Avoiding Coronavirus Financial Scams

Avoiding Coronavirus Financial Scams: Everything You Need to Know The coronavirus pandemic has found a way to affect our lives in almost every imaginable way. But one often overlooked

Avoiding Coronavirus Financial Scams: Everything You Need to Know The coronavirus pandemic has found a way to affect our lives in almost every imaginable way. But one often overlooked

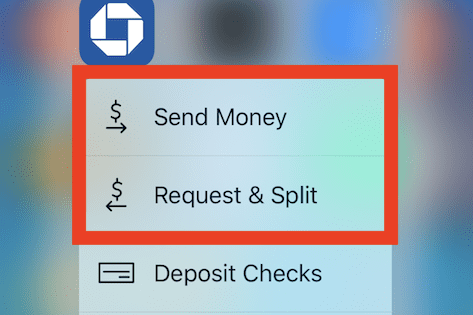

Have you ever needed to transfer funds over to friends or family but did not want to hassle with wiring fees or with sending in checks or cash deposits? Or

Managing your wealth is crucial and there are several programs offered by many large banks aimed to help you plan for your financial future and Chase Private Client is one of those

SoFi Money is sort of a hybrid between a checking and savings account. SoFi is a cash management account that offers a competitive APY and right now there is a

There are two main types of Chase savings account for the average consumer: Chase Savings and Chase Premier Savings. Below, I will go into detail about each of these accounts.

One pretty easy way to get “free money” is to sign up for bank account bonus offers. Utilizing these bonuses, you may only earn a few hundred bucks or you

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |