Amazon “Courtesy Credits” Explained [2020]

It’s not uncommon for large companies to issue courtesy credits in certain situations. For example, Southwest may offer travel funds if they botch a flight situation and credit card companies

It’s not uncommon for large companies to issue courtesy credits in certain situations. For example, Southwest may offer travel funds if they botch a flight situation and credit card companies

Managing your wealth is crucial and there are several programs offered by many large banks aimed to help you plan for your financial future and Chase Private Client is one of those

SoFi Money is sort of a hybrid between a checking and savings account. SoFi is a cash management account that offers a competitive APY and right now there is a

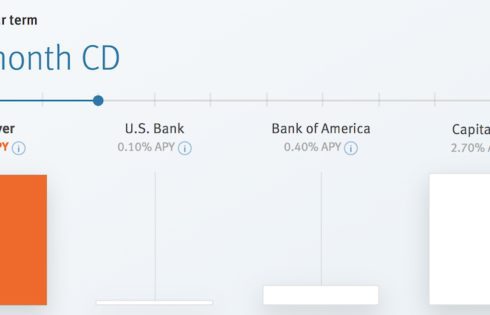

Many people don’t want to hold on to cash but don’t necessarily want to put their cash in a place like the stock market where they have to be subject

There are two main types of Chase savings account for the average consumer: Chase Savings and Chase Premier Savings. Below, I will go into detail about each of these accounts.

Do you have a credit score of 730 (or stuck to close to 730) and are you wondering what your approval odds are for credit cards or how to improve

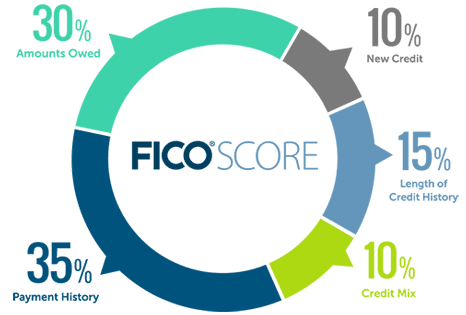

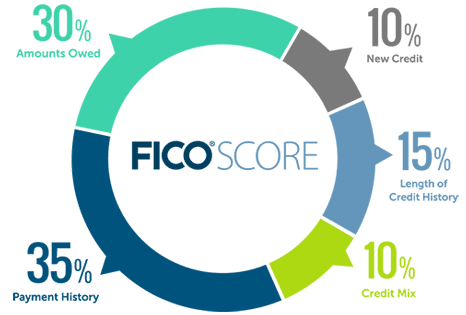

The focus on UponArriving is obtaining some of the best rewards credit cards and so when I talk about the importance of credit, that’s usually the #1 reason why. But

Goodwill letters to creditors are the first line of defense for many trying to rebuild their credit by getting negative remarks like late payments removed. Goodwill letters are simple letters

Credit limit increases are an easy way to help decrease your credit card utilization and give your credit score a boost. With a credit limit increase, a bank will increase

It’s easy to take credit reports and credit scores for granted. But could you imagine living in a time where even the idea of a credit reporting agency didn’t exist?

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |