Payment history is the most heavily weighted factor in the FICO credit score formula. It’s very important to understand the effect that a late payment will have on your credit score and to do everything you can to avoid making late payments.

With that said, mistakes do happen, and so it’s helpful to understand exactly how late payments are factored into your credit score and what can be done to help if you’re ever hit with late payments.

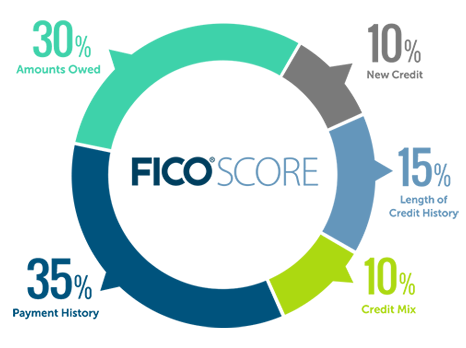

How your credit score is calculated

FICO determines your credit score in the following ways:

- Payment History (35%)

- Utilization (30%)

- Credit History (15%)

- New Credit (10%)

- Mixed Credit (10%)

Payment history is the number one factor for your credit score. This makes sense considering that the point of a credit score is to provide potential lenders with a way to gauge whether or not you might be a credit risk.

Viewing payment history would usually be the most telling way to measure how likely you are to manage future credit.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

What is payment history?

According to FICO, payment history is your track record for previous payments made on all loans and credit lines and includes the following:

- Credit cards (Visa, MasterCard, American Express, Discover, etc.)

- Retail accounts (credit from stores where you shop, like department store credit cards)

- Installment loans (loans where you make regular payments, like car loans)

- Finance company accounts

- Mortgage loans

Public record and collection items

- Bankruptcies

- Foreclosures

- Lawsuits

- Wage attachments

- Liens

- Judgments

Although many utilities, cable, internet, and phone companies often perform hard pulls on your credit, your monthly payments don’t usually show up on your payment history (I believe it has something to do with different state and regulatory laws).

However, if you go delinquent and a service provider has to charge off your account that can definitely be reported on your payment history, so always follow up with late payments!

As an aside, FICO scoring model 9 will implement changes that will really help a lot of people with their payment history.

First, these “nontraditional” payment histories with utilities, rent, etc. are going to be considered for your payment history.

Second, medical bills in collections (whether paid or unpaid) will no longer hurt your credit score.

You can currently get some utility bills reported to your credit report by signing up for Experian Boost. If your payment history is lacking or a little suspect but you have made a lot of qualifying payments, Experian Boost can be well worth it.

How long do late payments stay on your credit score?

Late payments will remain on your credit report for 7 years, although some bankruptcies will remain on your report for up to ten years.

Keep in mind that the negative effect of the late payment will be lessened over time, as discussed below.

How much do late payments affect your credit score?

How much a late payment affects your credit score depends on a mix of factors, including:

- How late they were and the number of past due items listed on a credit report

- The amount of money still owed on delinquent accounts or collection items

- How much time has passed since any delinquencies, adverse public records or collection items

A) How late they are

Creditors usually report late payments in one of these categories:

- 30 days late

- 60 days late

- 90 days late

- 120 days late+ or “charge off” (meaning they’ve signed off on considering your debt a loss).

How much does the “lateness” time period matter?

If you have a late payment right now do whatever you can do to pay that off because the later your payments are, the the bigger the negative impact will be.

If you have a late payment of 30 days or 60 days, the impact from those late payments will generally only be felt temporarily (unless you have an entire track record of late payments).

However, when it comes to payments of 90 days or more the effect can be much more severe.

According to Credit.com, “from a scoring perspective, a single 90-day late payment is as damaging to your credit scores as a bankruptcy filing, a tax lien, a collection, a judgment or repossession.”

Once you get into the 120 days+ late or charge off period, you risk getting additional marks on your credit report like collections and lawsuits/judgments, so there’s potential for even more damage to your score.

Thus, it’s very important that if you slip up, to immediately do whatever it takes to keep your payment from becoming even later.

Credit scores are not affected the same

Another thing about late payments is that the negative impact on your score works a little backwards from how you may have thought.

For example, one late payment could have a more significant impact on higher credit scores.

According to FICO data, “a 30-day delinquency could cause as much as a 90 to 110 point drop on a FICO Score of 780 for a consumer who has never missed a payment on any credit account.

So if you are going for a perfect credit score of 850, one late payment could set you back dramatically.

In comparison, a consumer with a 680 FICO Score and two late payments (a 90-day delinquency on a credit card account from two years ago and a 30-day delinquency on an auto loan from a year ago) would experience a 60 to 80 point drop after being hit with another 30-day delinquency.

Thus, if you’re really trying to preserve your high credit score then you’ve got to stay on top of your due dates because one slight slip-up could affect you dramatically.

B) Amount still owed on the accounts or collections

Your credit report will usually reflect how much is still owed on an account or whether or not you settled the amount.

If you pay off an overdue account in full the late mark will remain on your credit report. (Sometimes, you can negotiate with a collections agency or lender to remove the late payment entirely when you become up to date but that’s an entirely different matter.)

Some people are reluctant to pay their overdue payments since the negative marks still remain on their credit report. However, unless they are about to fall off very soon, it’s usually a good idea to pay those off for the following reasons:

- The FICO 9 model doesn’t factor in collections that have been paid but will punish you more unpaid collections.

- Some lenders won’t feel comfortable if you have amounts owed on your accounts or to collections for obvious reasons

- If the statute of limitations hasn’t passed in your state you could be sued for the debt which in addition to being a hassle to deal with, could add additional negative remarks to your credit score.

- Collection agencies may continue to sell your debt to other agencies which can cause future negative remarks to post (I discuss that below)

I’ve heard somewhat conflicting reports of whether or not the amount in collections matters to your credit score.

First, it all depends on the credit model being used. FICO 8 excludes amounts less than $100 and it’s said that the amount won’t matter if it’s more than $100.

However, I know for a fact that banks will sometimes consider the amount in collections, so that’s always something to think about.

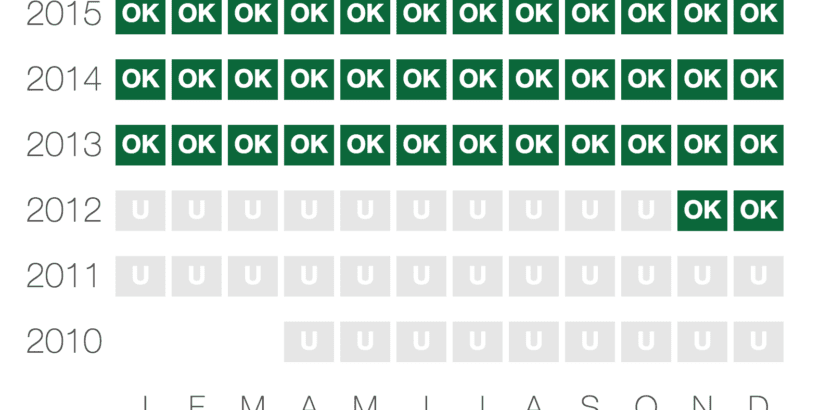

C) How much time has passed

Even though your late payments will remain on your credit report for 7 years, they will slowly lose their negative impact on your score over time.

After about two to three years a late payment should have a substantially lessened negative impact on your score, assuming you don’t have a report littered with negative marks or new late payments.

One thing that I don’t think is justified is that some lenders will consider the date that a debt or collections was sold when making their determinations.

If you’re not familiar, some collection agencies will sell off your debt to other collection agencies (for pennies on the dollar). When that happens your credit report will reflect the date that the debt was sold (the new opening date) and will also show the date of first delinquency (when you became late on a payment).

Some lenders will go by the new opening date and not the date of first delinquency which I think is a huge injustice. This is why I mentioned paying off your overdue accounts is often a good idea.

Warning: If the date of first delinquency (as opposed to the new opening date) is changed this is against the law and you should report it ASAP!

New FICO 10 Model

Bigger impact from late payments

Per Experian, with the FICO Score 10 Suite, “the impact of late payments is more pronounced than with prior FICO Score versions.”

It’s not clear yet exactly how much worse late payments will be with the new FICO Score 10 model but it is clear that you will be penalized harder for late payments.

Therefore, it is going to be more important than ever to make your payments on time.

Trended data

It’s worth noting that the new FICO Score 10Y model considers trended data. This means it will analyze your outstanding balances over the past 24 months.

According to Experian, “[t]his allows the credit scoring model to differentiate consumers who pay their credit card debt in full each month (known as “transactors”) from those who carry over, or ‘revolve,’ a balance from month to month.”

What is more, credit card debt is going to be treated more severely with FICO 10 than before.

So in the future it will be even more important to not just have on-time payment history but to show banks that you responsibly manage your credit lines.

By paying off your credit card balance in full each month you will look like a more responsible consumer and less of a credit risk.

How credit cards can help

Getting into the “credit card game” can actually improve your credit score because it can help you to build your payment history and potentially dilute any negatives on your report (or just continue the trend of making on-time payments).

For example, if you were to open a hand full of credit cards in a few months and make on time payments for a year, you’d be able to accumulate around 60 or more on time payments and from there continue to build up a positive payment history.

And so long as you keep your utilization low, your credit score should be improving since 65% of what determines your score will be benefited.

How authorized users can help

If you are in need of a payment history you can always try to become an authorized user on an account that has a long payment history. You may not experience a huge rise in your score but it should still help you.

FAQs

Paid third-party collections should help your credit score for lenders using FICO Score 9 and FICO Score 10.

Paying your collections is a smart move that can help you avoid lawsuits and prevent a negative impact on your credit score for lenders using FICO Score 9 and FICO Score 10.

Final word

Your payment history should always be a top priority for you when it comes to your credit score. It is the category that carries the most weight and can be the hardest to fix since it sometimes just requires the passage of time.

Always do whatever you can to pay your bills on time and if you miss a payment try to mitigate the damage done by paying it as soon as you can.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

Thanks for answering the same questions that I have in my mind for so long. Great article!