Many people don’t want to hold on to cash but don’t necessarily want to put their cash in a place like the stock market where they have to be subject to certain risks. For these people, CDs (certificate of deposits) can be great options. In this article, I’ll tell you everything you need to know about Discover Bank CDs, including the rates, fees, and IRA/Roth, AAA rates.

What are the Discover Bank CD rates?

The Discover CD rates will vary and can change every day. You can check the current rates here.

As of April 27, 2019, the APY rates were the following:

- .35% for 3 months

- .65 for 6 months

- .70 for 9 months

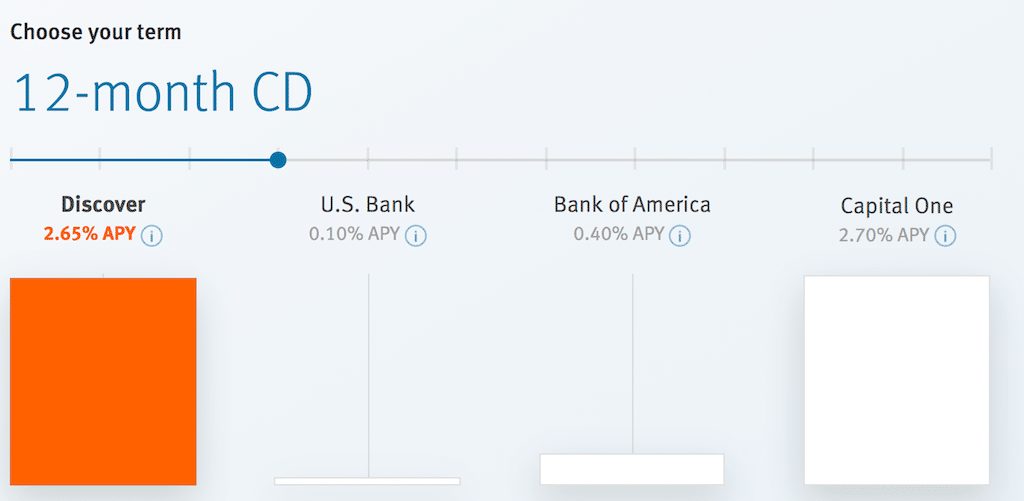

- 2.65% for 12 months

- 2.65% for 18 months

- 2.7% for 24 months

- 3% for 5 years

You can use a slider calculator to choose your desired timeframe here. I personally would avoid anything less than a 12 month CD since the rates are much lower than you can find with a savings account.

The Discover CD rates are better than some of their competitors like Bank of America and US Bank. However, you can find some CDs with better rates with certain FDIC insured banks like Capital One or Marcus by Goldman Sachs. Some of them even have lower minimum deposits.

Overall, I think the CD rates by Discover are okay but if you suspect you might need your funds during the CD period, you might want to stick with a money market account with an APY that might be a tad lower but with the freedom to do as you want with your cash without a penalty.

Are the Discover interest rates locked?

According to Discover, these interest rates are locked in. This is great because you know what you’re getting at the end of the CD period but if interest rates were to go up you might be missing out.

Discover Bank CD IRAs and Roth

Discover also offers CDs for retirement with Traditional IRA and Roth IRA accounts. Which account will be best for you will depend on a few factors like your income, age, and future tax bracket. If you want your CD to be funded with after-tax dollar then you’d go with a Roth IRA CD, which is better if you’re future income bracket is going to be higher.

You could also open up a Traditional IRA CD where your earnings are tax-deferred (better if your future income bracket will be lower). The contribution limit (which changes and can depend on filing status) is $6,000 in 2019 for tax-deductible contributions.

I don’t know if the Discover IRA CD rates are always the same as the standard CD rates but when I checked them they were the same.

Discover Bank CD rates for AAA members

Discover is known for offering better rates for AAA members. You can check on those rates here. However, depending on the state that you live in you might not be able to proceed. It is reported that you should still be eligible for the special AAA rates even if you get the following message:

We are unable to process your request at this time. You may have reached this page through a previously established bookmark or old web link or your AAA Club may no longer participate in the AAA/Discover Deposit Program

Therefore, I would probably call in to Discover and inquire about any potential special CD rates if you are a AAA member.

Discover Bank CD fees

Funding and withdrawal

There are no fees to wire in your funds from an external bank. However, if you are sending an outgoing wire there will be a $30 fee.

Early withdrawal penalty

If you need your money before the end of the CD period you can retrieve it subject to an early withdrawal penalty. The early withdrawal penalty depends on the length of the CD.

- Less than 1 year: 3 months simple interest

- 1 year to < 4 years: 6 months simple interest

- 4 years to < 5 years: 9 months simple interest

- 5 years to < 7 years: 18 months simple interest

- 7 years to 10 years: 24 months simple interest

You can withdrawal your funds beginning on the 8th day after your CD is opened and funded and for the next 22 calendar days, Discover will deduct each day’s simple interest on the issue amount withdrawn from the funding date to the date of withdrawal.

Note: In some cases, the Early Withdrawal Penalty may reduce the principal in the CD. For example, if you had a two year CD, and you decided to pull money out of it three months in, you would be hit with six months of simple interest and could reduce the value of your principal.

Discover Bank CD minimum deposit

The Discover Bank CD minimum deposit is $2,500. Not every bank requires you to make a minimum deposit for a CD account. For example, Capital One may not require you to put down anything. Others may have even higher deposits like $5,000 dollars or $10,000.

Sometimes when you are dealing with higher deposit minimums you might expect to get higher APYs but also check for penalty fees and other fees.

Discover Bank CD renewal

Discover should notify you 30 days before your CD matures. Once your CD time period is up, you’ll have a nine day grace period to make a change to your CD without penalty and your CD will automatically renew for the same term at the current rate at the time of renewal if no action is taken during the grace period.

Is a CD right for you?

Keeping cash around has it benefits. When the unexpected happens, you can easily retrieve your funds and use them instantly. But the biggest drawback is that you’re constantly losing purchase power as times goes by due to inflation. Inflation rates vary each year but generally you can expect them to be around 2% per year.

This means that if you leave $1,000 in a checking account for one year, when you come back to those funds that $1,000 might only have $980 worth of purchase power. And even if you go with some savings accounts like those from Chase, you’re still not getting a good return with interest.

With CDs you can beat inflation rates and allow your funds to grow while not assuming a level of risk associated with stocks.

With a 12 month APY rate of 2.65%, your purchase power will be stronger (on average) after one year. While the returns won’t be on the same level of as investing in the stock market or other securities, the assurance of your funds growing in an insured account is worth it for many people, especially those looking to diversify their portfolio with something secure.

Another good thing about CDs is they allow you line up your savings with your future plans. For example, if you had a big trip coming up in about 13 months then you could put your cash in a CD and allow those funds to grow.

Let’s say you put $12,000 in a CD for 12 months at 2.65% APY, that’s a increase in $480. You could then use that to cover a night at a great luxury hotel. Of course, I always recommend to travel with miles and points for free (or virtually for free).

Final word

Getting a Discover CD can be a decent option if you’re looking for a secure way to store your cash with potential to beat inflation and make some earnings in the process. Some other banks may have higher rates though so you’ll want to consider your alternatives if you’re thinking about going with Discover.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I am interested in learning more about your high yield current cd rates for 12 to 60 month terms. My investment would be in excess of $100,000. Thank you.