What Is a Perfect Credit Score? (And How to Get One) [2022]

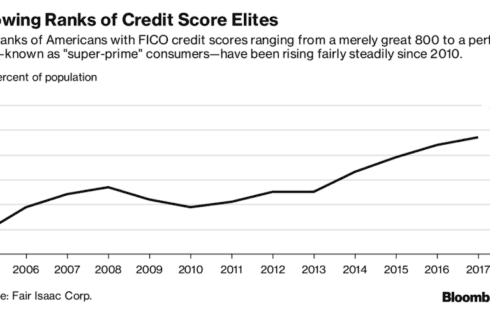

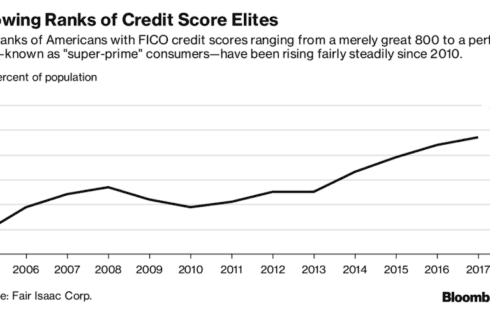

The “perfect credit score” is a bit of a misleading term because just being in the top tier of credit scores usually will grant you the same privileges as having

The “perfect credit score” is a bit of a misleading term because just being in the top tier of credit scores usually will grant you the same privileges as having

Becoming an authorized user can do wonders for your credit report but it can also do some harm if you’re not careful. Here’s a run down on how becoming an

Virtually every time you apply for a line of credit, such as a credit card, your credit report will be hit with a credit pull. But not every credit pull

One of the first questions that people tend to have before jumping on new credit cards is whether or not their credit score is going to be hurt if they

A lot of people are disappointed to find out that their credit score has gone down after opening up a new credit card. In some cases the credit score goes

This is the story of how I was able to remove student loan late payments from my credit report. As soon as I found out the amazing travel benefits created

A lot of people (including myself) rely on Credit Karma to monitor their credit score to make sure everything stays up to par. It’s a very easy and free to

A lot of people often wonder if credit inquiries hurt their credit score or wonder what the difference is between a hard pull and a soft pull. There’s a big

A very common question that I see come in often is: how long do hard inquiries stay on your credit? It’s an important question and understanding both the short-term and the

Are you trying to improve your credit score by 200 points or more? Are you wondering what is actually possible and realistic in terms of improving your credit profile? Well,

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |