Alaska Airlines Visa Annual Companion Fare Benefit Guide [2021]

One of the most valuable benefits for the Alaska Airlines Visa is the annual companion fare. If used properly, it is a way to not only offset your annual fee

One of the most valuable benefits for the Alaska Airlines Visa is the annual companion fare. If used properly, it is a way to not only offset your annual fee

The World of Hyatt Credit Card is one of the most lucrative travel rewards credit cards. One reason that it stands out is that it offers you the ability to

Perks that arrive every account anniversary are often the best reasons to keep a card for the long term. They offer consistent value that you can always rely on to

Offers contained within this article maybe expired. A lot of people have no idea that American Express actually has its own TrueCar portal to help you purchase automobiles and potentially

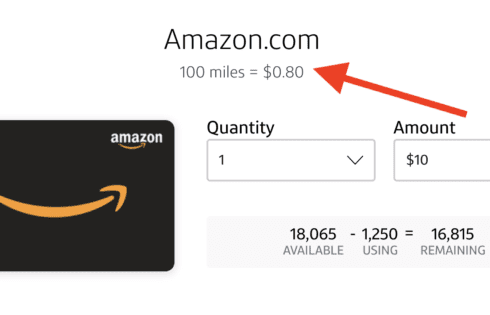

Amazon is such a behemoth that it is no surprise you can find different ways to utilize your credit card rewards with them. If you are a Capital One card

Offers contained within this article maybe expired. American Express has a very robust travel portal. Not only can you book different types of travel, but you can also take advantage

Offers contained within this article maybe expired. Several American Express cards offer annual airline credits that can help provide you with some savings on various purchases related to your air

One of the easiest ways to offset the annual fee of an airline credit card is to utilize the free checked baggage perk. It’s a relatively straightforward perk to use

Offers contained within this article maybe expired. When it comes to airline credit card perks, the free checked bag perk is a common benefit to find and can be one

Visa Infinite cards are the top tier type of Visa cards that are issued and are a step above Visa Signature cards. These cards come with top protections and premium

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |