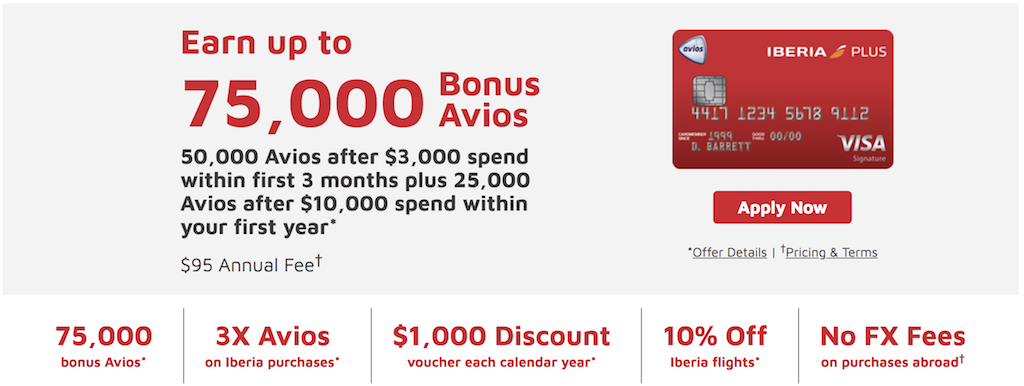

Chase recently announced two new credit cards, a co-branded Aer Lingus card along with a co-branded Iberia credit card. This article will take a look at the Iberia card and see if it’s a credit card worth pursuing.

Update: Some offers are no longer available — click here for the latest deals!

- You can apply for the card here.

Iberia credit card features

- 50,000 Avios after $3,000 spend within first 3 months

- Plus 25,000 Avios after $10,000 spend within your first year

- 3X Avios on Iberia purchases

- $1,000 discount

- 10% off Iberia flights

- No foreign transaction fees

- $95 annual fee (not waived)

Sign-up bonus

This card models the British Airways Visa which often offers 50,000 Avios as a standard sign-up bonus with the potential to earn an additional 25,000 or 50,0000 Avios with much higher spend throughout a year. 50,000 Avios isn’t a bad sign-up bonus by itself, but 75,000 Avios is much more exciting and could cover a roundtrip business class ticket to Europe.

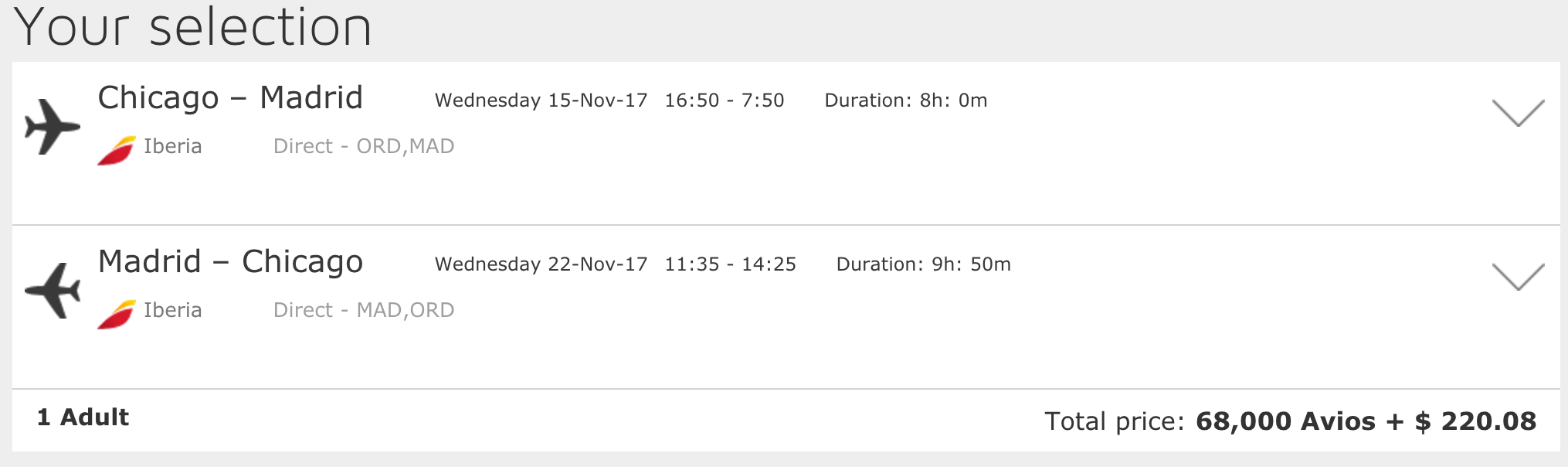

Iberia operates on a distance-based award chart similar to British Airways but it has its own sweet spots. One of the most popular sweet spots is flying business class to Madrid from destinations such as Chicago for only 68,000 Avios roundtrip. That’s a phenomenal deal and fees can be very reasonable at around $220 or lower. You can read up on some other sweet spots here.

Sweetspot from Chicago to Europe

Sweetspot from Chicago to Europe

Bonus spending

3X on Iberia, British Airways, Aer Lingus, LEVEL and OpenSkies purchases and 1X on all other purchases is not very compelling considering that Chase has so many options that can earn better rates on Ultimate Rewards (which can then be transferred to Iberia).

$1,000 discount

Earn a discount voucher of $1,000 to use toward two tickets on the same flight for each year you make purchases of $30,000 on your card. The discount voucher will be in the form of a code that can be applied for a discount of $1,000 when purchasing two tickets, for the same flights in the same class of travel.

A $1,000 discount is very nice and a unique perk I don’t recall seeing with other travel rewards credit cards. But $30,000 spend for that goal is a lot and you’d really have to examine what kind of opportunity costs you’re leaving behind be pursuing that spending goal.

It’s nice to see that the discount can even apply to business class flights. If you were able to find a cheap J fare, this $1,000 discount could potentially have you traveling in business class for economy prices.

10% discount

Use your Iberia Visa Signature Card to book your flight on iberia.com/chase10, and you will receive a 10% discount. The terms and conditions state the following key details:

- Discount is valid on the flight fare only and taxes, fees and carrier charges are excluded from the discount, on mainline flights operated by Iberia.

- Cardmember must travel to qualify for the 10% discount.

- To take part in this promotion, eligible participants must log in at iberia.com/Chase10 opens overlay to make a roundtrip booking.

- Discount applies for up to nine passengers booked on the same Iberia flight at the same time.

So it seems like this 10% discount only applies to roundtrip bookings? I’m not sure if that’s the case but nevertheless it’s pretty cool that the 10% discount applies to up to nine passengers. Depending on your travel habits, this 10% discount could potentially cancel out the annual fee alone.

Not subject to 5/24

Recent data points suggest that this card is not subject to the Chase 5/24 rule which makes sense since the British Airways Visa is also not subject to that rule.

Final word on the Iberia Visa card

This is a compelling new product issued by Chase for anybody interested in building up an Avios balance. If you’d like to transfer your Iberia Avios to your British Airways account you need to create an account with both programs asap because you’ll need to have your accounts open for 90 days to process a transfer. Outside of the sign-up bonus, this card could still be worth it if you think you’d utilize the $1,000 voucher or 10% discount but you’ll need to examine any opportunity costs you’re missing out on.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.