Offers contained within this article maybe expired.

The Bonvoy Brilliant is now offering a 100K bonus after you spend $5,000 in the first three months after account opening. This is the best public offer that we have seen for this card but you still might be wondering if it is worth it to jump on? In this article, I will break down the card and give you some insight into whether or not you should apply. Offer ends 4/08/2020.

Bonvoy Brilliant overview

- 100K bonus after you spend $5,000 in the first three months after account opening.

- $300 in Marriott statement credits (issued on card anniversary)

- $100 property credit

- 1 Free Night Award every year after your Card account anniversary for redemption levels at or under 50,000 points

- Bonus earning:

- 6x at Marriott properties

- 3x at U.S. restaurants and on flights booked directly with airlines

- 2x on all other purchases

- Complimentary Gold Elite status

- Earn Platinum Elite status after making $75,000 in purchases on your card in a calendar year.

- 15 nights towards the next level of Elite status.

- Priority Pass Select membership

- Receive a statement credit every four years after you apply for Global Entry ($100) or TSA Preè ($85) with your Card.

- No foreign transaction fees

- Annual fee: $450

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Eligibility

American Express has some long and confusing rules about the eligibility for this card.

Here are the rules:

Welcome offer not available to applicants who (i) have or have had The Ritz-Carlton™ Credit Card from JPMorgan or the J.P. Morgan Ritz-Carlton Rewards® Credit Card in the last 30 days, (ii) have acquired the Marriott Bonvoy Boundless™ Credit Card from Chase, the Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy™ Premier Credit Card from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy Bold™ Credit Card from Chase, the Marriott Bonvoy™ Premier Plus Business Credit Card from Chase or the Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 90 days, or (iii) received a new Card Member bonus or upgrade offer for the Marriott Bonvoy Boundless™ Credit Card from Chase, Marriott Rewards® Premier Plus Credit Card from Chase, the Marriott Bonvoy™ Premier Credit Card from Chase, the Marriott Rewards® Premier Credit Card from Chase, the Marriott Bonvoy Bold™ Credit Card from Chase, the Marriott Bonvoy™ Premier Plus Business Credit Card from Chase or the Marriott Rewards® Premier Plus Business Credit Card from Chase in the last 24 months.

That is a huge wall of text and so I would recommend just using the new app WalletFlo to automate your eligibility for these rules. It will also help you manage and keep track of things like annual fees and bonus points and just make your life a lot easier. It’s also 100% free so it’s worth checking out.

Should you go for this offer?

If you are under 5/24 you should probably not go for this offer.

As long as you haven’t opened up five accounts in the past 24 months, the Chase Sapphire Preferred (full review) or Chase Sapphire Reserve might be better options to go with first if you want better bonus earnings on dining and general travel expenses. You can also transfer their points to many partners (including Marriott).

(If you really wanna maximize your wallet, go with the Chase Ink Business Preferred first since that card will not count towards your 5/24 status.)

But if you are over 5/24 the Brilliant can be great — especially if you think you will utilize the credits.

If you are going to spend $300 at a Marriott property you are going to offset the annual fee by $300 to an effective $150. (By the way, there are also currently Amex Offers for $50 off Marriott properties when you spend $250.)

So then it is just a matter of how much value you will get from things like the bonus categories, gold status, and the free night.

Since you can use the free night on properties up to 50,000 points per night you can get a lot of value from the free night and easily make this card a keeper that you never cancel. That would be the number one factor I would look at when choosing to hold onto the card.

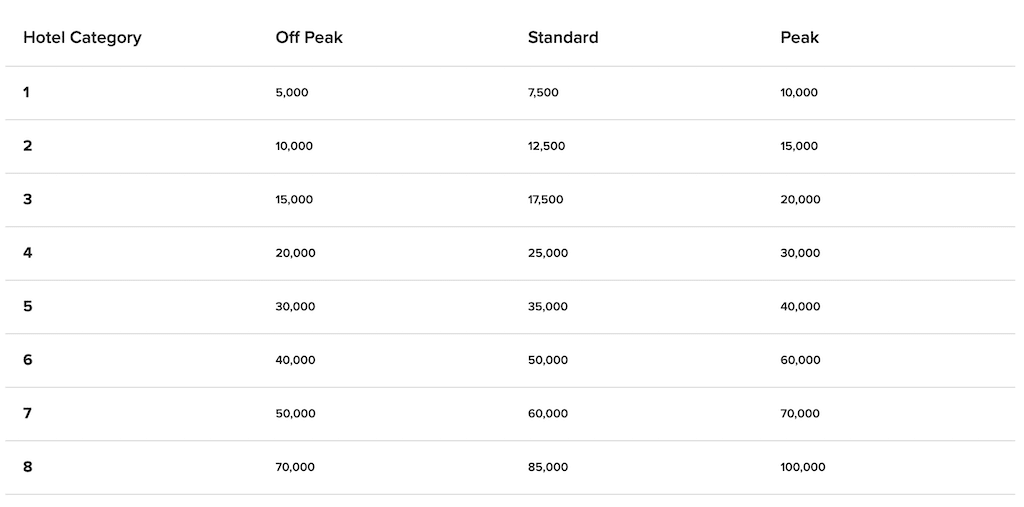

If you are wondering how many free nights you can cover with the 100,000 point welcome bonus here is a look at their award chart which now has off peak and peak prices.

Note that Marriott did just recently change the pricing for many hotels so there was a recent devaluation. If you want to search for specific properties based on the price and location you can do that here.

So 100,000 points could cover two nights at a category six/seven property which would be in a lot of cases a very nice luxury hotel like the Ritz-Carlton or St. Regis. If you combined your free night certificate with your points then you could potentially cover three nights at a category six property! You could be looking at over $1,500 worth of value from three free nights at that level.

Final word

The Bonvoy Brilliant is a no-brainer for people interested in staying at Marriott properties and spending at least $300 per year. Catching it at the 100K bonus is great timing but I still would go for a Chase card if I were under 5/24.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.