AMEX Membership Rewards Can Now Be Used on Expedia

Offers contained within this article maybe expired. American Express and Expedia have linked up offering Expedia users a new way to use their Membership Rewards. You can link now an

Offers contained within this article maybe expired. American Express and Expedia have linked up offering Expedia users a new way to use their Membership Rewards. You can link now an

Marriott is offering a new promotion where you can earn up to 45,000 Marriott points by connecting your social media accounts. The promotion is called #RewardsPoints. Utilizing social media for

The Citi Prestige® Card’s most valuable perk in my opinion is the 4th night free benefit. With this benefit you can get a consecutive 4th night hotel stay for free

American Express has sent out different targeted Amex Offers that can save you up to $30 cash back on your phone and cable bills or simply earn you up to

American Airlines is offering a new promotion where you can book hotels on their new AAdvantage hotel portal and earn up to 10,000 AA miles per night. American advertises that you

I’ve got several issues with Delta SkyMiles but my biggest ones have to do with their devaluations which usually come with no notice and their ridiculous dynamic pricing. In the

Aeroplan is offering a new promotion where you’ll receive a 35% bonus when you transfer hotel points to its program through August 21, 2017. Even though transferring hotel points to

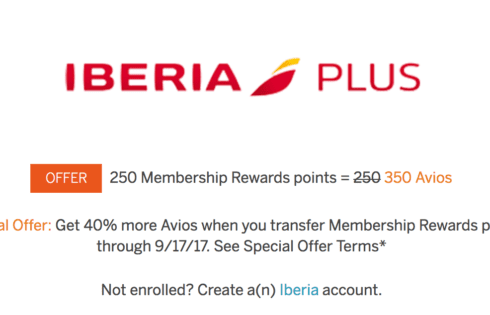

Offers contained within this article maybe expired. American Express just announced that British Airways Avios and Iberia Avios would once again be 1:1 transfer partners. This was great because it

Offers contained within this article maybe expired. Back in the fall of 2015, American Express lowered the transfer ratio of Membership Rewards to British Airways and Iberia from 1:1 to

Citi is offering a promotional bonus transfer rate to its lone hotel partner Hilton Honors. The promotional rate transfer Citi ThankYou points at a 1:2 ratio. So 10 ThankYou points

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |