Are you looking to see if you’re eligible for American Express pre-qualify offers for credit cards?

This article will walk you through how to check for your American Express pre-qualified offers and show you some things you can do to increase your chances of getting an offer.

I’ll also show links where you can get pre-qualified offers for other major banks like Chase, Citibank, Bank of America, etc.

Update: Some offers are no longer available — click here for the latest deals!

Table of Contents

What are American Express pre-qualified offers?

American Express pre-qualified offers are special credit card offers Amex allows you to pull up that usually mean you stand a good chance of getting approved.

They do not mean that you will be instantly approved and some people do get rejected even when applying for a pre-approved offer.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

How to check for American Express pre-qualified offers

You can check to see if you’re targeted for Amex qualified offers in four easy steps.

- Step 1: Go to the Amex website

- Step 2: Click on “Check for Offers”

- Step 3: Input your personal information

- Step 4: Submit your information

Step 1: Go to the Amex website

You can check for Amex pre-qualified offers by going to this link.

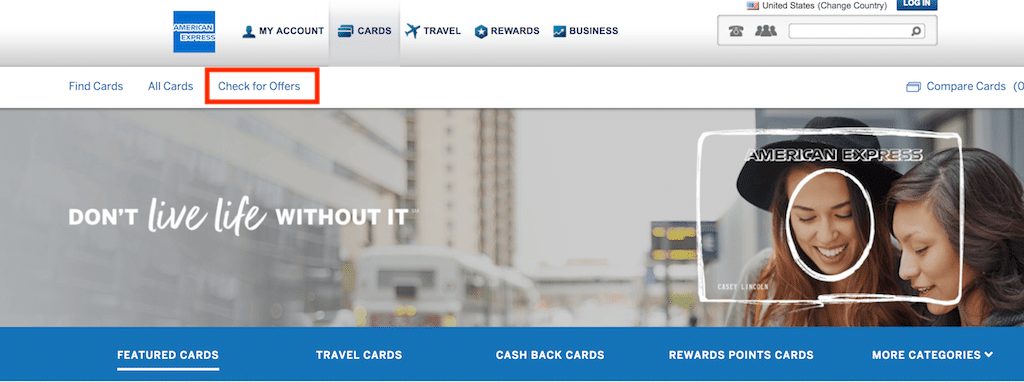

Step 2: Click on “Check for Offers”

Toward the top of the screen you should see a tab that says “Check for Offers.” Click on that.

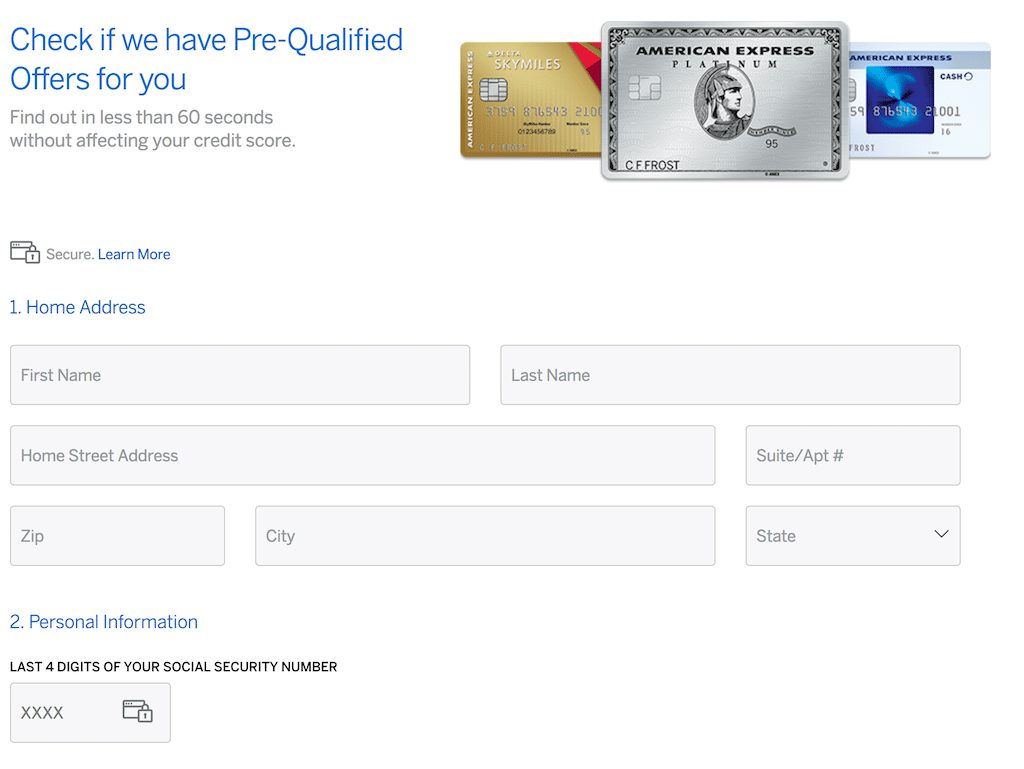

Step 3: Input your personal information

You’ll need to input the following information:

- Full name

- Address

- Last four of your social security number

Step 4: submit your information

Once you input your information, click on the “View My Card Offers.”

If you’ve been pre-qualified then some offers should show up.

You could also try calling American Express and checking if there are any pre-qualified offers for you.

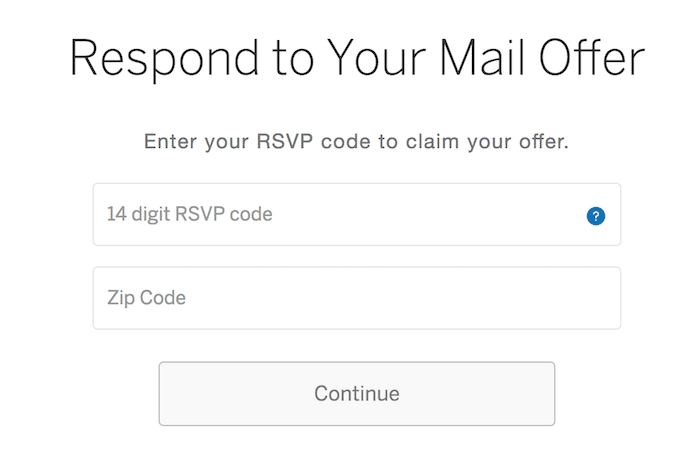

RSVP code offers

This is also the page where you can submit your RSVP codes to claim your targeted mailers. Sometimes American Express sends out special RSVP codes that allow you to access increased offers for credit cards. So don’t throw away mail from American Express!

CardMatch Tool

CardMatch Tool

You can also try to bring up pre-qualified offers via the CardMatch tool. This is a third-party tool that performs a soft pull on your credit in order to show pre-approved offers. Just like pre-qualified offers for Amex, the offers that this tool provides are not guaranteed to be approved.

What cards can you get pre-approvals for?

I’m not exactly sure which Amex cards you can get pre-approvals for, as this is something that can change over time. But some cards that you might try to get pre-qualified offers are:

- The Platinum Card

- The Amex Gold Card

- Amex EveryDay Preferred

- The American Express Green Card

- Amex EveryDay

- The American Express Gold Business Card

- The Blue Cash Everyday

- The Blue Cash Everyday Preferred

- Delta Skymiles cards (Platinum, Gold, etc.)

What credit score is needed for Amex pre-approvals?

It’s not 100% clear what credit score is needed for Amex pre-approvals but you’d generally want to get in the 700s for your best odds.

However, if your score is in the 600s then you can still definitely get pre-qualified offers.

I’ve even seen reports of people getting pre-qualified offers with credit scores in the mid-600s.

Just remember that the lower your credit score, the lower your approval odds will likely be. At a certain point, it makes more sense to just focus on improving your credit score and putting off going for pre-approval offers, as tempting as they can be.

Does Amex perform a soft pull or hard pull?

Amex will perform a soft pull on your credit report when they conduct the pre-approval.

They even state:

Check with confidence: this is not a Credit Card application and your credit score won’t be affected.

It seems that it’s becoming more and more common for Amex to perform soft pulls for their existing customers when they apply for cards.

It used to be that only soft pulls were done when an applicant was denied but now even some approvals are resulting in soft pulls.

You should always be prepared for a possible hard pull when applying for an Amex card but there’s definitely a possibility that you won’t have a hard pull if you’re already an Amex customer.

What’s the difference between a soft pull and a hard pull?

There’s a huge difference between a soft pull and a hard pull.

A soft pull will not affect your credit score.

On the other hand, a hard pull will bring down your credit score.

How bad will your credit score be affected?

The amount that your score will get brought down depends on your credit profile.

If you have a very established credit profile or a perfect credit score, the hard pull may only bring your score down a point (some say there might even be no effect).

On the other hand, if you have a very thin credit profile with a lower score, your score could go down over ten points.

In most cases, though, you’re looking at a 3 to 5 point drop due to a hard inquiry.

The good news is that your credit score will quickly go back up, usually in 60 to 90 days. After one year, the hard inquiries won’t have any effect on your FICO credit report and after two years it will fall off your credit report entirely.

What credit bureau will Amex pull?

If Amex does conduct a hard pull on your credit report, they will usually pull Experian, although it’s not guaranteed. If you want to learn more about which banks pull which credit bureaus you can read more about them here. You’ll find that there are certain trends with many issuers where they tend to pull one specific bureau.

What if I don’t have any offers?

If you don’t pull up any pre-qualified offers then don’t sweat it — plenty of people get approved even when no pre-approval offers come up for them.

I would probably check every three months or so to see if new offers popped up, but I wouldn’t be checking it on a daily basis.

Can Amex deny me?

As stated, just because you are pre-qualified, that does not mean that you will be approved.

There are plenty of data points out there of people getting pre-approved and then getting denied.

If you have a good credit score (720+), established credit history, and no blemishes on your credit report, I’d say your odds are very high of getting approved if you are pre-qualified.

What if I get denied?

If you are a current Amex customer and you get denied for a credit card, there is usually only a soft pull on your credit report (unless there’s been a big change on your credit report).

However, some people have reported that they’ve applied for pre-qualified offers and after being denied, they noticed that Amex only performed a soft pull on their credit report.

So if you get denied, there’s a possibility that your credit score won’t even be impacted if they don’t run a hard pull.

Targeted offers

American Express is also known for sending out valuable targeted offers.

If you want to receive targeted offers you can do these three things to improve your odds.

1. Don’t apply for any Amex cards

It seems that Amex likes to send out targeted offers to people who are not currently customers.

That’s not to say that current customers can’t receive targeted offers (they receive plenty) — it’s just that you might have an easier time coming across targeted offers when you have a great credit profile but are not currently a member of the Amex family.

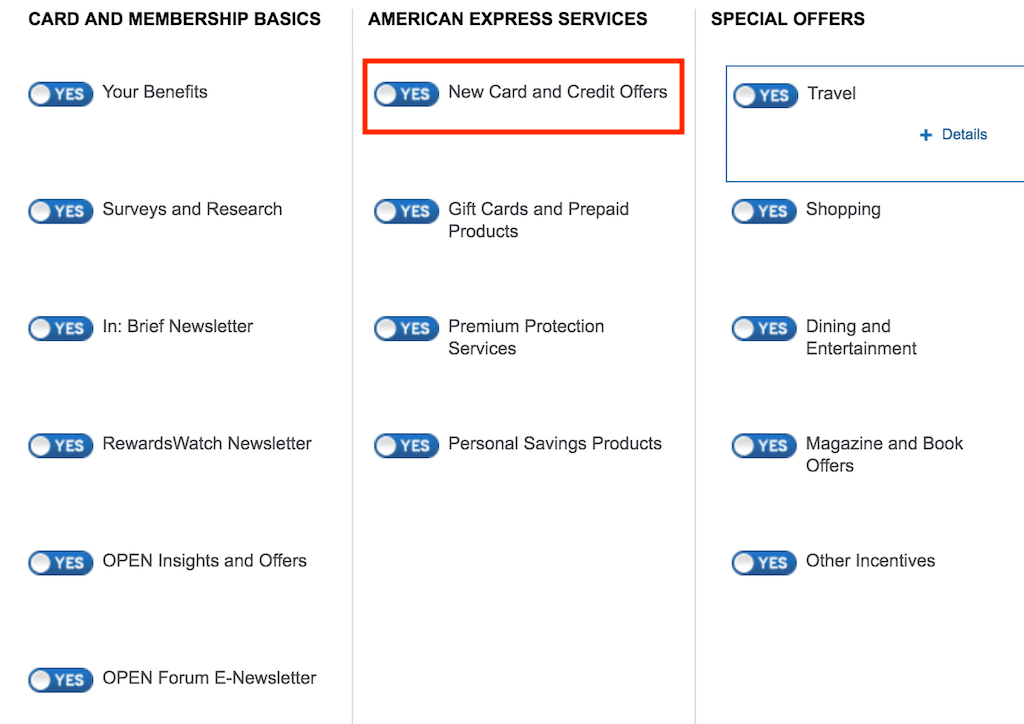

2. Opt-in to Amex offers

To make sure you’re receiving offers from Amex, you need to make sure that you’re opted in to their marketing communications. You can go here to manage your communications with Amex.

I chose to select all of the communications, just to ensure that I didn’t miss anything. However, you probably only really need to opt-in to “New Card and Credit Offers.”

3. Opt-in to credit card offers

You should also make sure that you’re opted-in to receive pre-screened offers with the official Consumer Credit Reporting Industry. This would likely mean more junk mail overall but many times there will be some great offers that come through so it’s worth sifting through a bit of junk mail.

If you’re not currently opted-in you likely won’t receive any offers. You can do that here.

Amex Platinum 100K

The American Express Platinum is a fantastic card with many rich benefits and one very special targeted offers is the Amex Platinum offer with a 100,000 point welcome bonus.

The standard public offer is for 60,000 Membership Rewards after you spend $5,000 in the first 3 months so this offer is significantly higher and you can find out more about this offer here.

Amex Application Rules

American Express might send you out pre-qualified offers but it’s up to you to make sure that you’re not violating one of their key application rules.

If you do violate these rules you’ll likely be denied.

Here are the most important Amex application rules that you should be aware of. If you would rather automate your eligibility for these rules just check out the new free app WalletFlo.

Once per lifetime

American Express will typically limit you to only welcome bonus per lifetime.

In reality, there are ways to get around this. Sometimes Amex will send offers out that don’t contain the once per lifetime rules.

Multiple credit cards at once

Amex will generally not allow you to get approved for two credit cards at once — you usually need to wait about a week.

Some people still get lucky and are able to get approved for two cards at once but they are mostly outliers. Also, note that Amex this rule only applies to credit cards and not charge cards, so it’s possible to get approved for two charge cards at the same time.

2/90 rule

Amex will allow you no more than two credit cards within 90 days. Again, this rule only applies to credit cards.

Top 3 Amex cards

The Platinum Card from American Express

- 60,000 miles after spending $5,000 within the first 3 months (75K offer in Google Incognito and there are even methods to get 100K offers)

- $200 airline credit and $200 Uber credit

- 5X on airfare and 5X on hotels booked through the Amex Travel portal

- Priority Pass access for you and two guests

- Centurion lounges access for you and two guests

- Delta SkyClub access when flying with Delta

- Hilton Honors Gold elite status

- SPG Gold Preferred elite status (and therefore Marriott Gold and Ritz-Carlton Gold), and rental car status as well

- TSA Pre-Check/Global Entry $100 credit

- Annual fee: $550 (NOT waived first year)

The Platinum Card from American Express is one of my favorite travel rewards credit cards with its high welcome bonus, 5X on airfare and its lounge access benefits which are much better than virtually every other premium credit card.

American Express Gold Card

The new Amex Gold Card is a very attractive option, too. The standard public offer is for 35,000 Membership Rewards but you can find referral offers that offer 40,000+ Membership Rewards.

But what really makes this card stand out are the bonus categories which are:

- 3X on airfare

- 4X points at Restaurants

- 4X points at U.S. supermarkets (up to $25,000 in spend per calendar year)

The card also comes with a $120 dining credit, which offers a $10 monthly credit that can be used at Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, and Shake Shack (read more about that credit here). With the addition of a $100 airline credit, it’s very easy knock down the effective annual fee to just $30.

Amex EveryDay Preferred

- Earn 50% more points 30 or more times on purchases in a billing period and

- 3X at US supermarkets on up to $6,000 per year in purchases

- 2X at US gas stations

- $95 annual fee

The Amex EveryDay Preferred is one of the best cards for earning tons of Membership Rewards. If you do a lot of shopping at supermarkets this card will be one of the most valuable cards you can get. Earning 3X on up to $6,000 at US supermarkets is great but that 50% bonus can put the earnings over the top.

Other banks pre-approval options

American Express isn’t the only bank to offer pre-approvals for their credit cards.

Plenty of other major banks also offer pre-qualified offers.

Bank of America pre-qualified offers

- Bank of America allows you to check for your pre-qualified offers here.

Barclays pre-qualified offers

- Barclays no longer allows you to check for your pre-qualified offers.

Capital One pre-qualified offers

- Capital One allows you to check for your pre-qualified offers here.

Chase pre-qualified offers

- Chase allows you to check for your pre-qualified offers here.

You can read more about Chase pre-approvals here.

Citibank pre-qualified offers

- Discover allows you to check for your pre-qualified offers here.

Discover pre-qualified offers

- Discover allows you to check for your pre-qualified offers here.

HSBC pre-qualified offers

- HSBC used to have a pre-qualified checker but it is no longer available.

US Bank pre-qualified offers

- US Bank allows you to check for your pre-qualified offers here.

Final Word

Amex pre-qualified offers are nice because they can give you an idea about which Amex cards to go with and sometimes they even result in soft pulls that don’t even impact your credit when you’re denied.

But you don’t need to receive a pre-approval to get approved for a card. So I’d give it a shot to see if I had any pre-approvals but I’d be more focused on building a solid credit score so I could apply for some of the best Amex cards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.