A lot of people don’t realize that one person can have tons of different credit scores at once. In fact, just for FICO alone, you could have over 60 different credit scores when you consider all the different editions and versions available! The good news is that you don’t really need to get caught up in all of the differences in these editions and versions. However, just in case you’re curious and want to know more about which credit scores matter, take a look at this article.

FAKO versus FICO

The first thing to be aware of is the difference between FAKO and FICO scores.

FAKO credit scores are basically non-FICO scores that you can get from websites like Credit Karma, Credit Sesame, Mint, Quizzle, etc. They are great because they are usually free and can give you an idea of where your credit score stands but they are not the scores that most lenders use so they have limited applicability. (Also, FAKO scores are not always the same as your FICO score, and I noticed that as I got more credit cards my FAKO scores generally remained lower than my FICO scores.)

FICO scores on the other hand are what the vast majority of the top lenders use to predict your credit worthiness. Thus, it’s your FICO credit score that you should mostly be concerned about. The thing about FICO, though, is that it can be confusing to know what your score is because there can be many different types of FICO scores.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Different editions (or generations)

Just like new software systems are rolled out every few years, FICO every few years comes out with different editions of it scoring model. For example, here are some of the previously released editions:

- FICO 98 (1998)

- FICO NextGen (2001)

- FICO 04 (2004)

- FICO Score 8 (2008) [most widely used today]

- FICO Score 9 (2014)

Each edition is implemented in order to more accurately predict the credit worthiness of consumers based on new developments in modeling, testing, and research. For example, when FICO Score 8 came out it lessened the blow that isolated late payments would have on a credit score, devalued the benefit of authorized users, ignored collection accounts of less than $100, and made high balances on credit cards more punishable. Also, the new FICO 9 model helps eliminates the negative effect of a paid collection account also lessens the negative effect of medical collections.

It can take a while for lenders to adopt new editions, however. The reason likely has to do with cost and the old adage, “if it ain’t broke, don’t fix it.” Remember, these lenders are in the business of making money and if they’ve been perfectly successful working with a previous FICO edition, there’s not much of an incentive for them to jump off that train and on to the next which may not be as proven yet. That’s why even today many mortgage lenders still use editions from 2004 or prior and most credit card issuers use the FICO Score 8. It just works.

Side note: some of the older scores are only available to lenders so you probably can’t get your hands on them. However, you should be able to find ways to access the more recent editions of your scores.

Different versions

So now you know that there are different editions of FICO scores, but did you also know there are different versions? In fact, there are so many different versions that you could have over 60 different type of FICO scores out there at once!

Different bureaus

You might be familiar with the different credit reporting bureaus. They are the following:

- Experian

- Equifax

- TransUnion

Each of these bureaus collects its own information about your credit file which is then used in conjunction with a FICO edition and version to formulate a credit score. This is why you could have a different FICO score for each bureau since they all collect their own information.

A lot of times, the credit scores for each bureau and edition are given names. You may have come across some of these names before. For example, the FICO Equifax score for the FICO 04 model is also called the “Equifax Beacon 5.0.” Scores for different editions for Transunion typically include “Risk Score” in their name and Experian typically includes “Risk model.”

So now you know there are different editions of FICO scores and that there are different versions of these editions based on information provided by the credit bureaus.

But it get’s even deeper.

Industry FICO scores

FICO also develops industry specific FICO scores. In addition to the “general” credit score, there are industry specific scores for the following:

- Auto

- Mortgage

- Credit card (bank card)

- Installment loan

- Personal finance

These industry scores don’t typically follow the 300 to 850 scoring model of the general credit score. But while the scores can vary, they are generally pretty close. Also, it’s never guaranteed that a given industry will use an industry specific score, since some choose to use the general scores.

Different bureaus

Each of these different industry versions also have different editions and also come in different versions based on the credit reporting agencies applying them. So for example, you have your “general” FICO Equifax credit score in multiple editions, your “auto” FICO Equifax in multiple editions, and so on and so on.

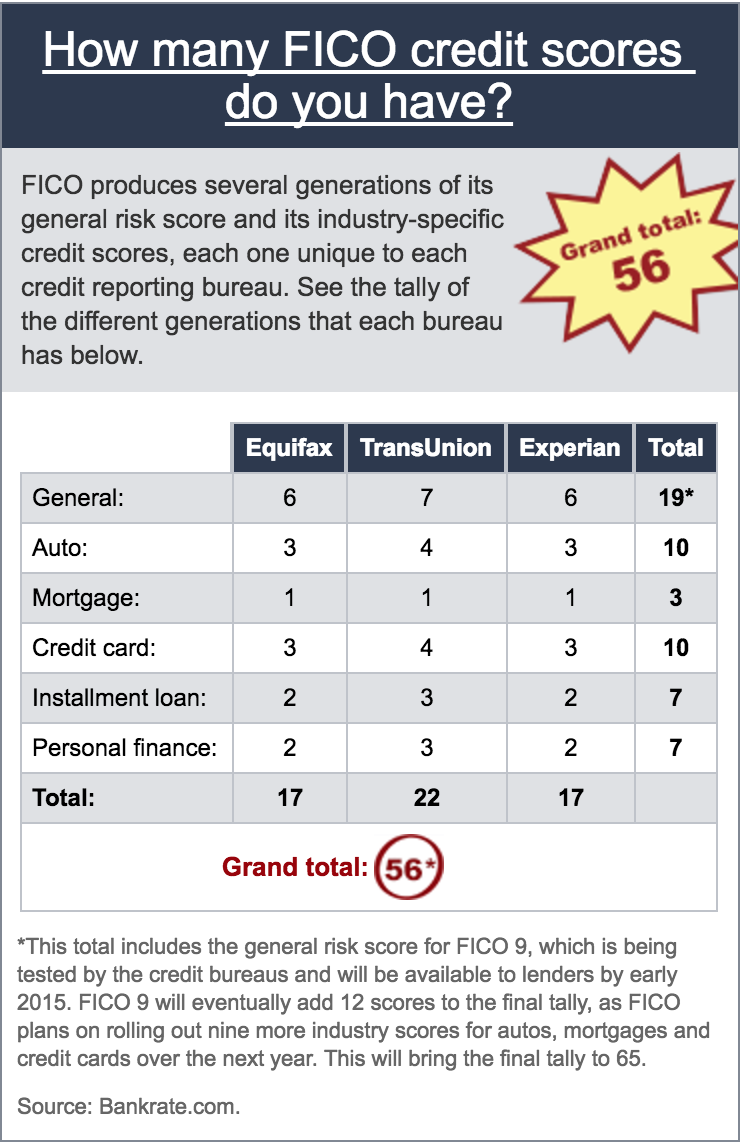

That’s how you get to over 50 (or even over 60 when FICO 9 is fully implemented) different types of credit scores. The chart below (via Bankrate) breaks this down in chart form which may help:

Side note: when you apply for a credit card, typically only reports from one or two bureaus are pulled but when you apply for a more significant loan, such as a home loan, likely three different bureaus will be examined.

Don’t let the complexity confuse you

So as you can see, your FICO credit score is probably far more complex than you ever thought. But there’s no point in worrying about the different models in the vast majority of cases.

Only in rare cases would I go out of my way to try take advantage of a certain type of score. For example, if I knew a lender was using the FICO 9 model and that medical collections or a paid collections was what was hurting my score, maybe then I’d try to go out of my way to transact with that lender. Or maybe if I were applying for a home loan and I knew of a lender who would use a more favorable FICO score edition, I would track them down. However, in the majority of cases, I think it’s enough just to find out your FICO scores from banks and other agencies and just stick to monitoring that.

Since the FICO Score 8 is the most commonly used score right now, I’d probably just try to stick with that score and monitor it.

Final word

It’s nice to know about the different types of credit scores available but it’s not recommended to obsess over them. I recommend sticking with one or two FICO scores that are available to you for free or for cheap and just monitoring those. And maybe, if you’ve got a big loan to get in the future, doing some research into what FICO models might be used by your prospective lenders.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Thanks for sharing this. Credit score is a tricky subject for me. Thanks for sharing.