Does Income Affect Your Credit Score? [2021]

A lot of people wonder whether or not their income affects their credit score. The answer is a little bit more complicated than a straight “yes” or “no” since there

A lot of people wonder whether or not their income affects their credit score. The answer is a little bit more complicated than a straight “yes” or “no” since there

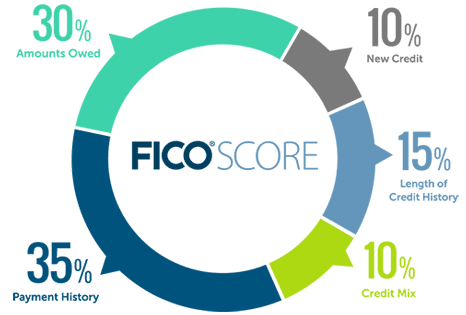

Credit mix is a category that accounts for 10% of your total FICO score. It’s an often overlooked category and probably the least discussed category of your score. While it’s

For a lot of beginners, there’s some confusion regarding whether or not you should pay off your credit card balance each month. A lot of people actually think it harms

Payment history is the most heavily weighted factor in the FICO credit score formula. It’s very important to understand the effect that a late payment will have on your credit

Are you thinking about opening up a Chase business checking account but you’re unsure which type of checking account is right for you? Do you also have questions about all

Many people still wonder whether or not credit cards are actually safer than debit cards. Lots of individuals don’t know about the differences in liability protection that exist between credit

Keeping up with your credit score and report is crucial given all of the different ways that your credit score can impact your daily life. Luckily, there’s a number of

Avoiding Coronavirus Financial Scams: Everything You Need to Know The coronavirus pandemic has found a way to affect our lives in almost every imaginable way. But one often overlooked

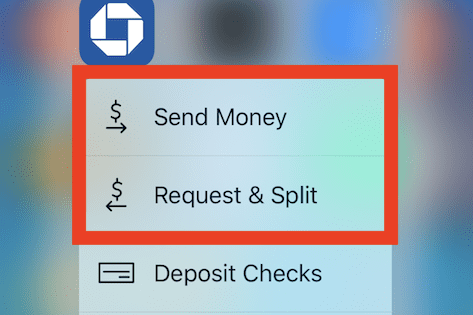

Have you ever needed to transfer funds over to friends or family but did not want to hassle with wiring fees or with sending in checks or cash deposits? Or

The reality is that in most cases, there’s no quick fix to your credit score. When you make a mistake like missing a payment or falling into delinquency, you often

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |