Should I Get A Cash Back Credit Card?

Cash back credit cards are by far the most popular type of credit cards for consumers (close to 70% of people with credit card rewards preferred cash back). Yet, many

Cash back credit cards are by far the most popular type of credit cards for consumers (close to 70% of people with credit card rewards preferred cash back). Yet, many

There’s a lot that goes into getting and keeping a great credit score. This is especially true when you’re into “travel hacking” and applying for new credit cards every month.

Having a thorough understanding of your credit score is vital not just for “travel hacking,” but for bettering yourself financially in the long-run. Since we don’t teach this stuff in

I generally recommend for people to avoid cancelling credit cards in order to continue to build up their credit report and improve their credit score. However, there are certain times

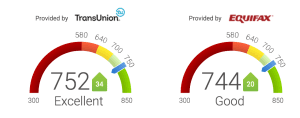

A lot of people don’t realize that one person can have tons of different credit scores at once. In fact, just for FICO alone, you could have over 60 different

One pretty easy way to get “free money” is to sign up for bank account bonus offers. Utilizing these bonuses, you may only earn a few hundred bucks or you

There are many common misconceptions and myths about credit cards and credit scores. One common area of misunderstanding is what happens when you close your credit card. A lot of people

[Offers contained within this article may no longer be available] Secured credit cards are one of the best ways to build up your credit score if you find yourself in

The cornerstone of award travel is your credit score. Without at least a decent credit score, you’re going to get hit with denials on your credit card applications left and right

[This article may contain expired offers] The United Mileage Plus Explorer Card is a great card with a pretty hefty sign-up bonus. If you’re a frequent United flier or live

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |