Which Citi Hilton Card is The Best?

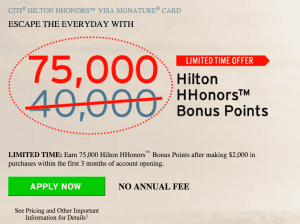

[Offers contained within this article may no longer be available] The Citi Hilton HHonors Visa Signature Card offer is back where you can earn 75,000 HHonors Points after making $2,000 in purchases within

[Offers contained within this article may no longer be available] The Citi Hilton HHonors Visa Signature Card offer is back where you can earn 75,000 HHonors Points after making $2,000 in purchases within

Offers contained within this article maybe expired. There are a number of credit cards that offer airport lounge access, but they all come with pretty hefty annual fees (which are

[Offers contained within this article may no longer be available] The American Express® Premier Rewards Gold Card and the Citi Thankyou Premier are two of the best travel rewards credit cards

[Offers contained within this article may no longer be available] The Citi Prestige and Citi Thankyou Premier are both two of the best travel credit cards with flexibility in point

[Offers contained within this article may no longer be available] Right now, the Citi Prestige is one of the best benefit-focused travel credit cards out on the market. It comes

[Offers contained within this article may no longer be available] The Citi Prestige and the American Express Platinum cards offer some of the best travel benefits in the credit card

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |