Are you thinking about opening up a Chase business checking account but you’re unsure which type of checking account is right for you? Do you also have questions about all of the documents you will need to open up these accounts?

I’ve opened up several business checking accounts over the years for various types of entities like LLCs and corporations so I can help you out with everything you need to know.

In this article, I will walk you through how to open Chase business checking accounts. I’ll show you all of the differences between the accounts and show you everything that you need to know about the requirements before stepping into a Chase Bank to open your account.

Table of Contents

Chase business checking accounts

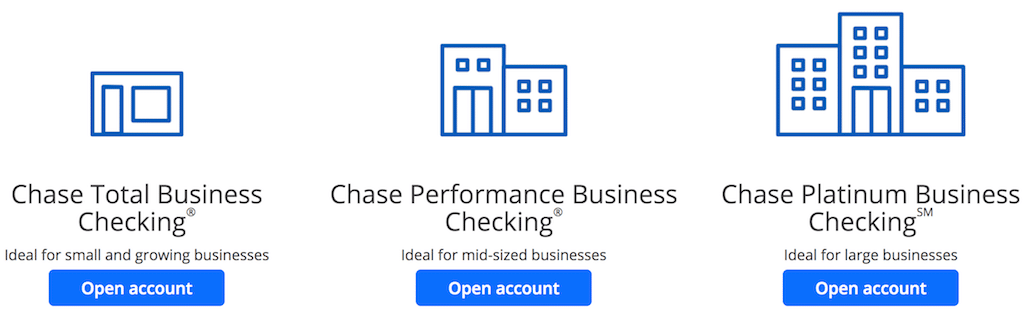

There are three main types of Chase business checking accounts that you can choose from.

- Chase Total Business Checking

- Chase Performance Business Checking

- Chase Platinum Business Checking

I will discuss the details of each of these checking accounts below. But first, I will explain to you how to open up a business account and some important factors you will want to consider.

Tip: If you are thinking about opening up a business account, make sure that you go for one of the top business credit cards like the Chase Ink Business Preferred. With that card you can earn 3X per $1 on the first $150,000 spent in combined purchases in categories like advertising, shipping, and travel.

How to open a Chase business account

It is pretty straightforward to open a Chase business account, but you will need to pay attention to these special requirements when it comes to the documentation needed for your business.

Schedule an appointment

The first thing that you will likely need to do is to schedule an appointment since most cannot set these accounts up online and must visit a branch. To locate a Chase Bank branch office click here. The search results will also pull up a phone number you can use to schedule your appointment and ask any questions.

It is possible that you could try to be a walk in in-branch but you will likely need to schedule an appointment ahead of time to make sure that there is a business banking agent available, since all branches do not always have banking agents on-site.

When you call, you can ask for a Chase Business Relationship Manager (BRM). These are special business representatives that often work with businesses that are established but they also work with newly established entities as well.

Gather your documents

Once you have your appointment scheduled, you will need to make sure that you have the required documentation to open up your account. The documents that will be required will depend on the type of business entity that you have set up and I go into detail about all of these below.

Tip: Be sure to call the bank ahead of time and verify the requirements for your bank account. Often times a business bank agent will reach out to you to verify your appointment and clarify any questions you have about the documents.

Create a cheat sheet

Regardless of what type of entity that you have set up, I highly recommend that you create a cheat sheet with facts about your business.

This might include the following information:

- Full legal name of your business

- Business address

- Phone number

- Number of business locations

- What/where products and services are sold

- The nature of your business

- Annual sales, revenue, and profit

- Number of employees

- The types of transactions in the volume of transactions that you expect to be running through your business account

You may not need to provide all of this information for every type of business account that is open, but it will be very helpful to have this information easily retrievable. This is especially true if you apply for the Chase Ink Business Preferred and have to sit through a reconsideration phone call.

Narrow down your focus

Before you waltz into a Chase branch, you should have a good idea of which Chase bank account is best for you.

If you are just starting off for you or have a really small business, then it is usually pretty clear that a Chase Total Business Checking account will likely be the best route for you.

However, if you have over 100 transactions per month going on in your account or you’re cash depositing over $5,000 dollars per month, then you might want to look into other options.

If you have a growing business or a midsize business then it could be a little bit more difficult to determine which one is best for you.

The Performance and Platinum accounts are pretty similar but there are some key differences.

- The Performance Account allows for 250 transactions with no fees while the Platinum account allows for 500 transactions with no fees.

- The Performance Account allows for $20,000 in cash deposits with no fees while the Platinum account allows for $25,000 in cash deposits with no fees.

- The Performance Account allows for two free outgoing domestic wires while the Platinum account allows for your four most expensive for wires to be free.

So it will be really beneficial if you can get a grasp on your transactions, cash deposits, and wiring needs before you ever step foot into a Chase Bank.

Check for bonuses and coupons

Chase will often be offering special bonuses for opening up Chase business checking accounts. These bonuses might be $200, $300 for $500 — it all just depends on the offer and coupon available. Typically, the $500+ offers are going to only be for the Performance Account or above and they may not always be available.

The requirements for meeting these bonuses can be very easy to obtain. For example, you may only have to maintain a $1,000 daily balance and process a few transactions per month.

Opening up these accounts is typically only a soft pull on your credit report, so opening up these accounts is often worthwhile. You will usually need to keep your account open for at least six months to qualify for these bonuses so keep that in mind.

Get versed in Chase business cards

While you are setting up your business account, you might get asked if you are interested in a Chase business credit card. There are three main Chase branded business cards that I would look at. The Chase Ink Business Preferred is my number one business card.

The Chase Ink Business Preferred earns 3X per $1 on the first $150,000 spent in combined purchases on all of the following categories:

- Travel, including airfare, hotels, rental cars, train tickets and taxis

- Shipping purchases

- Advertising purchases made with social media sites and search engines

- Internet, cable and phone services

If you are looking for a no annual fee business card then you might look at the Chase Ink Unlimited or the Chase Ink Cash. Both of those are solid options.

Below, I will go into detail about each of the different type of Chase business accounts. I’ll then go into detail about the necessary documentation that you will need to bring in for setting up discounts.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Chase Total Business Checking

Chase total business checking account are ideal for small businesses and for those that are growing.

Requirements

- $25 minimum deposit to open

- $15 monthly service fee

The monthly service fee is waived when you maintain a minimum daily balance of $1,500 or more if you maintain a linked Chase Private Client or Chase Sapphire Checking personal account. Otherwise it is only $12 when you enroll in paperless statements.

Features

- 100 transactions per month at no charge

- Unlimited electronic deposits

- $5,000 in cash deposits per statement cycle without an additional fee

- Domestic and international wiring

- Send and receive funds with wire transfers, Chase QuickDeposit, Chase Online Bill Pay and more

- Access to Chase Online Banking and Chase Mobile Banking

- Chase Business Debit, Deposit and ATM cards offer owners control and provide options for signers and employees to access ATMs and make purchases

- Access to 16,000 ATMs and 5,100 branches

Chase Performance Business Checking

The Chase Performance Business Checking account is good for those businesses that are starting to take off a bit with their growth.

Requirements

- $25 minimum deposit to open

- $30 OR $0 monthly service fee

Monthly service fee can be waived when you maintain a combined average daily balance of $35,000 or more in qualifying business deposit accounts. You can also get the monthly fee waived with a linked savings account.

Features

- 250 transactions per month at no charge, plus unlimited electronic deposits and incoming wires

- $20,000 monthly cash deposit without an additional fee

- All incoming wires and two outgoing domestic wires at no charge per statement cycle

- Access to Chase OnlineSM Banking and Chase Mobile® Banking

- Chase Business Debit, Deposit and ATM cards offer owners control and provide options for signers and employees to access ATMs and make purchases

- No additional charge for Positive Pay and Reverse Positive Pay Protection services at chase.com

- Interest option available

- Personal account benefits available

- Monthly service fee waived on a linked Chase Business Premier Savings account

- Access to 16,000 ATMs and 5,100 branches

Chase Platinum Business Checking

The Chase Platinum Business Checking account is most suited for established businesses who have large amounts of transactions and wiring fees.

Requirements

- $25 minimum deposit to open

- $95 OR $0 monthly service fee

Monthly service fee can be waived when you maintain a combined average daily balance of $100,000 or more in qualifying business deposit and business investment balances. You can also get the monthly fee waived with a linked savings account.

Features

- 500 transactions without a fee, plus unlimited electronic deposits and incoming wires

- $25,000 monthly cash deposits per statement cycle without an additional fee

- All incoming wires and your four most expensive outgoing wires at no charge per statement cycle

- Access to Chase OnlineSM Banking and Chase Mobile® Banking

- Chase Business Debit, Deposit and ATM cards offer owners control and provide options for signers and employees to access ATMs and make purchases

- No additional charge for Positive Pay and Reverse Positive Pay Protection services at chase.com

- Personal account benefits available

- Reduced balance requirement for Chase Private Clients

- Monthly service fee waived on a linked Chase Business Premier Savings account

- Access to 16,000 ATMs and 5,100 branches

- 24/7 customer service

Tip: If you are thinking about opening up a business account, make sure that you go for one of the top business credit cards like the Chase Ink Business Preferred. With that card you can earn 3X per $1 on the first $150,000 spent in combined purchases in categories like advertising, shipping, and travel.

Switching

You should note that if you would ever like to switch the type of business accounts that you have opened with Chase, that is possible. So don’t worry to much about making the right decision for the long term because you don’t always know what might end up being the best route for you to go in the future.

You can click here to learn more about switching your account types.

Documents required for a Chase business account

Here are the different entities that you might set up in the required documents for each.

Sole Proprietorship required docs

Who needs to be present

If you are the sole member of your proprietorship then only you have to be present.

However if multiple people are involved in the ownership, the following applies:

- Spousal Sole Proprietorships — both owners

- Sole Proprietorship Living Trust – the trustee(s)

- Sole Proprietorship with a Power of Attorney – the agent

- If you need to add authorized signers to the account, they must also be present

Two forms of personal ID

One ID must be a Government Issued ID, such as a State Issued Driver’s License, State Issued ID card, Passport, etc. The secondary form of ID can be something like a credit card/debit card with embossed name, employer ID, utility bill, etc.

Tax Identification Number

You will need to supply them with a tax identification number. This can be your social security number (SSN) or ITIN (for non-US citizens), or an Employer Identification Number (EIN).

Business documentation

The business documentation that you will be required to bring in will depend on the state that you reside in.

An assumed name certificate may be required if your business is operating with a DBA (doing business as). For example: Jim Jones DBA Jones Professional Painting.

However, this will not be required in AK, AL, HI, KS, MD, MS, NM, SC, TN, WI, and WY and not required for Sole Proprietors operating a business using the owner’s last name in CA, IN, KY, and TX.

It is usually pretty easy to get an assumed name certificate by going online or by visiting the local country courthouse. Each state will have different requirements for getting these but in many states you simply pay a small fee and fill out a form and you can get these issued instantly.

Trust documentation will be required if you have set up a trust.

Supplemental documentation

It is possible that you may be required to submit additional documentation which could include:

- Assumed Name Application or Filing Receipt

- Application to publish the assumed name in a newspaper

- Published newspaper entry

- Business License

Click here to read more about required sole proprietorship documents.

Partnerships required docs

Who needs to be present

- All general partners must be present

- If one of the general partners is a business then an authorized representative of that business must be present

Two forms of personal ID

One ID must be a Government Issued ID, such as a State Issued Driver’s License, State Issued ID card, Passport, etc. The secondary form of ID can be something like a credit card/debit card with embossed name, employer ID, utility bill, etc.

Tax identification number

You will be required to submit a tax identification number and this will require you to submit an EIN. Since this is a general partnership, you will not be able to simply submit your Social Security number.

Business documentation

The business documentation required will depend on the type of partnership that you have.

For general partnerships you will need the following:

- Written partnership agreement

- Joint venture agreement

- Personal identification (in some states)

- Website validation

If your business is organized in another state but operates in the state that you are opening up an account you might need documentation for both states. This could include a foreign partnership registration. You may also need to provide an assumed name certificate, depending on the state that you are in.

If you are dealing with a limited partnership, limited liability partnership, or limited liability limited partnership, Then you will be required to bring in a certified partnership agreement and will also be subject to the website verification.

There are also additional documents that might be required if you have a 10% or more ownership.

Supplemental documentation

You might be required to bring in the following supplemental documents:

- Amendments to your partnership agreement or joint venture agreement

- Letter on company letterhead listing the current general partners

- Meeting minutes listing the current general partners

- Annual report or statement of information

Click here to read more about required partnership documents.

Limited Liability Company LLC required docs

Who needs to be present

The individuals who need to be present depends on the type of LLC.

- For a member managed LLC, all of the members must be present.

- For a manager managed LLC, all of the managers must be present.

If one of the managers or members is a business then an authorized representative of that business must be present. If you would like to add an additional authorized signer then that person must also be there.

Two forms of personal ID

One ID must be a government issued ID, such as a State Issued Driver’s License, State Issued ID card, Passport, etc. The secondary form of ID can be something like a credit card/debit card with embossed name, employer ID, utility bill, etc.

Tax identification number

You will be required to submit a tax identification number and this will require you to submit an EIN. Single member LLC may use their social security number for their ITIN.

Business documentation

The required business documents are going to depend on the state organization. However, you can expect to be required to bring in the following:

- Certified articles of organization (certificate of formation) filed with the state agency

- Website validation

- Assumed name certificate

Supplemental documentation

You might be required to bring in the following supplemental documents:

- Certified amendment to the articles of organization or certificate of formation

- Operating agreement

- Letter on company letterhead

- Meeting minutes

- Annual report or statement of information

- Members with 10% or more ownership may be required to submit additional documents

Click here to read more about required LLC documents.

Corporation required docs

Who needs to be present

- And authorizing representative must be present.

- This could include:

- President

- Secretary

- Assistant secretary

- Acting secretary

- If you would like to add additional signers they must also be present

Two forms of personal ID

One ID must be a Government Issued ID, such as a State Issued Driver’s License, State Issued ID card, Passport, etc.

The secondary form of ID can be something like a credit card/debit card with embossed name, employer ID, utility bill, etc.

Tax identification number

You will be required to submit a tax identification number and this will require you to submit an EIN. Since this is a corporation, you will not be able to simply submit your Social Security number.

Business documentation

You may be required to bring the following documents:

- Certified articles of incorporation or articles of formation

- Website validation

- Active status verification

- Corporations that came into existence over one year ago will need to have verification that they are currently in good standing, or a status report, or a long form standing or short form standing.

Click here to read more about required corporation documents.

Chase Business checking accounts FAQ

You will need an EIN for your some Chase business checking accounts.

It is very easy to obtain an EIN and it often only takes minutes to complete the application and receive your number. The entire process can be done online for many people.

If you are a single member LLC you can use your Social Security number and you will not need an EIN.

There are some great business credit cards offered by Chase but my top choice would be the Chase Ink Business Preferred.

Chase may validate your entity via a state website prior to you opening up an account.

In some cases, this means you don’t even have to supply the documents to verify your entity because it will be done by Chase.

The monthly service fee depends on the type of account that you opened but it can range from $15 to $90.

However, you can get the fee waived by maintaining a certain average balance or by having certain types of linked accounts.

The type of documents needed to open up your account depends on the type of entity that you have.

A secondary ID would be something like a credit card or debit card with your name embossed on it. It could also be something like an employer ID, utility bill, bank statement.

If you are in doubt simply call up your local Chase branch and ask if your secondary ID is good enough.

Some banks may issue your debit card right on the spot but other times you may have to wait around a week for it to arrive in the mail.

Your active status verification can be a certificate of good standing, status report, and a longform standing or short form standing.

Just make sure that your documents are certified to open up your account.

Yes, you can open up a Chase business bank account for an entity that is formed out of state.

If you are doing business in the state that you are opening up a bank account in, you may need to register your out-of-state entity in that state.

This is usually called a foreign entity registration and it might be necessary before you can open up your bank account.

The appointment to open up your Chase business bank account can be finished in under 30 minutes.

It is recommended to set up an appointment because a lot of bank branches do not have business account managers.

The minimum deposit amount is $25. You can make this deposit with cash or send money from your bank account via QuickPay with Zelle.

Final word

Setting up a Chase business checking account is relatively straightforward.

However, to make the process much more efficient and to make sure that you were selecting the right type of account, I highly suggest that you have a detailed overview of your business and that you don’t forget to check on the ongoing bonuses.

If you have all of your business figures rounded up, and you have organized all of your necessary documents, the process should go very smoothly and you should have your account up and running very quickly.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Hola es José torres quiero abrir una cuenta con Chase donde puedo visitar la oficina