The “perfect credit score” is a bit of a misleading term because just being in the top tier of credit scores usually will grant you the same privileges as having the highest possible credit score.

Nevertheless, many people are interested or at least curious about how to obtain a perfect credit score and there are a number of things you can do to set yourself up to achieve that.

Here’s everything you need know about how to get a perfect credit score.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Table of Contents

What Is a perfect credit score?

The perfect credit score is 850 on both the popular Vantage and FICO models, which have a range of 300 to 850.

But this is a bit misleading because credit scores that are much lower will usually give you all the benefits of a perfect credit score as described below.

Credit scores broken down

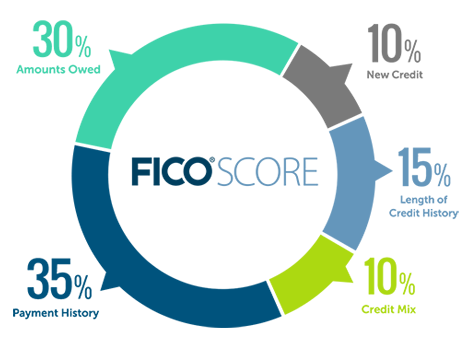

In case you need a refresher, here’s how your FICO score is calculated.

Your FICO credit score is determined in the following way:

- Payment History (35%)

- Utilization (30%)

- Credit History (15%)

- New Credit (10%)

- Mixed Credit (10%)

Payment History (35%)

Payment history is the #1 factor for determining your credit score.

Late payments will stay on your credit report for 7 years, although some bankruptcies (Chapter 7 bankruptcy) will remain on your report for up to ten years!

Luckily, the negative effect of late payments and other negatives begins to lessen as more times passes, so although it might stay on your report for 7 years, the effect will usually only be felt for a limited amount of time (i.e., a few years).

How much a late payment affects your credit score depends on a mix of factors, including:

- How late they were and the number of past due items listed on a credit report

- The amount of money still owed on delinquent accounts or collection items

- How much time has passed since any delinquencies, adverse public records, or collection items

Utilization (30%)

Utilization is your credit to debt ratio. You find this by dividing the amount of debt you have by your total credit limit. So for example, if you have a $10,000 total credit limit and owe $5,000 in debt, then your utilization is at 50%.

Credit History (15%)

The credit history category consists of the of the following factors:

- Longest opened account

- Average age of account

- Time since newest account

- Time since each account was last used

The most important of these factors is the age of the longest opened account while average age of accounts is second.

New Credit (10%)

This category is most known for its effect felt from hard inquiries.

Hard inquiries result when your credit is pulled for review by lenders and certain other institutions and they differ from soft inquiries in that the latter don’t affect your credit score.

Other factors besides hard inquiries in the new credit category are:

- How many new accounts you have

- How long it’s been since you opened your last account

Mixed Credit (10%)

This category evaluates your overall “mix” of credit lines.

So for example, it wants to see if you have a diverse range of credit consisting of different types of credit lines like student loans, auto loans, home loans, credit cards, etc.

If you need to freshen up your knowledge on credit reports, check out my introduction to credit scores and reports.

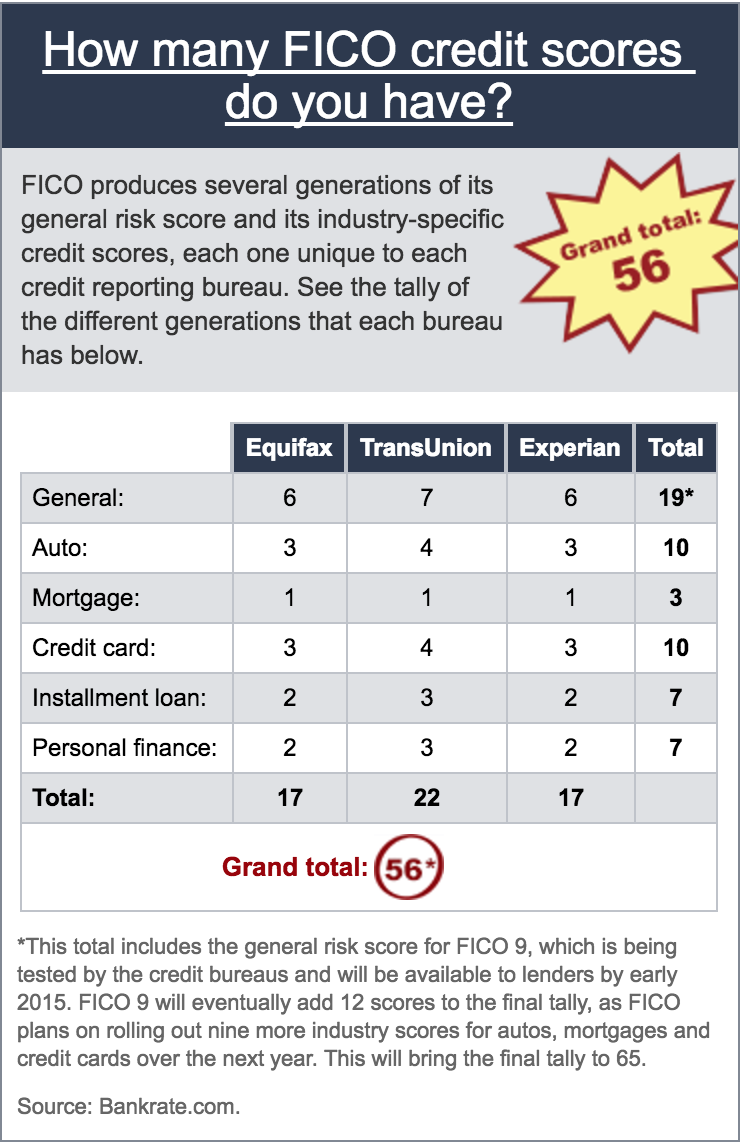

There are dozens of credit scores

There are tons of different types of credit scores so it’s good to know that there can be different types of perfect scores (850, 900, etc.).

Just like new software systems like Microsoft Windows are rolled out every few years, FICO every few years comes out with different editions of its scoring model.

For example, here are some of the previously released editions:

- FICO 98 (1998)

- FICO NextGen (2001)

- FICO 04 (2004)

- FICO Score 8 (2008)

- FICO Score 9 (2014)

- FICO Score 10 (2020)

Each edition is implemented in order to more accurately predict the credit worthiness of consumers based on new developments in modeling, testing, and research.

For example, when FICO Score 8 came out it lessened the blow that isolated late payments would have on a credit score, devalued the benefit of authorized users, ignored collection accounts of less than $100, and made high balances on credit cards more punishable.

Also, the FICO 9 model helps eliminates the negative effect of a paid collection account and also lessens the negative effect of medical collections.

Industry specific credit scores

FICO also develops industry specific FICO scores.

In addition to the “general” credit score, there are industry specific scores for the following:

- Auto

- Mortgage

- Credit card

- Installment loan

- Personal finance

These industry scores don’t typically follow the 300 to 850 scoring model of the general credit score so you might see perfect scores of 900.

But while the scores can vary, they are generally pretty close. Also, it’s never guaranteed that a given industry will use an industry specific score, since some choose to use the general scores.

Different bureaus

Each of these different industry versions also have different editions and also come in different versions based on the credit reporting agencies applying them (three major credit bureaus are Equifax, Experian and TransUnion).

So for example, you have your “general” FICO Equifax credit score in multiple editions, your “auto” FICO Equifax in multiple editions, and so on and so on.

That’s how you get to over 50 FICO credit scores (or even over 60 when FICO 9 is fully implemented) different types of credit scores. The chart below (via Bankrate) breaks this down in chart form which may help:

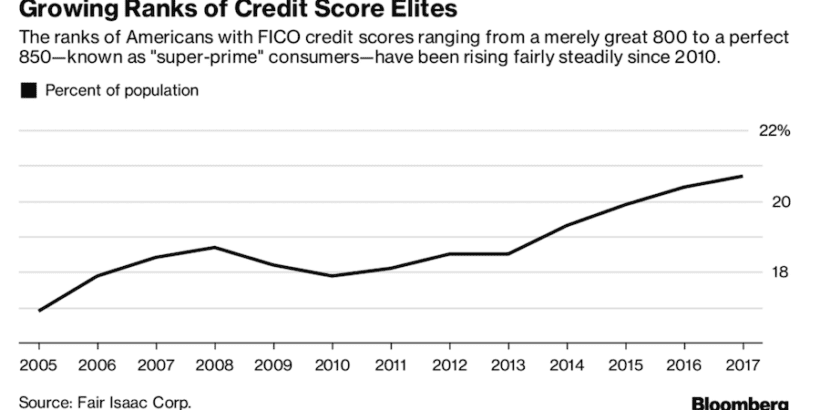

How many people have a perfect credit score?

According to CNBC of the 232 million U.S. consumers who have FICO credit scores, about 1.6 percent, have perfect 850s.

In the end, you don’t actually need an 850 to get the benefits of a perfect credit score, though.

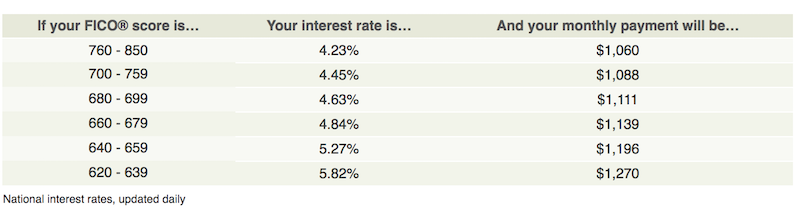

In fact, the real perfect score is likely a 760.

According to CNBC, a 760 can qualify you for the best mortgage rates while a 720 can qualify you for the best car loan rates.

The FICO mortgage calculator seems to back this up, lumping credit scores at or above 760 in with the best interest tier.

So all you really need to do is try to get to that upper bracket of credit which usually is about a 760.

Once you get over that, there’s really nothing to gain in many situations, though it’s possible that in certain markets you might get a slight nudge if you’re closer to 780, 800, etc.

Personally, I would rather hover around 720 to 760 while being able to take advantage of awesome credit card rewards then worry about maintaining an 850.

However, if you really want that perfect score here are some tips.

5 Tips for getting a perfect credit score

#1 Your payment history needs to be squeaky clean

Payment history is the #1 factor for your credit score so it shouldn’t come as a surprise that you’re not going to have a perfect credit score if you have late payments, bankruptcies, liens, judgments, collections, etc. on your credit profile.

According to FICO data, “a 30-day delinquency could cause as much as a 90 to 110 point drop on a FICO Score of 780 for a consumer who has never missed a payment on any credit account.”

So you can imagine how difficult/impossible it would be to climb up into the mid 800s with negative marks showing on your credit report.

Those negative marks do lose their affect on your credit score over time, but when it comes to obtaining a perfect credit score, you’re not going to get there with a negative history.

The good news is that you can still achieve a very high credit score even with negative marks.

The key is that there needs to be some time between the present time and your negative marks.

Also, if your credit report is littered with negative marks, that’s a very different situation from someone with an isolated one or two hiccups.

#2 Utilization needs to be low but not too low

You’re never going to have a perfect credit score if your utilization is high. And if you want to hit the perfect score, I’d shoot for somewhere between 2% to 4%.

Remember, having 0% utilization won’t benefit you as much as having a little bit of utilization.

According to MyFICO, Barry Paperno, consumer operations manager for FICO stated that a tiny reported balance can trump a zero balance.

“In short, the lower a consumer’s credit utilization, the better, but having a small balance is slightly better than having no balance at all.”

In fact, according to TMF, “the average FICO high achiever (800+ FICO score) uses 4% of their overall revolving credit limit,” so that should give you an idea where your utilization should stay.

So if you’re shooting for a perfect credit score, you want to make sure that you’re paying off your credit card at the correct time so that your credit card statement will reflect a small balance that puts your utilization under 5%.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

#3 Credit Mix plays a role

Credit Mix makes up 10% of your credit score and it’s often considered the least important factor for your FICO score. Because of that fact, many people don’t ever think about credit mix.

But credit mix does play a role in obtaining a perfect credit score.

Practically speaking, mixed credit is important because FICO says having a variety of loans is necessary for earning a perfect credit score.

Here are the different types of credit:

Installment credit lines

For installment credit lines you usually pay a fixed amount each month until you pay down an entire balance due. Common examples of installment loans are:

- Home loans

- Auto loans

- Student loans

- Personal loans (can often be revolving)

Revolving credit lines

Revolving credit lines offer you a credit limit that you can utilize at whatever pace you want to. Common examples include:

- Credit cards

- Store credit cards (Macys’ card, GAP card, etc.)

- Trade lines (credit line at a jewelry store or furniture store)

- Personal loans

Open lines of credit

Open lines of credit are credit lines where you’re given an unspecified amount of credit usually on a monthly basis and expected to pay that balance in full each month. Many open lines of credit will not reflect on your personal credit report (unless you miss a payment).

Other open lines like charge cards do report on your credit report.

Common examples include:

- Utilities

- Charge cards

The ratios needed for mixed credit

It’s not clear what the ratio needs to be in order to maximize your credit mix but just having one of each type of loan probably helps a lot.

I’d venture to guess that if you had a few credit cards and a couple of installment loans, you’d probably be able to maximize that category.

Paperno at FICO and states that, “The number of each type of account is not as important for a person’s score as simply having experience with both types of accounts, either currently or within the recent past.”

There are two take-a-ways from this quote for me.

First, it’s important to note that the number of different accounts doesn’t matter much. This makes a lot of sense since a lot of people probably don’t have more than one type of home loan, auto loan, etc.

Second, the quote stresses that what is most important is having “experience” with “both” types of accounts.

That’s important to me since it seems to imply that what’s most important is just having a mixture of both installment loans and revolving credit, since those are the two major different types of credit lines.

My ultimate take-a-way from this is that if you only have installment loans or only have revolving accounts, you probably won’t be able to achieve a perfect credit score but having a couple of each will take you far in this category.

You can read more about credit mix here.

#4 Credit history is huge

Credit history may only make up 15% of your credit score, but it’s essential for obtaining a perfect credit score.

Credit Karma reports that a “2011 study by SubscriberWise, a credit reporting agency for the communications industry, found the average length of a credit history for someone with an 850 FICO score was 30 years.“

That tells you a whole lot about getting a perfect credit history — it’s just going to take time.

If you’re relatively new to credit and have accounts only a few years old, you’re probably going to struggle to get to the top and so I would not worry about getting a perfect credit score.

If it ends up happening great, but it’s not worth obsessing over when in reality you might be years away of obtaining it due to a lack of credit history.

#5 New credit can bring you down

When you apply for credit, you’ll typically see a drop in your credit score from the hard inquiry of a few points, depending on how high your credit score is.

So if you want a perfect credit score, you don’t want any recent inquiries on your credit report.

Of course, not ever applying for credit would defeat the very purpose of achieving a perfect credit score in the first place.

But since the impact of hard inquiries usually diminishes after 90 days and falls off all together after one year, applying for new credit isn’t likely to drop you way below a perfect score if you’re already there. It would probably only be a matter of months until you’re back at a perfect credit score or near to it.

Tip: If you’re really focused on maintaining a perfect credit score then consider opening up small business credit cards since many of them don’t report to your personal credit report.

Opening those cards won’t show up as new accounts and won’t shorten your average age of your accounts, so it’s a great way to preserve your perfect credit score.

Perfect Credit Score FAQ

The perfect credit score is 850 on both popular Vantage and FICO models, which have a range of 300 to 850. Other models may go up to 900.

According to CNBC of the 232 million U.S. consumers who have FICO credit scores, about 1.6 percent, have perfect 850s.

If you want to hit the perfect score, I’d shoot for somewhere between 2% to 4%.

A 2011 study by SubscriberWise found the average length of credit history for someone with an 850 FICO score was 30 years.

No, according to Informa Research the lowest rates offered on mortgage loans went to people with scores at or higher than 760. And, the lowest rates offered on various auto loans went to people with scores at or higher than 720.

Final word

Getting the perfect credit score is an ambitious goal but with questionable utility.

You’ll need to manage your credit score the normal way by making on-time payments, keeping your debt low, and avoiding too many new inquiries. And you’ll also have to have well-aged credit accounts and a mix of installment and revolving accounts to give yourself a good shot at a perfect credit score.

But in the end, just getting to about 760 is all that’s needed to reap the perks that come along with the perfect credit score in many cases.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

#2 has not been my experience.

After holding steady for a year or two with FICOs in the high 830s to low 840s with 1-2% utilization, I started paying off my full balances each month a few days before the statement date. (Occasionally a pending charge will post on the due date, so my statement balances aren’t always zero.) Since I began doing that on all cards last year, all of my credit scores have increased and my FICO 8 and 9 scores as per PenFed and Experian are now both 850, and from Bank of America is 847.

On months when a large pending charge slips through on the statement date and pushes me above 1%, then I see a dip in my scores. So it seems like using cards to show activity but leaving $0 due is better than not using them at all, and also better than leaving a nonzero balance.

Purely anecdotal, I know.

Very interesting datapoint. To me that approach would make the most sense if you’re trying to figure out who can manage their credit best (the people who use it a lot and pay it all down). But how could the bureaus verify your spend patterns? Maybe the occasional non zero balance shows them that?

I really don’t know. Maybe charges slip through often enough that I’ve effectively been doing the “all zero except one” strategy most months? Or maybe having a mortgage and a pair of car loans fills the balance carrying need?

I just know that since that comment I’ve opened two new cards (one HP TU in September and one HP EX in October), and my FICO 8s are EQ=847, TU=840, and EX=826. A couple weeks ago when one card statement posted with $68 due (the rest $0 this month), I got a minor ding on EX that my total debt had increased. Other than that, all my scores went down slightly since my average age of accounts went down, but EQ rebounded almost completely when the 2nd new card was reported due to the increase in aggregate credit limit.