Citi pre-qualify offers can provide you with some extra assurance and better interest rates when applying for Citi cards.

But how exactly do you get these offers and what do they mean for your approval odds?

This article will take a close look at what Citi cards you can get pre-qualified offers for and how to check links for these offers. I’ll also show you some tips for getting approved for Citi credit cards.

Interested in finding out the top travel credit cards for this month? Click here to check them out!

Table of Contents

What are Citi credit card pre-qualified offers?

Citi credit card pre-qualified offers are special offers that can be pulled up for applicants who have a high chance of getting approved for various Citi credit cards.

They do not guarantee approval and some people have even been denied for multiple pre-qualified cards. However, your odds of approval are usually high. Some say 90% but I’m not sure about that figure.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How to check for Citi credit card pre-qualified offers

You can find Citi pre-qualified offers here.

Note that this link is also where you will enter your invitation numbers for mail offers.

Pre-approval mortgages

If you’re looking for information about pre-approval mortgages you can check here.

How to pull up the offers

It’s very easy to check your Citi pre-qualified offers.

- Step 1: Go to the pre-qualified page

- Step 2: Enter in your personal information:

- Name

- Address

- Last four digits of your social security number (SSN)

- Step 3: Select a “card benefit” that matters the most to you (travel, cash back, etc.)

- Step 4: Click “See Your Card Offer”

If you have any pre-qualified offers they will show up.

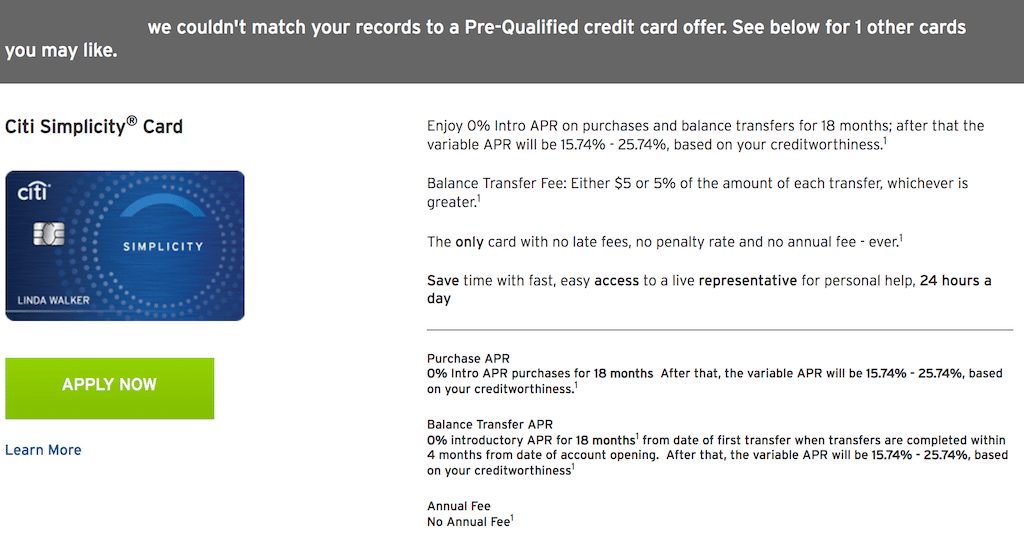

Otherwise, you’ll see a screen like the one below.

What Citi cards can I get pre-qualified for?

There are various credit cards that you can pre-qualified for.

List of pre-qualified Citi cards

- Citi DoubleCash

- Citi Diamond Preferred

- Citi Simplicity (examples)

- Citi Platinum Select (examples)

- Citi ThankYou Preferred (examples)

- Costco Anywhere Visa (examples)

- (Co-branded Hilton cards used to go out)

Citi DoubleCash

The Citi DoubleCash is a highly sought after card that earns 2% back on all purchases. It also comes with no annual fee so it’s one of the best cash back credit cards out on the market. It’s also one of the best 0% Intro APR offers on balance transfers, allowing 0% for 18 months.

Citi Platinum Select

The Citi Platinum Select is a one of the best airlines credit cards if you think you’ll be flying on American Airlines or their partners. This card often comes with 50,000 and 60,000 point offers and provides perks like free checked bags and priority boarding.

I’ve used the Platinum Select to rack up miles that I ended up using on partner flights to experience things like the Etihad First Class Apartment and Qatar Airways First Class.

Citi Simplicity

The Citi Simplicity is a great card for balance transfers because you can 18 months or longer to pay off your balance before the interest kicks in.

It also comes with no annual fee but there is a balance transfer fee of $5 or 5% of the amount of each credit card balance transfer, whichever is greater.

Other Citi cards

I searched for people who received offers for the more premium-level cards below, but I didn’t find reports of people receiving these offers:

- Citi Premier

- Citi Prestige

- Citi AAdvantage Executive card

- Citi Best Buy

Things to know about Citi pre-approval offers

There are a few things you should know about these offers before you decide to take advantage of them.

Fixed APR or a range?

If you’re given a specific, fixed APR for your pre-approval that could be a stronger sign of your approval odds versus just receiving an APR range. (But note that some cards like the Costco card offer one single APR).

Different APRs?

It’s not uncommon to see differences in interest rates based on your credit worthiness.

Some people have received lower interest rates in the mail than they have online as well, so sometimes it might be worth it to wait around for the right offer in the mail.

Tip: Inquire with Citi via chat about lowering your interest rate if you’re not happy with it.

Targeted offers

Citi will often send out targeted offers for its credit cards.

These offers should not be quickly discarded for two reasons.

First, these sometimes come with better sign-up bonuses that are much higher than the standard public offers.

Second, sometimes these offers don’t have the language limiting you to sign-up bonuses for certain cards in 24 month periods. You can find out more about these 24-month restrictions below.

Tip: Even if you don’t receive a targeted offer, you can often message Citi and request a match to those higher offers. Success is YMMV.

Credit report changes

Your pre-qualified offer is based on the status of your credit report at the time that the offer is generated.

So if your credit score and report changes after the time you receive an offer then your odds might be affected so always try to keep tabs on what’s going on with your credit report.

What if I’m not pre-qualified?

If you’re not pre-qualified you can still get approved.

In fact, I found one instance where an applicant was denied for two pre-qualified offers and then later approved when he applied a third time (without any pre-qualified offer).

So don’t think that you’ll be denied just because you don’t receive a pre-qualified offer.

What credit score is needed for pre-qualified offers?

After reviewing hundreds of posts, I saw a lot of pre-qualified offers for those with FICO scores in the low 700s and the upper 600s.

But even some people in the mid 600s received targeted offers.

So I would strive to get my score at or above 700 but once I start approaching the mid-600s, I would consider checking consistently for pre-qualified offers.

What credit bureau does Citi check?

Citibank will mostly pull from Experian and Equifax and in rare cases, TransUnion. Expect for Citi to pull from at least two credit bureaus.

You can read more about how credit pulls are done here.

Does checking for Citi pre-qualified offers affect my credit?

Citi will not conduct a hard pull on your credit report when you pull up pre-qualified offers so these will not affect your credit score.

How can I increase my chances of getting an offer?

If you do enough research, you’ll see that people with perfect credit scores don’t even get pre-qualified offers so it’s very hard to figure out why some get those and others don’t.

But there are a couple of factors you can control to increase your odds.

Utilization

You want to keep your utilization as low as possible. I’d shoot for under 10% if you’re trying to get pre-qualified offers.

Inquiries

Citi can be sensitive to recent inquiries so I would advise that you avoid applying for multiple lines of credit to increase your odds of getting an offer sent your way.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Citi application rules

Citi has specific credit card application rules that you need to be aware of.

“The Citi 8/65 Rule”

The 8/65 Rule means that you cannot apply for more than one Citi credit card in 8 days and not more than two credit cards in 65 days.

Business cards in 95 days

Citi will only approve you for one business credit card in any 95 day span.

Citi 6/6 rule

Something else to consider is what some dub the “Citi 6/6 rule” which states that you might be denied if you’ve had 6 or more hard pull inquiries in the last 6 months.

24 month rules

You cannot earn points for an additional card of the same brand if you’ve closed or opened up another one within 24 months. So for example, if you got an American Airlines card you could not earn the sign-up bonus on another American Airlines card within 24 months.

You can read more about these rules here.

Citi reconsideration line

If you’re not approved for your credit card application then you should consider calling the Chase reconsderiation line phone number.

Here is the Citi reconsideration line number:

- Inquiries: 800-763-9795

Some people will contact the Citi Executive Review Department at CitiBank Executive Review Department, P.O. Box 6000, Sioux Falls, SD, 57117. I’ve never done this but apparently others have had success.

You can check your Citi credit card application status by checking it online or calling the number below:

- Citi Application Status Number: 1-800-695-5171

You can read about my experience with Citi reconsideration here.

Opt-in

One thing you need to make sure that you have done is opt-in to receiving pre-screened offers. If you’re currently opted out there’s a chance you may have missed offers.

You can opt-in by clicking here.

Other pre-qualified offers

Other banks also offer pre-qualified offers.

Amex pre-qualified offers

Click to read more about Amex pre-qualified offers.

Chase pre-qualified offers

Click to read more about Chase pre-qualified offers.

Final word

Citi pre-qualified offers are worth looking into because it can make applying for Citi cards a little stressful. But you should always look into your options and consider that you might receive better in-mail offers.

Also, always consider that you might be denied for a pre-approval offer and that there are many specific Citi credit card application rules that you need to pay attention to.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.