Not as many people today use checks as they did in the past. In fact, in 2013 a survey showed that roughly 50% of millennial’s do not use checks. In 2019, that number is probably much higher. Since so many people resort to ACH and wiring and are unfamiliar with checks, they may not know how to use checks and how to understand the different parts of the check.

In this article I will tell you everything you need to know about checks including some important info about filling them out that you may have not known. I’ll also show you helpful diagrams with labels so that you can properly identify and understand each part.

Table of Contents

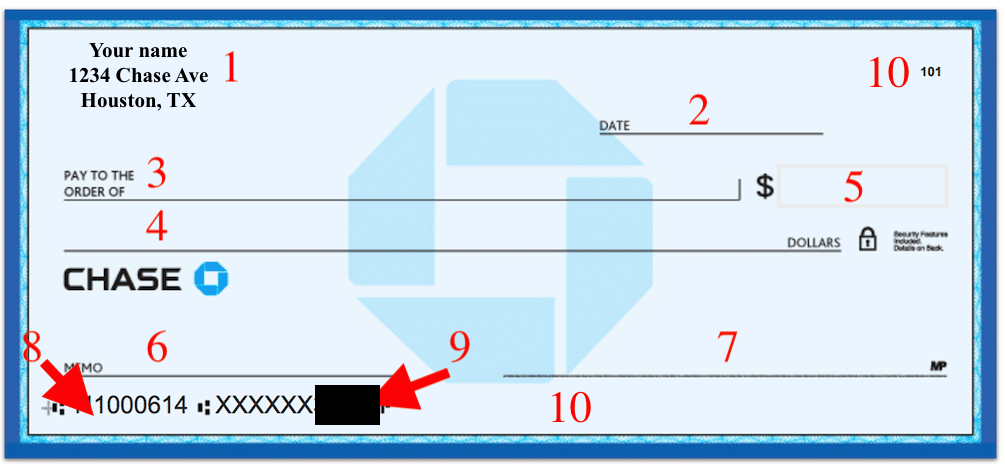

Parts of the check explained

Below, I will go over all of the different parts of the personal check with a complete diagram. Note that a business check could look a little different from a personal check.

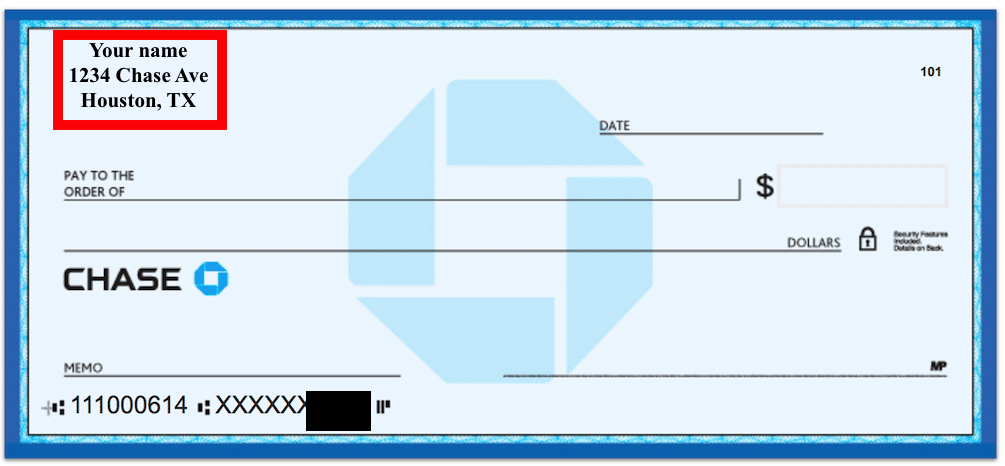

1. Contact information

In the upper left hand of a check, you should find the personal contact information. Typically, this will include the first and last name in addition to the home address and sometimes you might even find some type of a logo or design next to the name. If there are two payors, you might see two names (such as a husband and a wife).

Some checks (like starter checks) may not have contact information in this section but they can still be valid. With no contact information, some merchants might give you a hard time about it but if you write your contact details on the check (and have a matching ID), that might not be a major issue.

Also, in some cases the personal contact information might be scratched out with additional contact information written out. This would happen if you had a change of address and you needed to write the updated address on the check. But note that if your old address was out-of-state, that could pose some problems due to fraud concerns.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

2. Date

When you write a check to someone you will need to include the current date. This is very important because if you are not paying attention when you write the date, it is possible that you could write the wrong date or year and your check could be voided (some banks will still accept outdated checks but banks don’t have to accept checks that are more than six months old).

You can write the date in whichever format you prefer but if you would like to be on the safe side, I would write out the month in the following format: “September 22, 2020.” By writing out the month you can decrease the risk of your date being read wrong by you or anybody else (especially if you are accustomed to date formats in other parts of the world).

It is possible for you to put a future date in this field. This would be known as “post-dating” the check. You might want to do this if you don’t want the other person to cash the check until a certain date because you might be waiting on funds to arrive, for example.

Keep in mind that in many instances the individual can still cash the check even if you have it postdated (debt collectors are usually an exception to this). Also, some establishments might be weary of accepting a post-dated check because it can make them nervous or suspicious. So post-dating a check is typically for when you are dealing with an individual that you trust.

3. Pay to the order of

The “pay to the order of” blank is designated for the individual or the organization that you are making your check out to. In other words, you are telling your bank to deliver funds to this person or entity. This person or entity is known as the “payee.”

The payee is the only person who can cash or deposit this check although it is possible for them to sign the check over to somebody else. (More on that below.)

If you are not sure who to put in this line, you should call up the individual or entity that you are dealing with. Many times, on bills or invoices, you can see an address and contact information for where a check should be sent and addressed.

There is also something called “Pay to the Order of: Cash.” This means that your check can be cashed or deposited by anybody. As you probably can understand, this is a pretty risky option to go with. (Some people do this simply to draw cash out of their own account.)

And finally, there is sometimes the ability to assign your check to someone else by writing “Pay to the Order of: [name of recipient]” on the back of the check. In order to do this, you need to make sure the issuing bank of the check and the recipient bank of the check are okay with it first but this is yet another use of “Pay to the Order of.”

Tip: Read how to send checks securely through the mail

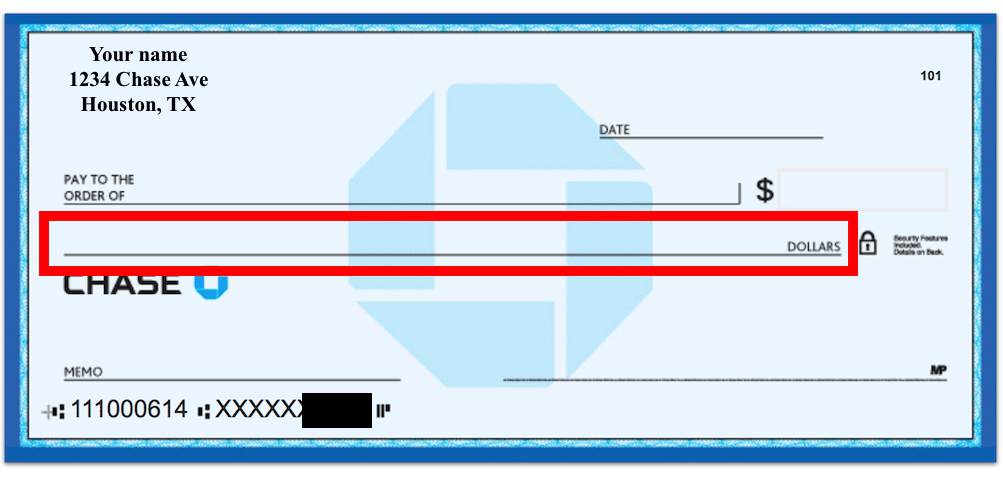

4. Transaction amount

Underneath the Pay to the Order of line is where you will actually write out the dollar amount of the transaction.

For example, if you were writing a check for $124.73 you would write out, “One Hundred Twenty Four Dollars and 73/100.”

Many people blow off this section and simply scribble out something but that is a huge mistake as I explain below. I would always recommend to try to write out the total amount in clear, plain handwriting.

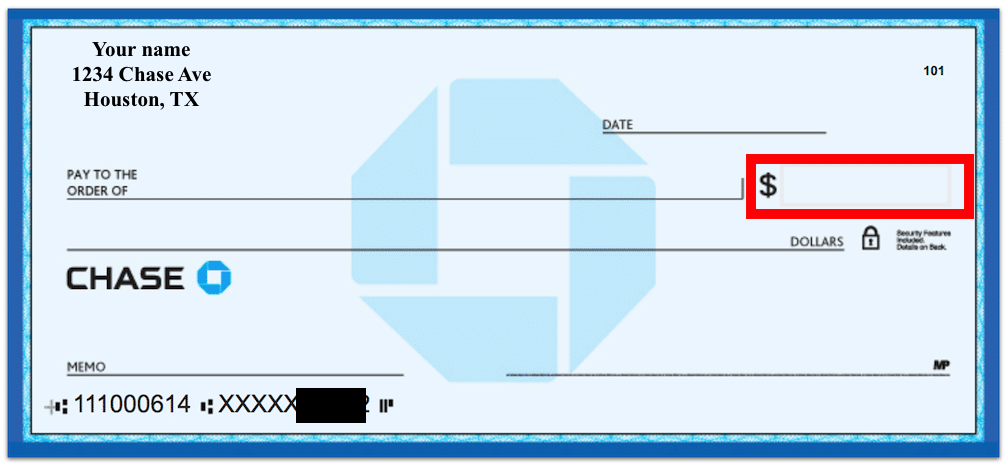

5. “Money box”

The little box area on the right side of the check is where you will enter the numerical amount for the transaction. So instead of writing out the words for your transaction totaled you will simply write the numerical version. Sticking with the example above you would simply write: “$124.73.”

Something to keep in mind that a lot of people don’t realize is that this little box is not the official way to determine how much I check is written for. Instead, the official amount for the check is determined by what is written out by words.

If there was ever a circumstance where there was a difference between what was written in the money box and what was written out in words, whatever is written out in words will take precedence. So this is why you really want to make sure that you clearly write out the dollar amount.

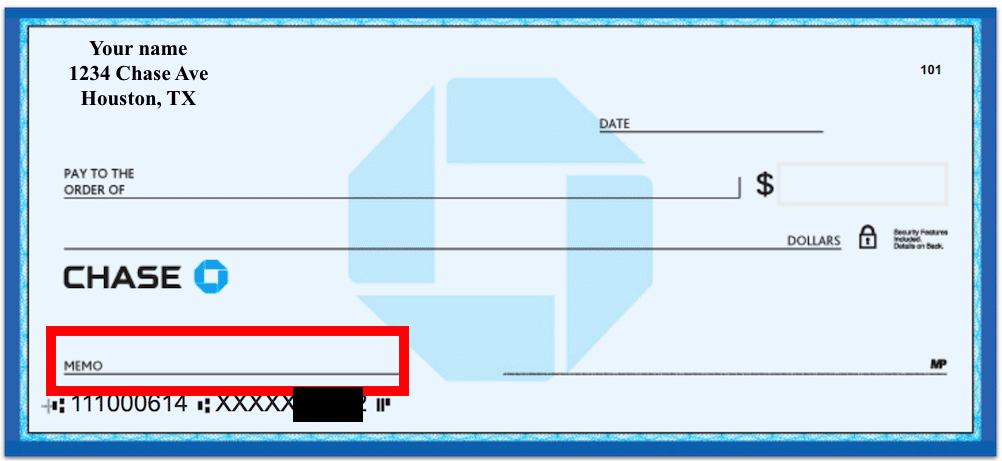

6. Memo

The memo blank of a check is probably the least important field you can find on a check. The memo is an opportunity for you to make special notes about the transaction that might be helpful to yourself or to the party receiving the check.

You can literally write whatever you want to write in this section and your check will still be valid. Just try to avoid certain words or phrases (e.g., “crack rock”). Also, if you would like to leave the memo section blank that is fine.

7. Signature line

In order for your check to be valid it must be signed by yourself. If there ever is any fraud (or suspected fraud) on your account the signature will be key and an agent may review it to make sure that it matches your signature card. Therefore, I would suggest to not simply scribble your name or signature but to put some effort into it to make sure that you are providing a valid signature in this blank.

Your signature should always be the very last item that you put on a check because you could potentially be authorizing someone to take out large amounts of money your account.

If you see “MP” on the signature line like on the image below, that means that there is “microprint” on the check. When MP is there, the signature “line” isn’t actually a line and is instead made up of very fine print that says something like “Authorized Signature Only” or something along those lines. It’s like a secret message and actually pretty cool.

You might also see a signature line on the back of the check but that is where the recipient of the check would sign for things like deposits.

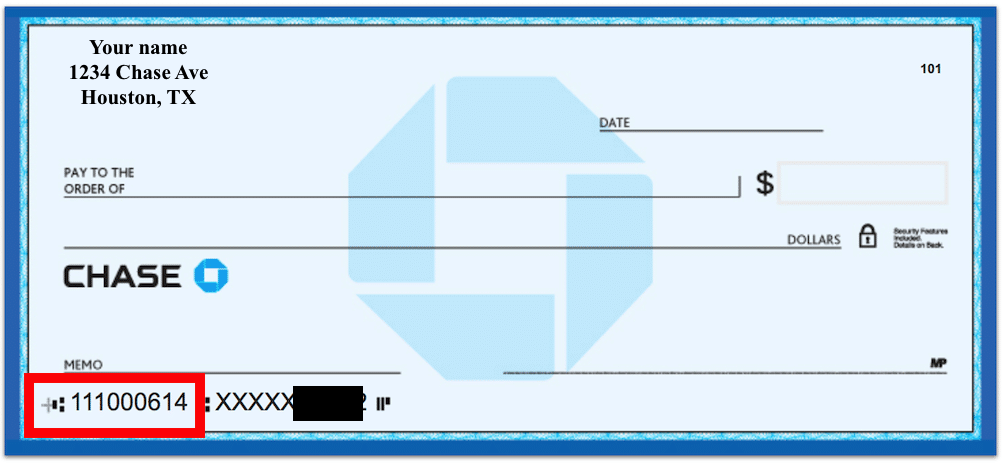

8. Routing number

Each bank has a specific ABA routing transit number (known simply as the “routing number”) and this nine-digit code could change depending on the state or location of the bank. You can always find routing numbers pretty easily online. These numbers are out in the public so there’s no need to attempt to conceal them from others.

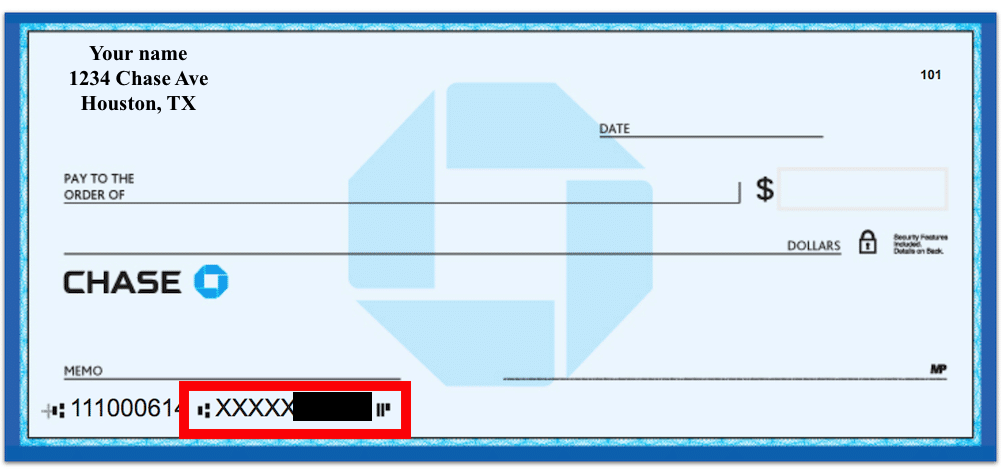

9. Account number

The account number is the number tied to your specific bank account. This is a number that you do not want to share with other people and want to keep it as private as possible since sharing it with others could lead to others accessing your account.

I should note that usually you’ll find the numbers in the following order: Routing Number, Account Number, and then Check Number. But that’s not always the case.

For that reason, if you’re looking for the Routing Number and Account Number, sometimes you’ll want to verify these online. Since routing numbers can be viewed by all the public, you can usually use process of elimination to find the account number.

10. Check number

This is usually a small number that simply helps you keep track of the number of checks you have written. You typically will find this number in the upper right-hand corner of the check and on the right side of the bottom as well.

Parts of a check FAQ

Some banks will not accept a check that is dated more than six months ago.

Yes, you can put a date in the future on a check. This is known as “post-dating” and is usually done when someone does not want the check cashed until a specified date in the future.

Just note that post-dated checks can still be cashed prior to the date on the check sometimes.

The person or entity that you would like to cash your check is who you should list under the pay to the order of field.

This means that your check can be cashed or deposited by anybody. You should use extreme caution when using this method since anybody can cash or deposit your check.

Yes, you need to write out the dollar amount on your check.

The written dollar amount takes precedence over the dollar amount listed in the money box. Therefore, you should pay extra close attention when writing out the dollar amount.

The memo section is an optional field on checks that you can use to make special notes about the transaction. It is okay to leave this section blank.

MP stands for micro print and it is a security measure that is found in the signature section of a check.

The routing number will be the number on the bottom left corner of the check in most cases.

The account number is typically located to the right of the routing number on the bottom of the check.

The check number is often located in two places.

You can find it in the upper right corner of the check and also on the bottom to the right of the account number.

Final word

As you can tell, there are many different parts of a check. Understanding what each of these are and their importance is crucial for avoiding silly mistakes that could cause your check to be voided or leave you vulnerable to fraud.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Want too know when I’m receiving my 1200.00 stimulus government check im almost out of groceries can’t pay my rent and my electric bill so please lwave email at my gmail account address [email protected] or call me at cellphone #315-965-6897 ok

Ok I got a 5071c in the mail I call IRS office and they could not verify my identity so I had to go into office for formal interview but the pandemic shut down the government offices I got letter early March and pandemic happened 1 day after I talked to IRS I cany get my info on check my payment what do I do