Discover Credit Line Increase (Tips & Data Points) [2021]

Requesting a credit line increase from Discover is a pretty easy task. The hard part is predicting what the outcome of your request will be, though. In this article, I’ll

Requesting a credit line increase from Discover is a pretty easy task. The hard part is predicting what the outcome of your request will be, though. In this article, I’ll

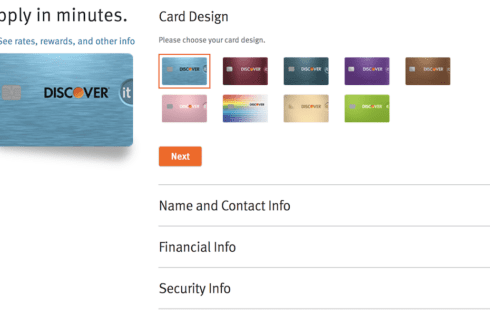

Discover pre-approval offers can give you some extra assurance when applying for Discover cards. But how exactly do you get these offers and what do they mean for your approval

Some credit card issuers allow you to benefit whenever you can successfully refer other people to their credit cards. Discover is one of these banks and they actually have a

Discover Deals has been one of the best reasons for picking up a Discover card for a while but that’s going to be changing soon. For those who don’t know,

Discover Deals is a fantastic way to save extra money on lots on online purchases because it often offers some of the most competitive cash back rates out of any

The Discover it credit cards come in many different forms but they don’t all offer the same level of value. In this article, I’m going to focus on the Discover it vs

The Discover it and Discover it Student are two very popular cash back credit cards. They are very similar credit cards but there are some key differences between the two

Discover is like American Express in that it acts as the credit card issuer and also its own payment network. Over the years, Discover has emerged as one of the

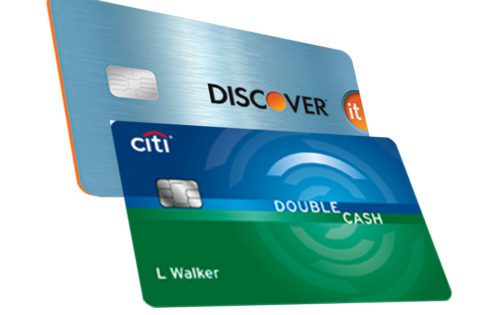

The Citi Double Cash and the Discover it are two of my top-rated cash back cards for 2016. They both offer different perks and different ways to earn cash back and

[This article contains expired offers] There are two Discover it® cards and two Chase Freedom cards available. For this comparison, I’m going to compare the Discover it® cash back card with

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |