Chase Sapphire Reserve Lounge Access Policy Explained [2022]

The Chase Sapphire Reserve is one of the hottest premium credit cards with a number of solid perks, including Priority Pass airport lounge access. I’ve used its Priority Pass membership

The Chase Sapphire Reserve is one of the hottest premium credit cards with a number of solid perks, including Priority Pass airport lounge access. I’ve used its Priority Pass membership

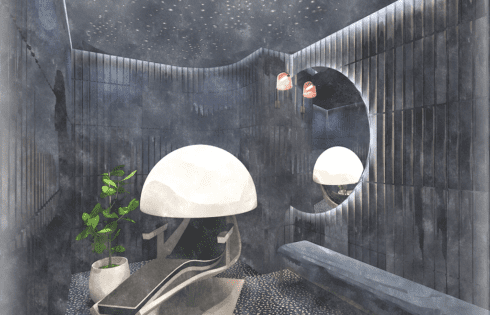

Capital One looks to be expanding its future airport lounge network with the addition of a new lounge coming to Denver International Airport (DEN), opening in 2022. This will be

The Citi Prestige is an interesting credit card because it’s not marketed quite as well as other premium cards but it does offer tremendous value to certain niche customers. People

Offers contained within this article maybe expired. American Express just announced new changes to its Centurion Lounge admission policy. The previous policy allowed Centurion and Platinum Card cardholders to bring

[Offers contained within this article may no longer be available] The Chase Sapphire Reserve, Citi Prestige, Platinum Card from American Express, and Ritz-Carlton are four of the top benefit-based credit

Many people are understandably reluctant to apply for credit cards with high annual fees of $450 plus. In fact, I’ve met some people that think people like myself are crazy

[Offers contained within this article may no longer be available] Any time you’re applying for a card with an annual of $450 plus, you want to be sure that you’re

Offers contained within this article maybe expired. There are a number of credit cards that offer airport lounge access, but they all come with pretty hefty annual fees (which are

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |