Below are a number of different travel hacking topics, terms, and concepts that you should familiarize yourself with. This list isn’t meant to be comprehensive nor is it meant to be memorized after one reading. If you are just starting out, it will likely take you weeks to get knowledgeable about all of these things. Just bookmark this page as a reference and do the best you can to gain a foundational understanding of how the process works.

Opening credit cards can actually raise your credit score

Once you get your credit score up (or if it’s already up), you might be wondering if opening up new credit cards will bring your score down. A lot of people perpetuate the myth that getting credit cards will lower your credit score. In reality, as you responsibly open and use new credit cards, your score will actually go up!

It’s true there there will be some short-term dips from hard inquiries and new accounts, but your credit score will eventually rise (probably to an all-time high) so long as you maintain low utilization and make on-time payments.

If you are thinking about applying for a home loan or any other substantial loan, such as an automobile loan, then you’ll need to think about the impact on your credit report. If you apply for a home loan with tons of recent inquiries and new accounts on your report, you could be costing yourself thousands in the long-term since your interest rate might be affected.

Thus, if you’re thinking about applying for a home loan or car loan soon you should consider holding off on applying for credit cards until you’re finished with that whole process.

Know the basics of credit card offers

There are basically three different types of sign-up bonuses.

1) The standard sign-up bonus

The standard sign-up bonus for a credit credit requires you to spend a certain amount on purchases (usually $1,000 to $3,000) within a certain amount of time (usually 3 months) within opening your account and once you do that, you’re given your bonus after your statement closes or sometimes even sooner.

Now, we are seeing more tiered sign-up bonuses which allow you to earn points for spend across multiple periods. For example, you might get 25,000 points after spending $3,000 in three months and another 25,000 points if you spend a total of $6,000 in six months.

2) Annual spend bonus offers

Some sign-up offers provide you with additional points or benefits (like a companion pass or elite status) for hitting certain annual spend thresholds, such as $10,000 or $30,000.

3) Activation or single-purchase bonuses

Some credit cards like the Barclays Aviator Red don’t even require any minimum spending to receive a bonus or only require a single purchase to receive your miles. So at times you can literally purchase a pack of gum end earn enough miles first class roundtrip within the US.

Most spending requirements are $3,000 or less but some jump up to $5,000, $7,500, $10,000 and beyond. It’s important to know that these minimum spending requirements are not absolute and can fluctuate, sometimes even offering you more points for spending a few thousand dollars less!

Educating yourself on the different spend requirements will help you filter out cards that may have spending requirements that aren’t quite realistic for you and allow you to better prepare a plan for accumulating miles that won’t put you in a financial bind. It will also help prevent you from jumping on sub-par offers (which brings us to the next step).

Get to know some of the best credit card offers

This is huge.

Knowing the best credit card offers (or at least knowing where to find them) will help you avoid making making impulsive decisions to apply for cards and help you anticipate what your future applications should be. Sometimes there can be 3 different offers out simultaneously for the same credit card offering vastly different bonuses, so you’ve got to stay informed to avoid jumping on a sub-par offer.

I highly recommend you to read my article on how to find the best credit card offers. That article will walk you through various ways to increase your chances of getting targeted for the best credit card offers and also show you how to go about finding the best offers. Without that knowledge, you’ll be losing out on potentially tens of thousands of miles and points.

There are also ways to seek out pre-approvals for certain Chase cards and Amex cards, which can present amazing value.

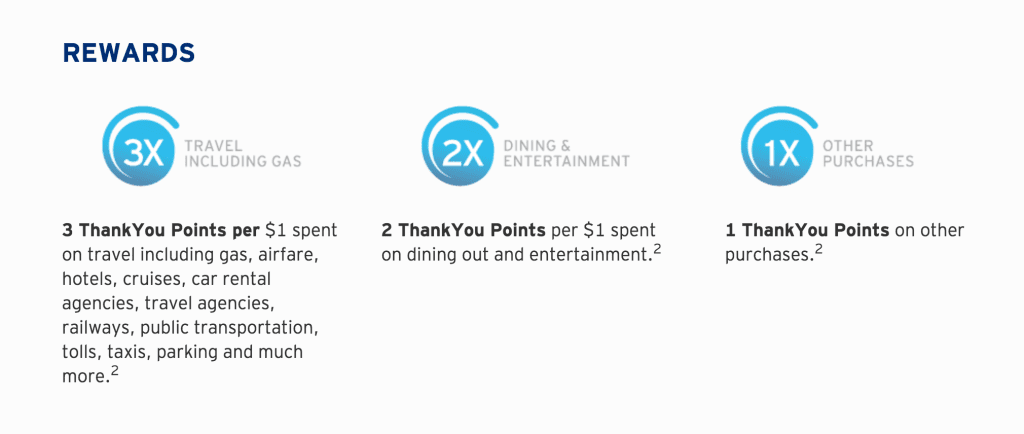

Get to know bonus categories for spending

Typically, a rewards card will offer you 1 point per dollar (1X) spent and then “bonus points” worth more than 1 point per dollar on certain categories, such as:

- Travel (airfare, hotels, trains, parking, and pretty much anything travel related)

- Groceries

- Dining

- Gas

- Entertainment

- Office supply stores

- Cable, cellphone, utility bills.

These bonus points usually range from 2 points per dollar (2X) to 5 points per dollar (5X). It may not sound like too much but it certainly can add up.

Some of my favorite cards that I think you should be looking into for their bonus earnings are:

- The Chase Sapphire Reserve

- The Chase Sapphire Preferred

- The Chase Ink Preferred

- The Chase Freedom Cards

- The American Express Platinum Card

- The American Express Premier Rewards Gold Card

- The Everyday and Everyday Preferred from American Express

- The Citi Thankyou Premier and Citi Prestige

- Discover It

Take a look at the bonus categories for these cards (and others out there as well) and try to figure out which card (or combination of cards) will offer you the most earning potential when it comes to your specific spending habits.

Become well-versed with the credit card rules

There are some very specific “unwritten” rules that different banks and credit card companies implement when it comes to applying for their credit cards. These include rules like:

Other important rules are those that affect your eligibility for obtaining subsequent bonuses for the same card. For example, in the vast majority of cases, you’re only allowed one American Express sign-up bonus per lifetime! Before you ever apply for any card, you should always check to make sure that you’re not violating any of the application restrictions.

Look into these rules and try to commit them to memory. It’s one thing to get denied for a credit card due to the discretion of a banker but it’s quite another thing to get denied because you simply violated a well-known rule. The latter is totally avoidable.

Research the rewards programs

Familiarize yourself with the rewards programs of the major banks: Chase, American Express, and Citi, Barclays, etc. Look at the different transfer partners for Chase Ultimate Rewards, American Express Membership Rewards, and Citi Thankyou Points and see if there are any partners that you prefer over any others.

Pay attention to the transfer ratios and note those which are different from other programs. Know that bonus transfers are occasionally offered to different partners so you might be able to end up with something like 50% more points once you’ve transferred them out. If you keep tabs on the sources listed below, you’ll never miss a bonus transfer promotion.

Get familiar with “cents per point”

Cents per point refers to the value of a miles or point earned. It’s important to know what the value of the points or miles that you will earn are because it’s the only way to make sure that your redemptions and credit card choices will be ideal.

If you don’t know the value you’re getting for your points you might end up using them in ways that end up losing you tons in value and you might end up choosing credit cards that don’t maximize your earnings. Read my article here to find out more about cents per point and why it matters.

Sign-up for shopping and dining portals

A lot of people are often surprised to learn that you can additional miles and points with shopping and dining through portals. Shopping portals allow you to earn miles when shopping at all kinds of different stores, including most popular department stores and online shops. You can read my article on using shopping portals here.

Dining portals work a little different. You register your card with a single dining program and then find local restaurants that participate in the program and every time you go there you’ll earn miles in addition to whatever you earn on your card. You can read about the American Airlines AAdvantage Dining Program here.

Shopping and dining portals are a great way to supplement your earnings or even help you accumulate miles if you’re waiting to apply for credit cards down the line.

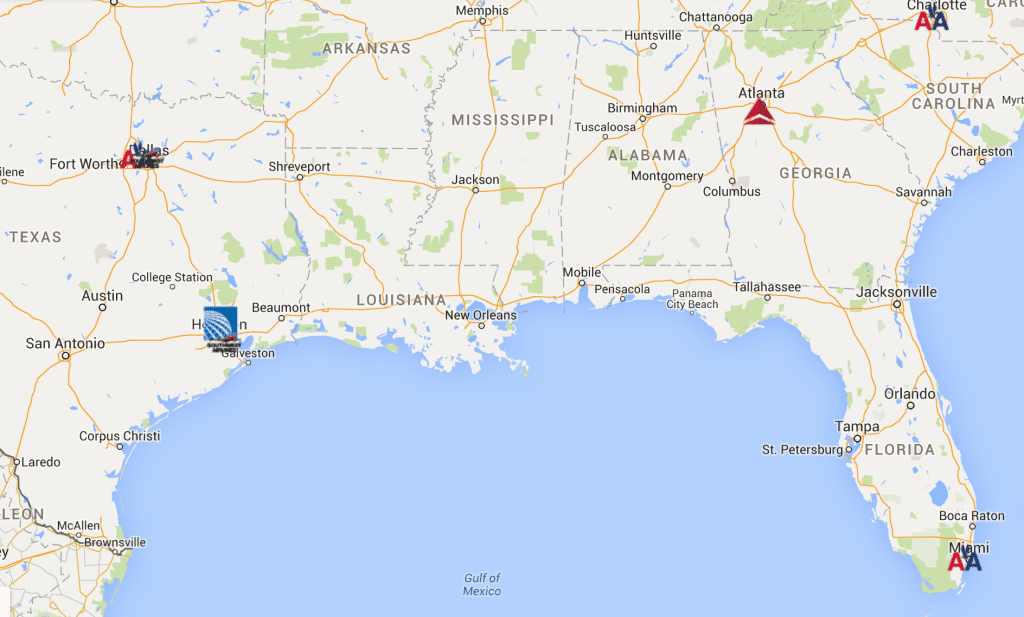

Find out what airline hubs are near you and explore routing options

You need to know what airline hubs are near you because those airlines are usually going to provide you with the most practical options for your routes and may make it easier to choose which cards to apply for. Check out this link for a map of domestic airline hubs.

For example, I live in Houston where we have HOU (a Southwest hub) and IAH (a United hub). Between those two airlines, I have a very wide range of availability for flights both domestically and internationally so those partners are very valuable to me. In addition, United is a part of the Star Alliance so any other programs that transfer to Star Alliance partners are valuable to me.

Now, you don’t have to stick to your nearby airline hubs. For example, I’ve found some great SAAver Awards with American Airlines that routed me from IAH through DFW (an American Airlines hub) and MIA (another American Airlines hub) and have jumped on those routes before. Also, you may not even have an official airline hub near you, so trying to fly via a hub is not always necessary.

Get familiar with award charts

You should start researching award charts for different airlines.

Most award charts are region-based meaning that they require a specific amount of miles to get from one region to another (e.g., North America to Europe requires 50,000 miles). You simply find the region you’re flying out of and the region you’re flying into and you’ll be able to find out how many miles are needed for your trip.

You’ll need to pay special attention to how the regions are defined in the different charts because sometimes you will find countries placed in regions that you wouldn’t expect to find them in (e.g., Flying Blue puts Israel into Europe). Also, some continents (Asia, South America, etc.) are often sub-divided differently depending on the airline.

Some award charts are distance-based, meaning that your mileage requirements is dependent on how many miles your trip comes out to. These awards are usually ideal for short-haul flights that would require many more miles with a traditional region-based chart. British Airways Avios, Iberia, and LAN, are all examples of these kinds of programs.

Here are a few award charts for major airlines that you can take a look at:

- ANA Award Chart

- American Airlines Award Chart

- United Airlines Award Chart

- Singapore Airlines Partner Award Chart

The award charts breaks down exactly how many miles will be required to get from any region to any given destination. Pay attention to the differences in class (economy, business, first, etc.) and to the differences between standard and saver awards (as you’ll be trying to go for the saver awards).

Unfortunately, not every airline publishes an award chart.

For those that don’t, you can try to find charts created by bloggers (like this chart I created for British Airways Avios) or just go to the airline’s website and plug in different destinations into their search to see what the mileage requirements are. Some airlines, like Flying Blue, have tools that will calculate how many miles will be required for your routing.

Your goal at this point is not to memorize entire award charts, but for you to get a general idea of the different redemptions needed to get to your desired destinations. Once you get more into it, you can start looking for special sweet spots in awards redemptions which offer the best redemptions.

Learn about airline partners and alliances

This can get pretty confusing and so you don’t need to know the ins-and-outs of alliance partners right now — just the basics.

You need to know that you can use miles from one airline to book trips through one of its alliance partners. For example, you can use British Airways Avios to book American Airlines flights at some pretty great rates to get around the U.S. You can also use American Airlines miles to book on airways like Etihad, Qatar, etc.

The goal is always to find which alliance partner is going to give you the biggest bang-for-your-buck for your specific time period, destination, and desired fare. It can take a lot of meticulous research to find the best booking techniques and routes that offer the most efficient use of your points. But now you can use a tool like AwardHacker to make this process much easier.

It will also help if you get familiar with the three main airline alliances below:

- Star Alliance

- One World

- SkyTeam

When using alliance partners, you’ll want to consider what the taxes and fees will be for the award flight and you’ll also want to be careful about routing and booking restrictions — some programs are notoriously difficult to deal with.

Think about how and where you want to travel

You should start thinking about the type of travel you plan on doing.

For example, if you’re interested in traveling in economy class domestically, the Southwest Companion Pass may be one of your first goals to obtain. In that case you’d likely seek out Chase Southwest cards and perhaps a Sapphire Preferred

If you’re interested in extravagant first class flights to Europe, Asia, or the Middle East, then your overall game plan is probably going to entail a more aggressive approach, where you hit several sign-up bonuses from different cards to quickly accumulate the 100,000+ miles you’ll need for your trips.

If you don’t know where you want to go and how you’d prefer to get there, that’s fine. Some people believe you should always have a plan with specific destinations outlined before earning miles since there’s a chance you might not be earning the “right” kind of miles.

While I think it’s great to know exactly where you want to go, I don’t think it’s necessary to know the specifics of your trips. Just having a rough sketch of the region(s) and dates is often enough, especially if you’re going to be transferring points from a flexible rewards program and you know have a list of potential airlines and/or hotels you know you can choose from.

Think about applying for business credit cards

You don’t have to be a CEO of a business to apply and get approved for business credit cards from the major banks. Even considering yourself a “sole proprietor” for the re-selling you do on Ebay, Amazon, or Craig’s List can qualify you. Click here to find our more details about how to open up business credit cards.

Opening up business cards is a tremendous way to benefit your credit score and take advantage of special sign-up bonuses that otherwise wouldn’t be available to you. And there are all kinds of different business cards you can choose from like these cards great for entrepreneurs and start ups.

So do some research on filing a d/b/a in your state/county/etc. and look into getting a free EIN (Employer Identification Number aka tax ID number used for business apps). You may not think applying for business credit cards sounds appealing right now but if you get into the rewards game heavy, you will likely revisit your opinion on that.

Start planning major future expenses

Now is a great time to start planning out any major expenses that you might have coming up. Creating a rough timeline of when these expenses will need to be paid can help you create a plan for when it will be most beneficial to apply for new cards throughout the year so that you never struggle to obtain a sign-up bonus.

Some ideas for some major future expenses that might be useful to you are:

- Vacations

- Weddings

- Income taxes

- New furniture, appliances, remodeling, etc.

- Down payments on vehicles

- New electronics (TVs, cameras, tablets, phones, etc.)

- Medical bills (turn unfortunate situations into gains)

- Education-related expenses (books, loans, etc.)

- Holiday shopping

These are all great ways to meet minimum spend requirements on credit cards without having to resort to potentially problematic manufactured spending techniques.

Get to know the travel benefits of credit cards

One thing I knew little to nothing about before I got into this hobby was the amazing world of travel benefits. I knew there were ways to get access to nice airport lounges where free alcohol and snacks were offered and I knew there were ways to breeze through security and customs priority lines, I just didn’t know how credit cards fit into the equation.

If you’re not familiar with many travel benefits, it’s a good idea to look into the following:

- Global Entry

- TSA Pre-Check

- Priority Pass lounge access (or other lounge programs)

- Hotel elite status

After seeing what these benefits are all about, you can decide if those are things you are interested in. If you are, then there are a number of cards that can offer you those benefits as perks, such as the American Express Platinum Card and the Citi Prestige.

If these things don’t interest you then you might be able to cross some credit cards off your list early and make it easier on yourself to make a decision on the card you want.

Partner, spouse, family member?

Having a spouse or partner that’s willing to go in on travel hacking with you can be extremely valuable. It allows you to expand your earning options with different cards and makes it a lot easier to accumulate an array of hotel cards that offer you status, since you can divide those up between the two of you.

Getting your partner involved early in the process is especially beneficial because you’ll both be earning miles and points together and one person won’t have to “carry the burden” of the other with their points.

If for some reason your partner doesn’t seem interested or they think that you’re up to something shady, then consider earning some first class tickets or free luxury hotel rooms and see how they react to reaping the benefits of your “shady” hobby. Just try not to judge them too hard when they finally come around and get into travel hacking even harder than you! 😉

Know the risks

My final bit of advice is to be aware of the risks of getting into this hobby. Travel hacking is, for the most part, a relatively low-risk game with the potential for very high rewards. However, the risks can involve getting shutdown by banks and potentially losing access to your credit cards in addition to your hard-earned miles or points.

Usually the people who get shutdown are those who are thoroughly abusing the system and typically they aren’t too surprised that the banks have caught on to them. Still, sometimes people get hit out of the blue with financial reviews of their accounts and are left stunned.

I suggest that you review the shutdown threads on Flytertalk so that you’re aware of the risks of this hobby and how to steer clear of falling into common pitfalls. It probably won’t ever happen to you but it’s important to be aware of the risks before jumping head first into the game.

Start reading up on blogs, forums, and websites

So with all of those tips out of the way, here are some of my favorite sources where you can read up on a lot of the information I just mentioned. If you check out these sources regularly and follow them on social media you will rarely if ever be out of the loop when it comes to new credit card offers, flash deals, etc.

Blogs:

- MilesFeed – This is your one stop where you can check up on many blogs for the latest news.

Websites:

Some people require a couple of weeks while others may want a couple of months to get comfortably familiar with all of these concepts and aspects of travel hacking. However, once you feel like you’ve obtained a foundational understanding, it’s time for the fun to start and for you to begin your credit card applications!

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

I am assuming you have many credit cards with annual fees and you pay a lot for those annual fees too.

You’d be surprised. I strategically downgrade/product change cards to avoid most annual fees. For other cards I’ll pay annual fees because I net more value from those cards than what I pay in my annual fee. And then, for some other cards, I might cancel one here or there. So in the end, annual fees don’t usually end up being a major issue.