How To Order Checks From Chase (Online, Phone, Prices) [2022]

Are you trying to order new checks or checkbooks from Chase? Well, the process is very simple and it can be done online, over the phone, or even in-branch. This

Are you trying to order new checks or checkbooks from Chase? Well, the process is very simple and it can be done online, over the phone, or even in-branch. This

Not as many people today use checks as they did in the past. In fact, in 2013 a survey showed that roughly 50% of millennial’s do not use checks. In

ATMs are extremely convenient and allow you to withdraw cash as well as make deposits with both cash and checks. But banks set certain limits for your withdrawals and Chase

Sometimes it’s nice to add a little bit of a personalized touch to your debit and credit cards to keep things interesting. And it’s even nicer when this comes with

Safety deposit boxes can be smart ways to store some of your valuable belongings. However, they are not perfect by any means and are not designed to store all of

There are a few reasons why you would want to write a check to yourself. Typically, you are probably wanting to transfer some money from one account to another or

If you are like millions of people then at some point you will probably need to send off a check in the mail (even in 2021). Unlike cash, sending off

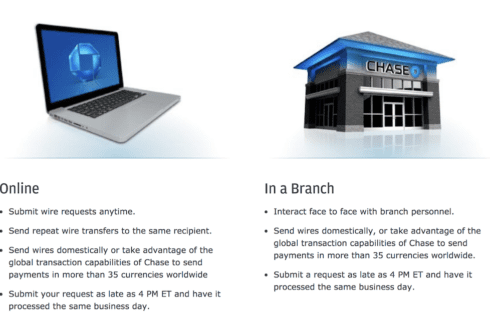

If you’re traveling or living aboard you might need to initiate a Chase wire transfer at some point. But how much will the fees be and how do the wire

Are you thinking about opening up a Chase business checking account but you’re unsure which type of checking account is right for you? Do you also have questions about all

Many people still wonder whether or not credit cards are actually safer than debit cards. Lots of individuals don’t know about the differences in liability protection that exist between credit

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |