Virtually every time you apply for a line of credit, such as a credit card, your credit report will be hit with a credit pull. But not every credit pull is equal and not every credit pull affects all of your credit scores.

This comprehensive article will first explain what credit pulls are and the difference between hard pulls and soft pulls. I’ll then show you how to find out which credit bureau (Experian, TransUnion, or Equifax) a bank will pull from when you apply for a credit card by utilizing credit databases.

Table of Contents

What are credit pulls?

Credit pulls are when an entity, usually a lender, “pulls” your credit report to review your creditworthiness (i.e., how likely it is that you will responsibly borrow and pay back funds).

There are two different types of credit pulls: “soft pulls” and “hard pulls.” Knowing the difference between these two is very important.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Soft pulls

Soft pulls do not affect your credit score.

These can be done by lenders for things like pre-approvals but they are probably most commonly done when you check your credit score using something like Credit Karma or other times when something like a background check is done on you.

Hard pulls

Hard pulls are just like soft pulls except that they do affect your credit score. These are almost always done when you apply for a credit card or for any type of financing (home loans, car loans, etc.). And they can even happen for things like utilities and cell phones.

Unlike soft pulls, you want to limit hard pulls because they affect your credit score, as explained in more detail below.

How do credit pulls affect your credit score?

It’s really helpful to understand how credit pulls (hard pulls) affect your credit score.

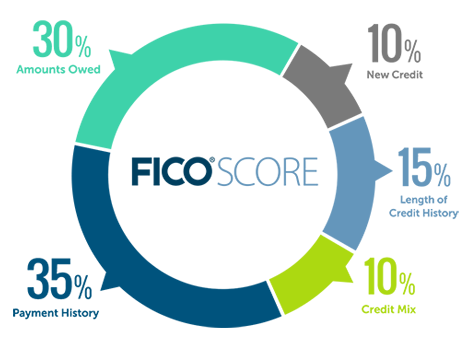

Hard pulls affect the “New Credit” category of your FICO score which accounts for only 10% of your total credit score. Below is how your credit score is determined:

- Payment History (35%)

- Utilization (30%)

- Credit History (15%)

- New Credit (10%)

- Mixed Credit (10%)

Each time your credit report is pulled, your credit score will likely drop a few points, typically 3 to 5 points. For people with more established credit profiles, this drop might be even smaller. For people with weak credit scores, this drop could be larger (even over 10 points.)

The good news is that your score will bump back up over the course of a few weeks or months. After 12 months, the credit pull won’t even effect your FICO credit score and after two years it will drop off entirely. To read more about how hard inquiries affect your credit score, click here.

Why does it matter which credit bureau will be pulled?

You might be wondering why it even matters which credit bureau will be pulling your credit score. Well, there are a few important reasons why it matters.

Mitigate damage to your credit report

- It’s important to give your credit report a break every now and again. By alternating credit bureaus pulled, you’ll be able to mitigate the dings to your credit report.

For example, if you have three recent hard inquiries on your Experian report and you can choose to apply for a card that will pull from only TransUnion, that will allow you to give your Experian score a break.

Minimize appearance of hard pulls

- Many credit card issuers don’t like to see a dozen plus inquiries over the past year or two, so by trying to go for certain bureaus, you can minimize the appearance of being a credit savage.

Using the same example as above, if you were to apply to a bank that pulls TransUnion they would not technically see your recent Experian inquiries. So it would not look like you are aggressively pursuing credit as much as you are, which is a good thing.

Utilizing your “cleanest” credit report

- Some banks will not approve you if you have negative marks like late payments or collections on your credit report. So by knowing which banks pull which credit bureau, you can avoid those banks at least until more time passes and your negative marks don’t mean as much.

It is not uncommon for derogatory remarks or certain types of negative reports on your credit to only be reported to one or two bureaus. Some banks will deny you even if those negative marks are very old. So if you have one report clean from any negative marks and you can rely on that one report for a credit card application, that can help you get approved.

Utilize your highest credit score

- Sometimes your credit score can vary dramatically between the bureaus in which case you’d obviously want to go for banks who might use your higher score.

Remember that just because one or two credit bureaus are pulled, your new account will still likely show up on all three of the major credit bureaus. This is great because if you only have one good credit report like TransUnion, you can leverage that one to get new cards which will eventually boost the score of your other credit reports!

Are credit pulls worth it?

Credit pulls are absolutely worth it when you’re able to secure a much-needed loan or pick up one of the best rewards credit cards.

When you’re earning hundreds (or even thousands of dollars) in credit card rewards, a short-term ding on a credit report is well worth it.

How to find out which credit bureau will be pulled

The truth is that all we have are imperfect tools to work with to determine which credit bureau will be pulled.

With that said, we also have certain trends that we can base our predictions on. These trends and tools can at least help us make an educated guess as to which bureau will be pulled.

I’ll start by identifying which credit card issuers are known for pulling certain bureaus and then get into the different methods for figuring out which bureau will be pulled by using databases.

Credit card issuer trends

The information below is based on my experience with dealing with these issuers for myself and for many others over the past few years. It’s also based on a review of the data found in CreditBoards. Understand that your experience could differ greatly from my findings below.

American Express

American Express loves to pull Experian.

For every single one of my Amex issued credit cards over the past few years, they have always pulled from Experian (and only Experian). However, sometimes they can mix it up and pull from another bureau like TransUnion. But if you apply for an Amex card, you can almost always count on Experian being pulled.

- Note: If you are a current Amex customer, they typically only do a soft pull if they reject you for a credit card and sometimes only do a soft pull when they approve you!

Barclaycard

Barclaycard is great because they usually pull from TransUnion. This allows you to give your other credit reports a break as they’ll sometimes only pull from TransUnion (bot not always).

Capital One

Capital One likes to invite everybody to the party and they pull from each of the three credit bureaus. In the past you could freeze one bureau like Experian to save yourself the hard pull, but recent data points show that’s not always successful.

This “freezing” technique can work for other credit card issuers, too. But you need to pay close attention to what works and what doesn’t since these type of things can be in flux sometimes. For more info on this check out the DOC’s article here.

Chase

Chase is a hard one to predict. I’d say expect an Experian pull and one additional bureau but it could be very location-specific.

Citibank

Citibank will mostly pull from Experian and Equifax and in rare cases TransUnion. Expect for Citi to pull from at least two credit bureaus.

As you can tell, it’s hard to pinpoint which bureau will be used for the credit pulls. But you can use the tool below to narrow your focus by region and potentially get a more accurate idea of what to expect.

Creditboards Credit Pull Database

The Credit Pull Database on Creditboards.com is the most popular source for checking which credit bureau will pull your credit for a credit application.

The key is to remember that the data you’ll find is usually self-reported. This means that it could be inaccurate, outdated, or perhaps even anomalous data that doesn’t accurately represent a given segment of society.

But that’s okay, because at least we have guiding posts for the data on credit pulls.

As long as you always remember that the data you’re relying on may not be 100% correct in every scenario, you won’t be surprised if your experience doesn’t accord with the data you found.

Using the Credit Pull Database

The Credit Pull Database is extremely easy to use.

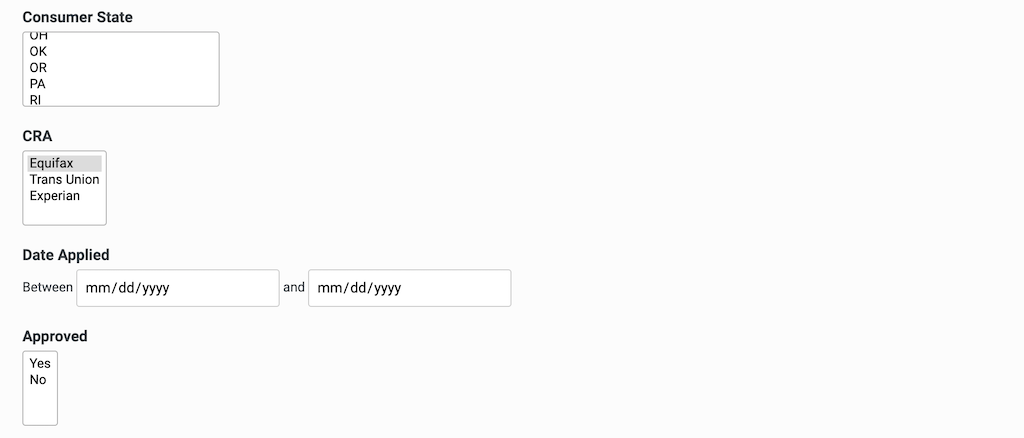

Just click on this link and you’ll be able to search by the following criteria:

- Consumer State

- Credit Reporting Agency

- Date applied

- Approved

You do not have to select all of the details. I selected Texas and Equifax and found credit pulls data points for the following banks:

- NFCU

- Wells Fargo

- Discover

- PenFed

- US Bank

- USAA

- Chase

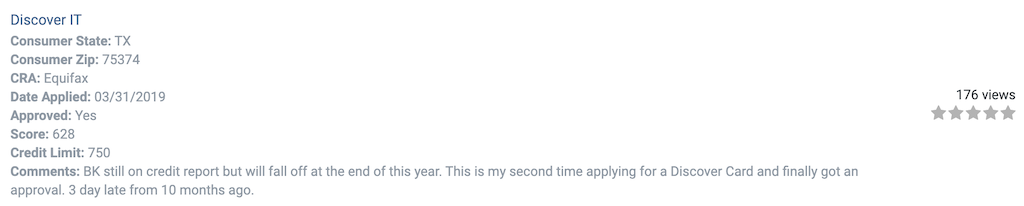

In addition to the credit bureau data you can also see other relevant data points. You can see user details like:

- The applicant’s ZIP Code

- The date applied

- Whether or not they were approved for the credit card

- Their credit score

- Credit limits

- Random comments

The comments can be really helpful because you can find out if people were approved with things like bankruptcies on their credit report. Also, if there were multiple credit bureaus pulled sometimes people will report them in the comments.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Alternative methods for finding credit pulls

Reddit spreadsheet

The folks over at Reddit have put together a spreadsheet with credit card application data. The spreadsheet includes even more criteria than CreditBoards such as income, average age of accounts, and how many accounts have been opened in the past 3, 6, and 12 months.

This data is incredibly useful but may not be as voluminous as CreditBoards.

The data also might be skewed in favor of people with better credit scores since I imagine the demographics of those who frequent that forum are from more affluent sectors of society or at least have better credit scores.

Personal credit reports

You can also search your own credit reports to see which credit bureaus were pulled in the past. The issue with this is they they won’t show up beyond 2 years. Also, the credit bureaus could change what bureaus they pull from.

You can check your credit score for free with Credit Karma (TransUnion and Equifax) and FreeCreditReport.com (Experian).

Credit card issuers who do soft pulls

Outside of the Amex exceptions mentioned above, there aren’t many other issuers that will conduct a soft pull of your credit when applying for a credit card.

So what can you do?

You can try out something called the “Shopping Cart Trick.”

There are a few steps that you’ll need to follow but if you’re successful, it’s actually possible to get approved for a credit card without ever having a hard pull on your credit card. It’s not going to be a huge credit line, but at least it’s something.

Read more about how that method works here. Note that this method does not work as much as it used to.

Credit limit increases

Before you ever request a credit limit increase from a bank make sure you inquire with whether or not they conduct a hard pull on your credit report.

Amex

American Express will not conduct a hard pull when you request a credit limit increase. To request an increase, you typically want your account to be open for 60 to 90 days and will likely shoot for an increase of 2X to 3X your credit. If you would like to find out more about how to request a credit limit increase with American Express click here.

Barclays

Barclays will usually do a hard pull when you request a credit limit increase but they are pretty generous when it comes to auto increases.

Capital One

Capital One will conduct a soft pull. You can find out more about how to get a credit increase with a Capital One here.

Chase

Chase will conduct a soft pull — read more about getting Chase credit limit increases here.

Citi

Citi will do both hard pulls and soft pulls but they should notify you beforehand. Just call the number on the back of your card to inquire with a rep of whether or not you’ll get a hard pull or soft pull. Read more about Citibank credit limit increases here.

Discover

The process varies for Discover. If they accept your initial request, that’s usually a soft pull but if you’re trying to get a larger credit line increase, then that could result in a hard pull.

Final word

In the end, you’ll probably have to leave some of this stuff up to chance.

But it’s still a good idea to check these resources out so that you can at least give it a shot at trying to navigate your way through the hard pull landscape. Even if you only get it right 50% of the time, those instances could still work in your advantage and allow you to minimize damage to your credit score.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

great information, very informative.

This was so informative ! I am a newbie to the working of the credit world This information should be required reading for high school and college students as a debt management or debt avoidance course.