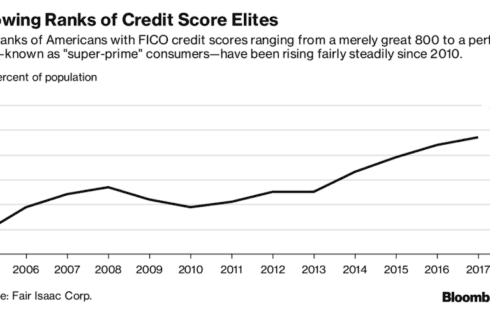

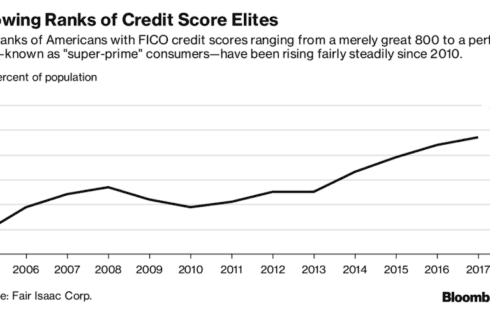

What Is a Perfect Credit Score? (And How to Get One) [2022]

The “perfect credit score” is a bit of a misleading term because just being in the top tier of credit scores usually will grant you the same privileges as having

The “perfect credit score” is a bit of a misleading term because just being in the top tier of credit scores usually will grant you the same privileges as having

Are you trying to order new checks or checkbooks from Chase? Well, the process is very simple and it can be done online, over the phone, or even in-branch. This

Not as many people today use checks as they did in the past. In fact, in 2013 a survey showed that roughly 50% of millennial’s do not use checks. In

ATMs are extremely convenient and allow you to withdraw cash as well as make deposits with both cash and checks. But banks set certain limits for your withdrawals and Chase

These days, most of us go around using plastic for just about everything: bills, dining, shopping, etc. And coins are becoming more and more obsolete for things like parking meters

Sometimes it’s nice to add a little bit of a personalized touch to your debit and credit cards to keep things interesting. And it’s even nicer when this comes with

Safety deposit boxes can be smart ways to store some of your valuable belongings. However, they are not perfect by any means and are not designed to store all of

Becoming an authorized user can do wonders for your credit report but it can also do some harm if you’re not careful. Here’s a run down on how becoming an

There are a few reasons why you would want to write a check to yourself. Typically, you are probably wanting to transfer some money from one account to another or

Virtually every time you apply for a line of credit, such as a credit card, your credit report will be hit with a credit pull. But not every credit pull

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |