A lot of people often wonder if credit inquiries hurt their credit score or wonder what the difference is between a hard pull and a soft pull. There’s a big difference between the two and becoming informed about what kind of credit inquiries affect your credit score (and how much they do) can help you make better decisions when pursing credit cards in order to preserve your credit score. So here’s the low down on how credit inquiries affect your credit score.

What’s a credit inquiry?

An inquiry is when an an entity pulls (or retrieves) your credit report for review. There are two different kinds of inquiries or “pulls”: soft pulls and hard pulls.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What’s the difference between a hard and soft pull?

A soft pull is an inquiry that does not do damage to your credit score. It can be performed even without your permission.

A soft pull will still show up on some credit reports but it should never result in a drop in your score or be categorized under the “inquiry” category that really matters to lenders (the one where hard pulls go). Soft pulls usually result from credit card pre-approvals, personal credit checks from places like Credit Karma or Credit Sesame, and various other checks like those from employers. (Employers must always receive permission to conduct a credit check according to the FCRA, however.)

A hard pull is a different story. A hard pull on your credit can only be done with your permission and will almost always result in a temporary drop of your credit score and is something that you want to constantly keep an eye on.

What counts as a hard pull?

Generally, any time you apply for a loan, whether it be a home loan, car loan, student loan, personal loan, business loan, etc., you’ll incur a hard pull (see below about combined inquiries). Also, opening new credit cards (even many store credit cards), some bank and credit union accounts, new phone accounts, new cable/internet service accounts, and new utility accounts can often result in hard pulls.

Even getting auto insurance quotes, applying for apartments, and renting from rental car agencies (usually only if paying cash) can result in hard pulls to your credit. And finally, if you ever agree to any kind of background check (especially one from a financial institution), there might be a chance for a hard pull.

Sometimes hard pulls occur due to error, so you should always try to verify whether or not an entity will perform a hard pull and try not to take “we don’t know” as an answer. Someone within the chain-of-command should always be able to provide you with a clear answer.

How do hard pulls affect your credit score?

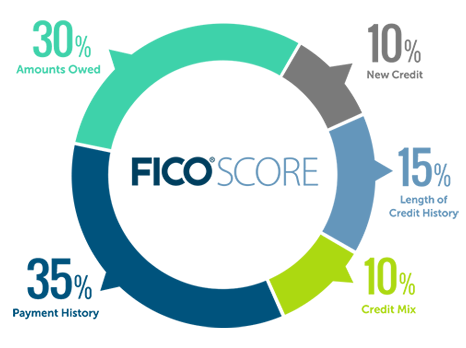

FICO determines your credit score in the following ways:

Hard inquiries fall into the “New Credit” category that accounts for 10% of your score. Other factors in this category are:

- How many new accounts you have

- How long it’s been since you opened your last account

I don’t think FICO releases exactly how these factors ultimately impact the 10% category of new credit but they have provided us with some guiding information that I’ll discuss below.

Related: How to Raise Your Credit Score by 200 Points

Why does an inquiry hurt your credit score?

You always have to look at these things trough the perspective of a lender. When people are pursing credit, there’s usually a reason why. They want access to credit in order to use that credit. For someone who hasn’t shown an established history of managing credit, the pursuit of credit is questionable since they will likely be using that credit and it’s not clear that that they will be able to manage it (i.e., pay it back).

Also, if someone is pursuing multiple lines of credit, it’s a sign that they might be in financial trouble or are getting ready to accumulate a lot of debt, which might make them a risk until they prove they can handle their credit. That’s why inquiries hurt your score because they’re meant to signal to lenders that you are doing something that could potentially make you a credit risk.

And that’s why the negative effect is only temporary and doesn’t affect people with longer credit histories as much because once you’ve proven you’re responsible, your pursuit of additional credit is no longer indicative of a credit risk.

How long do hard inquiries remain on your credit report?

Hard inquiries will remain on your credit report for two years.

How much do credit inquiries affect your credit score?

Generally, a new hard inquiry will temporally drop a credit score by 2 to 5 points.

The more established your score is the less the impact a hard credit inquiry will have. This means that if you have an established and rock solid payment history with multiple accounts spanning 10+ years, then a hard inquiry will have a very small impact on your credit score. In fact, it’s possible you may only experience a negligible (and some even say nonexistent) effect on your score in some instances.

However, if you have a bad credit score and little to no history then the impact will be higher — sometimes much higher. Some people have reported drops of 12 or more points from inquiries.

In addition, if you have multiple hard inquiries and new accounts, it’s possible that each new inquiry will count more against you. The reasoning goes back to you being considered a credit risk.

Consider that people with 6 or more inquiries on their report can be 8 times more likely to declare bankruptcy than people with no inquiries. If you’ve got an established credit history obviously this stat wouldn’t apply and FICO would probably realize that. But if you’re just starting out, it’s easy to see how so many inquiries could significantly damage your credit score.

How long will hard inquiries affect your credit score?

Hard inquiries will only affect your FICO credit score for 12 months. This is tremendous news for those of us who have racked up many credit card inquiries over the past two years. However, you don’t always have to wait for a year for hard inquiries to lose their effect.

It’s generally accepted that hard inquiries begin to lose a lot of their negative effect on your credit score after about 60 to 90 days. This is why some people wait 90 days in-between applying for multiple credit cards. This probably is somewhat dependent on your credit history and score. The better those things are the less amount of time it will probably take for your credit score to rebound or for the inquiries to lose their effect.

Do hard pulls hurt my chances of getting a mortgage?

First, if I were planning to buy a house I’d probably sit out from applying for credit cards for 6 to 12 months, leaning more towards 12. This would definitely be the case if I knew my potential lender used FICO.

But this might still make you curious about the impact of inquiries that are over one year old. Would those count against you when trying to get a mortgage?

I’ve spoken with a (respected) mortgage lender about this issue and this is the response I received verbatim:

“We don’t really look at the number of inquiries but rather if those inquiries have resulted in new debt. If they are just inquiries that didn’t result in new debt then we don’t care about them.”

That means that they are more concerned with installment loans like personal loans, car loans, etc., and wouldn’t care about additional credit card accounts (unless those potentially resulted in new debt).

I know lenders can vary dramatically, so don’t take this advice to be universal. However, it’s good to know that even if you have inquiries that will take another 12 months to fall off your report (i.e., inquiries over 1 year old), they may not have any negative impact on you getting approved for a mortgage. Again, always check up on this stuff with your local real estate experts and lenders, since I’m sure this varies.

Some hard pulls on your credit are combined

FICO can detect when you’re shopping around for the best interest rate for an installment loan for a house, car, or even student loan (I’m not sure what other loans qualify for this). When it detects this, it lumps the inquiries into one. So, for example, if you went car shopping and had your credit pulled 8 times in a week, those inquiries should only impact your credit score as if they were one single inquiry.

Related: Can You Pay for a Car with a Credit Card?

The time period in which inquiries will be combined varies based on the credit score model. Generally, the time period is 30 days but it can be as soon as 14 days or as long as 45 days. Personally, I’d try to keep the inquiries as close together in time as possible (like within 7 days) but that’s just because I like to play things like this conservatively.

Another instance when hard pulls can be combined is when you apply for credit cards from the same bank at the same time. Some banks, such as American Express, will allow you to apply for multiple cards at once and the bureaus that receive the credit pulls will combine them.

This doesn’t work 100% of the time but if you apply for credit cards within minutes of each other, you’ll have a good shot at combining hard pulls and thus reduce the negative impact on your credit score.

Can you remove hard pulls from your credit report?

If there’s a hard pull on your credit report that you know is not supposed to be there you can dispute it. There have been controversial ways to remove hard pulls in the past but I’m not going to get into those since they are mostly dead (if not all dead) and they can often be more hassle than they are worth.

Keep in mind that if you aggressively dispute things on your credit report (especially if you do so without justification), your credit report can become subjected to heightened fraud protections. This can be a real pain when you’re pursuing multiple credit cards because it might bring unwanted attention to your applications and lead to denials, since you’ll often have to call in and may not be able to get auto-approved. Just something to think about.

Remember, it’s still just 10%

Remember that credit inquiries only make up a portion of your “new credit” category and that category only counts for 10% of your total score.

With that said, if you have a lower credit score and/or a thin credit profile you may want to try to space out credit card applications (that don’t combine inquiries) to avoid huge dips in your credit score. Spacing them out every 90 days or so would be a good idea. Even if you do push it too quickly in the beginning and cause your score to take a huge dip, don’t worry. That dip should only be temporary. Just take a break from applications for a few months and you’ll probably see your score rise back up.

And as stated, if you have a high credit score along with an established credit history, inquiries will probably be a non-issue for you.

Can I avoid hard pulls when applying for a credit card?

Yes, some people have luck avoiding hard pulls when they apply for credit cards by utilizing something called the shopping cart trick. You can read more about how this trick works here.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

9 comments

Comments are closed.