Some credit card issuers allow you to benefit whenever you can successfully refer other people to their credit cards. Discover is one of these banks and they actually have a pretty unique way of doing the referrals.

In this article, I will tell you everything you need to know about the discover referral friend program, including how it works with popular cards like the Discover it and how to get up to $500 in referrals. I’ll also talk about how this referral program is a little bit different compared to other programs out there and some things to watch out for when going for the referrals so that you don’t miss out on points.

Table of Contents

What is Discover refer a friend?

Discover refer a friend is a special program that allows you to earn additional cash back or miles whenever you refer a friend that is approved for a Discover credit card. In addition, the individual that you refer can also earn some additional cash back or miles whenever they make a purchase after being approved. This means that each of you can capitalize on savings with your Discover accounts.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How does Discover refer a friend work?

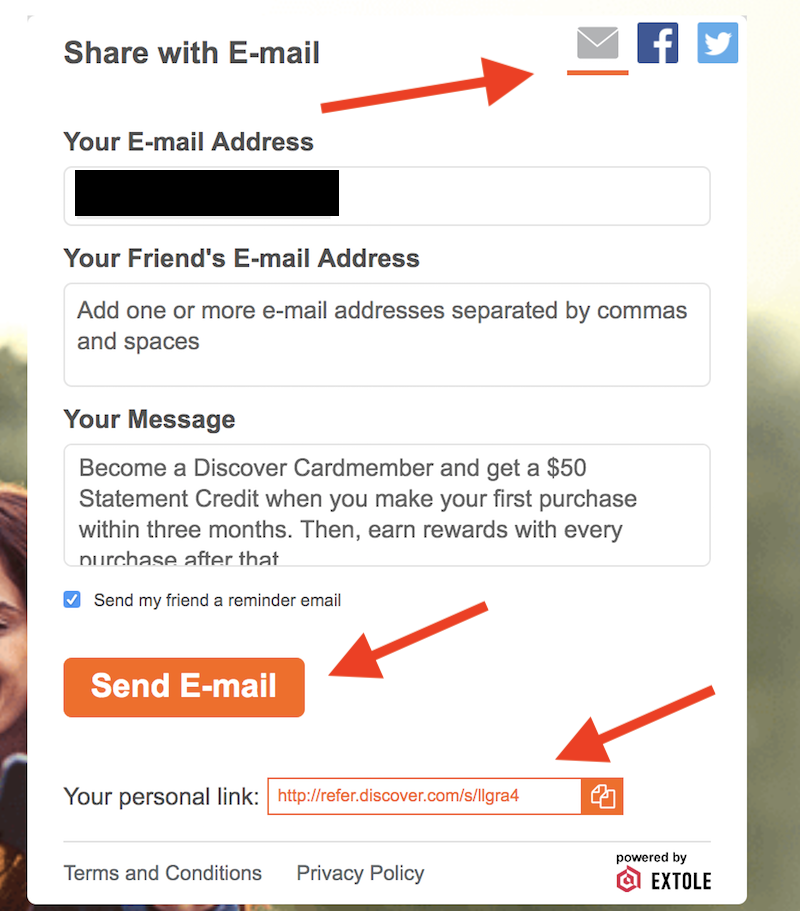

The process for Discover refer a friend is very simple. All you have to do is log into your account right here and then generate a referral link. Once you log in you should see the options to share your referral link. There are three different ways you might share your referral link.

Social media

You can share the referral link on social media with Facebook or Twitter. If you share the referral on Facebook this is what it will look like (note: you could add your own text to the post).

I don’t know how effective these generally are when sharing, but I would generally go with one of the two approaches below over the social media approach.

Discover has a pre-drafted email that you can send out your referrals with. You can actually send out this email to multiple email addresses by simply leaving a space (or comma) between email addresses. Also, you can select to send your friends reminder emails (which they might not enjoy so be thinking about that).

This is what the email will say when it is sent out:

Become a Discover Cardmember and get a $50 Statement Credit when you make your first purchase within three months. Then, earn rewards with every purchase after that.

Personalized link

You may also just want to copy and paste the personalized link. This would be a very easy way to share the referral via a text message. This is my preferred method when dealing with referral links since I have full control over all the content that will go out with it and don’t have to worry about cheesy pre-written messages.

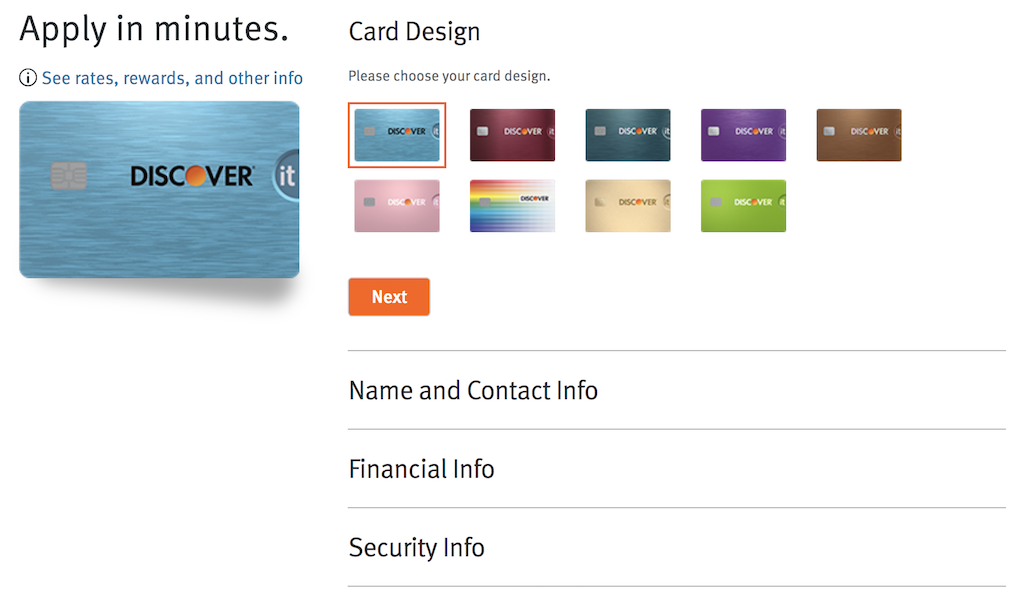

When you send out a personalized link the application page will look pretty standard. This is in contrast to some other banks that make it much more apparent that your friends are being sent a referral link.

Sometimes the referral link may not be working. This could be due to maintenance for some kind of technical issue that is usually resolved. If the referral links are not working for you then I would recommend to call the number on the back of your credit card to inquire with Discover.

How much will I get for the referrals?

You will receive a $50 Statement Credit referral reward if your friend applies for the specific offer you send via the link provided and is approved.The person applying for the credit card must use your referral link in order for you to get credit.

Also, if they make a purchase within three months of being approved they will be able to receive a $50 credit. Not many other referral programs offer a credit to the person getting approved for the card so Discover is a bit unique in this regard.

How many referrals can I do each year?

You will be limited to a maximum 10 referral rewards ($500) per calendar year. This is actually pretty generous considering that many other programs limit you to only five referrals per year. I’ve also heard that Discover will double your referrals if it’s your first year with the Discover It.

The terms do state that “Statement Credits you receive may be taxable to you.” In the past year, we have seen several other issuers start to issue tax forms for the referrals that went out.

In many cases where people receive tax forms the people who did the referrals are getting about $600 or more worth points are miles. So if you only have a few referrals with Discover you may not get a tax form sent to you but just be aware of what the terms state.

Will I get notified when they are approved?

You will not receive a notification whenever your friend is approved or declined for a Discover credit card. This is because of privacy laws and other referral programs with other banks also do not allow you to see this information.

Since you will not be notified if others are approved it is a good idea to follow up with the individual or individuals that you sent out your referral links to see if they were actually approved. And you might also want to re-emphasize to them that they should use your specific referral link so that both of you can benefit.

How long does it take to get the cash back?

After you have successfully referred someone to a Discover credit card you might be wondering how long it will take for you to receive your cash.

The terms and condition state:

Please allow up to 1-2 billing periods for the statement credit to post to your account after each referral is approved.

Sometimes you might receive your referral cash back much quicker than that but you should definitely follow up with Discover if a couple of months have gone by and you have not received your statement credit.

Are all Discover cards eligible?

Not all Discover credit cards or eligible for the refer a friend program. For example, the terms and conditions specifically state:

You are not eligible to refer a friend if you have a Discover it® Secured Credit Card, Discover it® Business Card, or Discover® Business Miles Card.

Is everybody eligible?

Something that you need to know about this program is that not everybody is eligible for the Discover referrals. For example the terms and conditions state:

Existing Discover cardmembers and those who have opted out of receiving market communications from Discover are not eligible referrals.

This means that you want to clarify if the people you are trying to her are currently Discover card members and if they have opted out of receiving marketing communications. If they fall into those two categories you may not be able to get a referral bonus. It should be noted that other banks don’t put these restrictions on current customers.

You should also note that your account must be in good standing to receive your referral reward. In other words, if you have late payments for an unpaid balance on your card and are overdue you will not likely be able to receive a bonus.

Are there other referral programs?

Several other banks offer referral programs and if you would like to read more about some of those check out the referral program for Chase and for American Express.

Final word

The Discover referral program is very similar to the other banks. The big differences are that you can make up to 10 referrals per year and also that the recipient of the referral link can also benefit whenever they make a purchase within the first three months after being approved. Allowing both parties to benefit from the referrals should make it easier to successfully refer other people to Discover credit cards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Great post! I’ve had a Discover card for a few years and actually forgot about it. I initially got it for the double cashback the first year, but stopped using it since.