my case, I received an alert that my email address is associated with dark web activity. In other cases, you might get notifications that your credit card numbers, usernames, and passwords have been found. These dark web scans take place every single day so your information stays up-to-date.

You can also get alerted whenever there is a change of address associated with your Social Security number, since that is often a sign of fraud or identity theft. (The scans take place once a month).

Other alerts will consist of things like new accounts. Interestingly, although the credit score is taken from your TransUnion report, CreditWise provides credit report alerts from two of the major credit bureaus: Experian and TransUnion. (This is why sometimes you might receive two alerts.)

Capital One Credit Wise score simulator

You can use the score simulator tool to simulate the effect that a certain action will have on your credit score. For example, you could see what type of effect paying off $10,000 worth of debt would have on your score. Other examples include things like increasing the credit limit on a credit card or canceling your oldest credit card.

The results of these simulations are pretty speculative. In some cases, it can provide you with an idea of what kind of change to expect and your credit score. However, you have to remember how complex credit score models actually are. Credit scores are affected by multiple factors which all affect each other and so in many cases it is just too speculative to know for sure how your credit score will be impacted.

Related: Capital One Amazon Offers & Discounts Guide

Credit Wise vs Credit Karma

If you want to find out more about your credit score then you probably want to go with Credit Karma. For one, while both of these use the same type of Vantage model Credit Karma will also show you your Equifax score and report. Sometimes certain items are only reported to one credit bureau so this can give you a more accurate idea of what your overall credit profile looks like.

Both of these services have a credit score simulator tool. As already mentioned, these can be useful in certain situations but credit scores are so complex that it is usually impossible to get it right.

Credit Karma also has some different features that you can use. For example they have a debt repayment calculator that you can use. And they also have a special feature for unclaimed money. But most of all you can dispute your items (but not every error) directly through Credit Karma which makes it a very efficient tool. So overall I would say that Credit Karma is definitely the more equipped tool.

How often will my score be updated?

Your score will be updated on a weekly basis but you can check it as often as possible. Also, checking your credit score will not result in a hard pull so it won’t impact your credit score at all.

Credit Wise vs FICO

The VantageScore model is pretty similar to the FICO model but it has some key differences. It uses the same FICO range of 300 to 850 for the score and stresses many of the same factors as FICO — it just gives them different weight and has some slightly different ways for calculating them.

Here are the 3.0 factors according to Credit Karma:

- Payment history (about 40%)

- Age and type of credit (about 21%)

- Credit utilization (about 20%)

- Balances (about 11%)

- Recent credit (about 5%)

- Available credit (about 3%)

Here are the factors for the FICO model.

- Payment History (35%)

- Utilization (30%)

- Credit History (15%)

- New Credit (10%)

- Mixed Credit (10%)

As you can probably tell that there is a good deal of overlap between the two credit models. The biggest differences to me are that Vantage puts more weight on the payment history and also the age of your credit. Therefore, it is possible that if you have negative payment history, that could affect you more for Credit Wise. Likewise, if your account ages are on the lower side of that could count against you more for Vantage.

On the flip side, new inquiries might count more against your FICO score and if you don’t have a diverse mix of credit that could also count more against you.

One of the key differences between the models is that closed accounts continue to age for FICO models but they don’t for Vantage models. This can result in huge differences in account history for folks like me who have opened and closed quite a few cards over the past few years. For people like myself, we have a very short average age of accounts for Vantage but we have a much more established average age of accounts with FICO.

Another big difference is that the Vantage models will combine related inquiries within a 14 day window. Meanwhile, newer FICO versions count multiple credit inquiries of the same type within a 45-day period as a single inquiry.

Therefore, if it took you 3 1/2 weeks to find an auto loan and you had multiple inquiries within those weeks, that could have had a bigger impact on your Vantage score versus your FICO score.

So Credit Wise can be a good option to keep an eye on where your credit stands but if you want to have a more accurate idea of your credit score and how it looks in the eyes of most banks then you want to go with FICO.

Capital One Credit Wise disputes

If you need to dispute an item Credit Wise does give you some directions but they do not have a direct dispute process or tool.

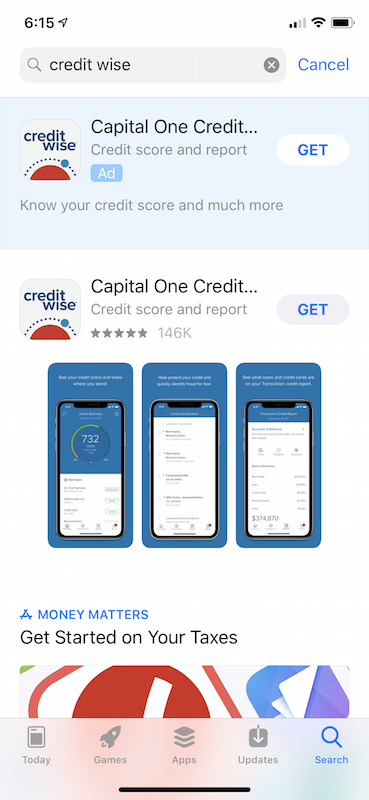

Capital One Credit Wise App

One convenient way to use the Capital One Credit Wise service is to download the app. The app is free to download and is available on the Apple App Store and Google Play.

The app has all of the same features as above except they are displayed in mobile form.

How to cancel Credit Wise

- You can cancel your Credit Wise service by selecting the “Cancel My Account” option on the Settings page

- Credit Wise customer service number: 1-888-817-2970

Final word

Overall, Capital One Credit Wise can be a useful tool to see where your credit score is but it’s not a FICO score so you don’t want to rely on this score for the majority of lenders since they don’t use the Vantage model. Since it’s free, there’s no harm in using it monitor your credit report but you might want to go with Credit Karma instead, since it has more features.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

3 comments

Comments are closed.

Credit Wise does not reflect all (less than 50%) of my credit availability which lowers my score. There is no mechanism that I can see to update them.

Interesting. Wonder why that is happening.

Recently charged almost $15K on Capital One Visa. Paid 3 weeks before due date. Yet creditwise does not report early payments when statement closes on the 8th of the month. Dinged my score 94 points. The explanation was “timing” because the charge was only days before closing date. But that does not explain why early payments are not included in their report to trans union.