Does Getting New Credit Cards Hurt Your Credit Score?

One of the first questions that people tend to have before jumping on new credit cards is whether or not their credit score is going to be hurt if they

One of the first questions that people tend to have before jumping on new credit cards is whether or not their credit score is going to be hurt if they

[Offers contained within this article may no longer be available] Secured credit cards are one of the best ways to build up your credit score if you find yourself in

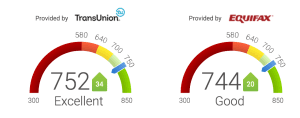

The cornerstone of award travel is your credit score. Without at least a decent credit score, you’re going to get hit with denials on your credit card applications left and right

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |