If you’re traveling or living aboard you might need to initiate a Chase wire transfer at some point.

But how much will the fees be and how do the wire transfers work?

This article will show you how these wire transfers work (step-by-step) and what kind of transfer fees you can expect to pay for both domestic and international wire transfers.

I’ll also show you how to locate all of the important account numbers like routing numbers, SWIFT numbers, ABA numbers, etc.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

Chase Bank wire transfer fees

The wire transfer fees charged depend on whether you are sending or receiving wires and whether your wire transfer is domestic or international.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Chase domestic wire transfer fees

- Incoming (receiving) wires: $15

- Outgoing wires (online): $25

- Outgoing wires (in-branch): $35

Chase international wire transfer fees

- Incoming (receiving) wires: $15

- Outgoing wires (online): $40

- Outgoing wires (in-branch): $45/$50

Note that wire fees do change from time to time so always check for the most updated fees before processing your wire transfer.

If you are sending an online wire transfer to a bank outside the U.S. in foreign currency (FX), there will be no Chase wire fee for amounts equal to $5,000 USD or more or only a $5 Chase wire fee when less than $5,000 USD.

You should also note that some premium Chase accounts allow for free wire transfers.

For example, with Chase Private Client, you’ll have no Chase fee for all domestic and foreign wire transfers, incoming or outgoing, completed at any Chase branch, chase.com, via telephone or email.

Read more about Chase Private Client here.

Chase wire transfer limit

The total daily limit on wire transactions with Chase is $100,000 or your available balance.

Business customers can request a higher limit.

Chase wire transfer processing time

The amount of time it takes for a Chase wire transfer to go through and process depends on if you are sending them domestically or internationally.

Domestic wire transfers

For domestic wire transfers you can expect them to take about 1-2 business days for the funds to be received.

International wire transfers

For international wire transfers you can expect them to take 3-5 business days to be received.

Notice that there is a cut-off time at 4pm EST for sending Chase wire transfers.

How to do a Chase bank wire transfer (instructions)

First, make sure that you are enrolled in Chase wire transfers.

Before you can begin making Wire Transfers, you must first add a wire recipient – the person or entity to which you will transfer funds.

How to add a recipient

Log-in to your Chase account and from the “Send Payments” tab, select the Wire Transfer option.

Click “Add a Wire Recipient.”

Enter information about your recipient, including:

- The recipient’s name

- A nickname for your recipient

- Your recipient’s mailing address, including country

- A message to your recipient

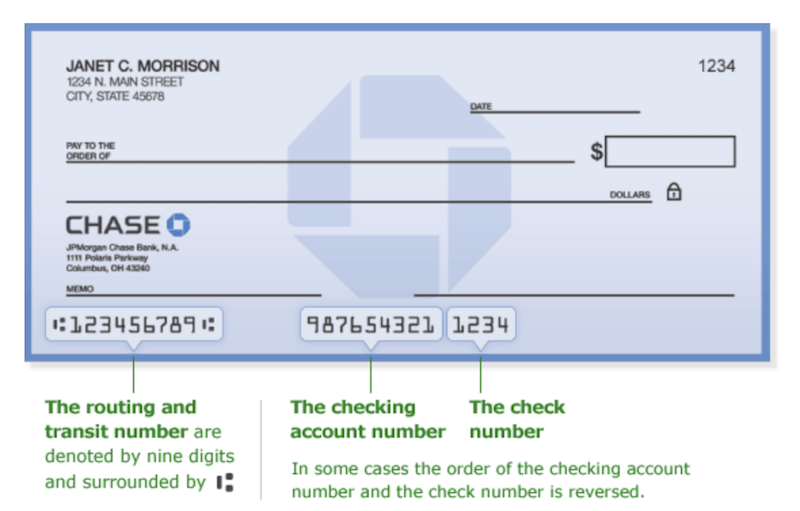

Next, you’ll need to enter the bank routing number (ABA or SWIFT code) for your recipient’s bank.

What is a SWIFT Code?

A SWIFT code is an international bank code that identifies particular banks worldwide and is also known as a Bank Identifier Code (BIC). A SWIFT code will have 8 to 11 characters.

Other terms used by international banks include:

- CHIPS (Clearing House Inter-Bank Payment System) – US and Canada only

- NCC (National Clearing Code)

- BSC (Bank Sort Code)

- IFSC (Indian Financial System Code).

What is an ABA number?

An ABA (American Bank Association) routing number is a 9-digit numeric code used to identify financial institutions in the United States.

If you do not know the recipient’s SWIFT code or ABA bank routing number, use the following links to search for them:

(Click here for a guide to using these links.)

Once you input that account number information, the routing number you enter will be displayed on the next page, along with the name of the recipient’s bank.

You’ll then be able to enter additional information about your recipient’s bank, including:

- The bank’s mailing address

- Your recipient’s bank account number

- A message to your recipient’s bank — (This is usually additional transaction-related information that the originator would like to provide the recipient’s bank. For example, this could be used to tell that bank additional information about the recipient, such as the official name of the recipient. These instructions will not affect how we process your request.)

- You can also choose to add an intermediary bank at this time — (This is the bank that funds go through to get to the intended recipient. Most often used when the originating bank does not have a direct relationship with receiving bank.)

IBANs (International Bank Account Numbers)

Note that the SWIFT code is used to identify a specific bank for your international transaction, but you’ll still need to identify an individual bank account for your international transaction

That’s when you use IBAN numbers.

IBANs (International Bank Account Numbers) are a series of up to 34 alphanumeric characters that uniquely identifies a customer’s account held anywhere in the world.

The IBAN consists of a two-character country code, followed by two check digits, and up to 31 alphanumeric characters for the bank account number.

The account number must be in IBAN format for the following countries:

- Austria

- Belgium

- Bulgaria

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovak Republic

- Slovenia

- Spain

- Sweden

- Turkey

- United Kingdom

- Iceland

- Liechtenstein

- Norway

After you’ve input all of that information, be sure to review it.

If you need to make changes, click “Change.”

Once all information is correct, click “Add Recipient” and you should receive a message confirming that your recipient has been added.

How to send a Chase wire

To make a one-time wire transfer in U.S. Dollars, click on the “Send Payments” tab, select “Wire Transfer” and click “Schedule Wire.”

Select the account from which the funds will be transfered. Then select your wire recipient by clicking the radio button next to the recipient’s name.

Click “Next” to continue.

Enter information about your Wire Transfer, including:

- The amount of the Wire Transfer

- The date on which the Wire Transfer will be sent (the wire transfer can be scheduled for up to one year in the future)

- A message to the Wire Transfer Recipient (this is usually additional transaction-related information that the originator would like to provide the receiver. For example, this field is often used to communicate invoice information or for further credit to information.)

- Instructions for the recipient’s bank

- Memo information — (this is a field that allows you to provide information about the wire transfer for your own personal records.)

Then click “Next” to continue.

Once all information is correct, click “Wire Money in U.S. Dollars” and you should receive a message confirming that your Wire Transfer has been scheduled.

You can do wire transfer in foreign currencies but keep in mind that wire transfers sent to international recipients cannot be future dated or repeating.

Note: All foreign exchange prices are provided by The J.P. Morgan Investment Bank Foreign Exchange Group.

For more detailed instructions from Chase, click here.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

What countries can I wire funds to?

You will be able to send money via wire in more than 35 currencies worldwide.

However, you will not be able to transfer money to the following countries due to US sanctions:

- Afghanistan

- Belarus

- Iran

- Iraq

- Lebanon

- Liberia

- Libya

- Myanmar

- Sierra Leone

- Syria

Chase wire transfer help

Sometimes you just need to speak to someone to help sort things out, especially when there’s a lot of funds passing through.

If you have any questions or need help when scheduling a Wire Transfer, you can call Chase at: (877)242-7372

You can also call the Chase Commercial Online Service Center phone number at: (877) 226-0071

Government, Not-for-Profit, and Healthcare Banking Clients can call the help phone number at: (855) 893-2223).

What is the Chase Bank wire transfer routing number?

If you have a Chase check you can find your routing number on your checks as shown by the below image.

If you don’t have your checks and you need to find your Chase routing number, know that the routing numbers are different for each state.

Here’s a list of them by state/region:

| Arizona | 122100024 |

| California | 322271627 |

| Colorado | 102001017 |

| Connecticut | 021100361 |

| Florida | 267084131 |

| Georgia | 061092387 |

| Idaho | 123271978 |

| Illinois | 071000013 |

| Indiana | 074000010 |

| Kentucky | 083000137 |

| Louisiana | 065400137 |

| Michigan | 072000326 |

| Nevada | 322271627 |

| New Jersey | 021202337 |

| New York – Downstate | 021000021 |

| New York – Upstate | 022300173 |

| Ohio | 044000037 |

| Oklahoma | 103000648 |

| Oregon | 325070760 |

| Texas | 111000614 |

| Utah | 124001545 |

| Washington | 325070760 |

| West Virginia | 051900366 |

| Wisconsin | 075000019 |

Chase international wire SWIFT Code

The SWIFT (or BIC Code) for Chase Bank is CHASUS33

Thank bank’s address is: Chase Bank, 270 Park Avenue, New York, NY 10017, USA

Chase travel notifications

Are you going to be spending time abroad soon?

Before you embark on your international travels, you’ll want to be sure to put travel notifications on your credit cards and Chase bank accounts.

It’s a pretty simple process and you can do it online or even via the Chase app.

Doing so can save you a lot of headache, and I’d highly consider putting in your travel notices.

Chase foreign transaction fees

If you’re going to be traveling abroad and doing some spending, you might want to consider going with a Chase card that offers no foreign transaction fees.

I’d recommend looking into cards like the Chase Sapphire Preferred and the Chase Sapphire Reserve. The Sapphire Reserve earns 3X on dining and travel purchases, so you’ll be earning a lot of points in the process your travels. It also has a $300 travel credit and Priority Pass membership that will get you into airport lounges all around the world.

To read more about the Sapphire Reserve benefits, click here.

Chase wire transfer FAQs

The total daily limit on wire transactions with Chase is $100,000 or your available balance. Some business customers may request higher limits.

A domestic wire transfer will usually take 1 to 2 business days but an international wire transfer may take up to 3 to 5 business days.

There is a cut-off time at 4pm EST for sending Chase wire transfers.

The SWIFT (or BIC Code) for Chase Bank is CHASUS33

Thank bank’s address is: Chase Bank, 270 Park Avenue, New York, NY 10017, USA

IBANs stand for “International Bank Account Numbers” and are a series of up to 34 alphanumeric characters that uniquely identifies a customer’s account held anywhere in the world.

The IBAN consists of a two-character country code, followed by two check digits, and up to 31 alphanumeric characters.

You can find Chase routing numbers here.

You may be able to avoid the wire fee if you are wiring an amount of $5,000 or more to a bank outside the U.S. in foreign currency.

Final word

Setting up a wire transfer with Chase is pretty easy to do. Whether you’re doing it online, over the phone, or in-branch, it shouldn’t be a major problem and this article should show you what kind of fees and waiting times to expect.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I already registered, but when I want use can not access, it go out so I can not proceed myself

If so I will send request via email people mailed to me , and help me pay to request bank and account

I have been told by a friend that the daily limit for a wire transfer at Chase Bank is $2000, but your website information indicates that the limit is $100,000. What is the correct limit?

Thank you

Hey Carl, that sounds like the Chase quick pay limit which I know is $2,000 for a lot of people. I just wired over $10,000 the other day so I know the limit is well over $2000 for wire transfers.

Can you explain to me how I can also make wire transfers please?

I’m not quite sure

simply call chase or look it up