[Offers contained within this article may no longer be available]

The Amex EveryDay® Preferred Credit Card is a card that a lot of people tend to sleep on. It’s not quite the travel card as the Premier Rewards Gold Card but it offers a tremendous potential for earning Membership Rewards with its 50% monthly bonus in points earned. Here’s a review of the Amex EveryDay® Preferred and some things to consider when applying for the card.

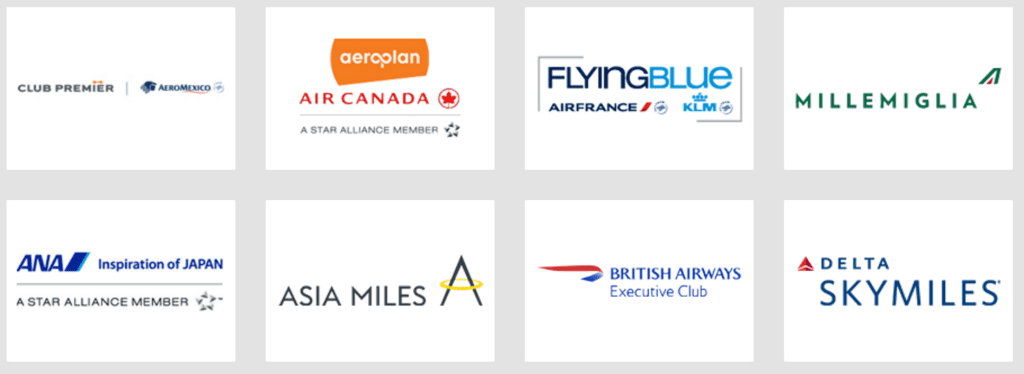

Transfer Partners

American Express cards like the Amex EveryDay® Preferred earn you Membership Rewards. They are generally considered one of more valuable reward currencies and these points can be transferred to several different airline and hotel partners. Below is a list of the eligible travel partners.

Airlines

These partners do not have all have the same transfer ratios as you can see below:

- Delta Skymiles

- Club Premier AeroMexico

- Aeroplan Air Canada

- Flying Blue (Air France/KLM)

- MilleMigilia Club Alitalia

- ANA

- Asia Miles

- Avios British Airways (250 points = 200 Avios)

- Emirates Skyrewards

- Hawaiin Airlines

- Iberia Plus

- JetBlue

- KrisFlyer Singapore Airlines

- Virgin America (200 points = 100 Elevate points)

- Virgin Atlantic

Hotels

- Best Western Rewards

- Choice Privileges

- Hilton HHonors (1,000 points = 1,500 HHonors points)

- SPG (Starwood Preferred Guest) (1,000 points = 333 Starpoints)

There are a few things to keep in mind about Membership Rewards:

- Bonus transfers are occasionally offered allowing you to transfer your points to partners for higher ratios. Check this thread for a history of these transfer bonuses.

- Your Membership Rewards cannot be freely transferred between you and any friend or family members

- They don’t expire as long as you remain a cardholder

Redeeming Points

If you don’t decide to transfer your Membership Rewards to other travel partners you can always utilize them for travel redemptions or purchases.

Membership Rewards can be redeemed in the following ways:

- Between .5 and 1.0 cent per point for gift cards

- 0.6 cent per point for a statement credit/charge.

- 1.0 cent per point on air fare

- 0.7 cent per point on hotels, cruises, and vacation packages.

Aside from maybe using them for air fare to earn or maintain elite status, I personally do not think these are good redemption rates. However, depending on the circumstances (no availability with travel partners, short on cash, etc.), it might make sense for you to redeem your points through the Amex travel portal.

Sign-up Bonus

- Get 15,000 Membership Rewards points after you use your new Card to make $1,000 in purchases in your first 3 months.

- This is the standard public offer

- Get 30,000 Membership Rewards after you use your new Card to make $2,000 in purchases in your first 3 months.

- This offer comes around occasionally, often via Google Chrome Incognito.

- Get 50,000 Membership Rewards after you use your new Card to make $2,000 in purchases in your first 3 months!

- Highly targeted offer that only some have received in the mail.

If you already hold an American Express card, your chances of receiving the 50,000 offer in the mail are very slim. Thus, the 30,000 offer is probably going to be your best bet but there’s no way of knowing when it might come around again.

One bonus per lifetime

You need to know that American Express has a once per lifetime rule for receiving sign-up offers for its cards. There are some exceptions to this and you can read more about them in the American Express application rules article.

Bonus Category Earning

This is where the Amex EveryDay® Preferred Credit Card really shines and in my opinion, it might just be the top earning travel rewards credit card, especially if you max out the supermarket categories. Let’s take a look at its bonus earning potential.

- 3x points at US supermarkets (On up to $6,000 in purchases per year)

- 2x points at US gas stations

- 1x points on other purchases

These are decent bonus categories. The two notably missing categories are dining and travel purchases, but those categories can be covered with cards like the American Express Premier Rewards Gold Card or the Chase Sapphire Preferred®.

What really makes this card such a high earner is that when you use your card 30 or more times on purchases in a billing period you get 50% more points on those purchases!

The additional 50% bonus can absolutely earn you a killing. In fact, over at The Points Guy, they ran an analysis of the earning potential of this card versus the Premier Rewards Gold Card and Platinum and the Amex EveryDay® Preferred outperformed them in every scenario in terms of earning Membership Rewards!

Now, Im pretty sure those calculations (from 2014) did not factor in the 2x on dining on the Premier Rewards Gold Card and I don’t think they factored in the potential for 4x on airfare. Thus, it’s definitely possible that the Premier Rewards Gold Card might out earn the Amex EveryDay® Preferred based on some of the spending habits.

But still, the Amex EveryDay® Preferred is one of the best all-around daily spending credit cards (“daily drivers”) and is likely the best for earning Membership Rewards for someone who will max out the supermarket 3X earnings and obtain the 50% bonus each month.

Amex Offers

Amex Offers are promotional offers that are available to all Amex cardholders. Some of these offers will essentially provide you with free money, often giving you back $5-$15 off purchases at different online retailers. If you used consistently and effectively, you can easily save yourself $100-200 a year on items you would’ve likely purchased anyway.

No interest for the first 15 months

- 0.0% introductory APR for the first 15 months. After that, your APR will be 13.24% to 22.24%, based on your creditworthiness and other factors as determined at the time of account opening

Foreign Transaction Fees

- 2.7% on international transactions

Annual Fee

- $95, not waived the first year

Downgrading

The Amex EveryDay® Preferred can be downgraded to the no annual fee Amex EveryDay®. The Amex EveryDay® earns:

- 2x points at US supermarkets on up to $6,000 per year in purchases(then 1x)

- 1x points on other purchases.

- If you use your Card 20 or more times on purchases in a billing period you get 20% more points on those purchases

So you lose out on 50% bonus (reduced to 20%), 3X on supermarkets (reduced to 2x), and lose out completely on the 2X on gas. However, with no annual fee and the ability to hold on to and earn Membership Rewards, downgrading to the Amex EveryDay® is a solid choice if you don’t want to continue to the pay annual fee.

Final Word

The Amex EveryDay® Preferred is a top points earning rewards card. However, since the card doesn’t earn bonus points for dining or travel, it’s highly recommended that you supplement this card with one that does, such as the American Express® Premier Rewards Gold Card or the Chase Sapphire Preferred®. Having at least one of those cards will provide a traveller with complete bonus category earning potential along with superior benefits, such as better travel and purchase protection.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

One comment

Comments are closed.