Advertiser Disclosure: UponArriving has partnered with affiliate partners and may receive a commission from card issuers. UponArriving does not display all credit card offers and affiliate relationships may impact how offers are presented.

Offer no longer available

Right now the Citi Premier® Card is offering one of the best ever welcome bonuses of 80,000 ThankYou Points after you spend $4,000 in purchases within the first 3 months.

This is proving to be the hottest card for WalletFlo users for the summer and so I think it would be a good time to take a look at what type of valuation you should be giving your ThankYou Points.

Table of Contents

Citi Premier overview

As mentioned, the Citi Premier® Card has an outstanding welcome offer of 80,000 ThankYou Points after you spend $4,000 in purchases within the first 3 months.

But in addition to the bonus, you can also get:

- 3X on air travel and hotels

- 3X on dining

- 3X on gas stations

- 3X on supermarkets

- 1x on other purchases

- $100 Annual Hotel Savings Benefit

- No Foreign transaction fees

- $95 annual fee

While you can do better on some of these individual spend categories, the Citi Premier® Card is certainly a strong all-around spender.

If you want solid rewards but don’t want to mess around with multiple cards, this card can make it easy to earn a lot of points with your spend.

Interested in the 80,000 ThankYou Points welcome bonus? Learn how to apply here.

ThankYou Points valuation examples

That 80,000 point welcome bonus is very attractive but exactly how much value should you expect to receive for those points?

Below, I’ll show you how it could range from $800 to over $28,000!

And no, that $28,000 is not a typo.

Remember – You can input your own custom points valuation into the WalletFlo app and that will impact how your credit card ranks on your Cheat Sheet!

Cashback and gift cards

Valuation: 1 cent

You can redeem Citi ThankYou points for cashback/statement credits or for lots of different gift cards at a rate of one cent per point.

Gift cards are one of the most convenient ways to redeem points and if you can get one cent per point it’s not a terrible use of your points (but definitely not optimal).

Generally, for me gift cards are a last resort when redeeming transferable points but as long as you get one cent per point it’s not the end of the world.

Citi Travel Portal

Valuation: 1 cent

You can use the Citi Travel Portal to redeem at a rate of one cent per point for things like airfare, rental cars, cruises, and hotels.

When you book airfare, you’ll also earn miles for your flights so you do get a bit more value than one cent per point if you factor that in.

While the value is still on the low side, the benefit of using the travel portal is you don’t have to worry about award inventory so you can book any flight you see.

This method is for people who want to save money on travel but don’t want to bother with the challenges of transferring points. It can also be useful for cheap flights and some hotels.

Sometimes you may just want to book your travel outside the travel portal and reimburse yourself with direct deposit cashback so you can get your full benefits, travel protections, etc.

Tip: If you utilize the $100 Annual Hotel Savings Benefit you can technically get over one cent per point for hotel redemptions.

Citi Travel partners

If you’ve been in miles and points for a while you know that the best value for your points comes from utilizing transfer partners.

So let’s take a look at some of the Citi partner redemptions to see what type of valuations you might be working with.

We’ll start small and then ramp up the value.

Interested in the 80,000 ThankYou Points welcome bonus? Learn how to apply here.

JetBlue (USA Domestic)

Valuation: 1.2 cents per point

An economy redemption on JetBlue from LAX to MIA would run you 12,900 points for a $164 flight. So that comes out to about 1.2 cents per point.

You should be able to do better than that on other JetBlue flights but not that much better. (If you can get around 1.5 cents per point you are doing pretty good with JetBlue.)

Because JetBlue award prices are tied to revenue prices (similar to Southwest), these are always going to represent the lower end of redemptions for ThankYou Points when it comes to travel partners.

Tip: If you have the JetBlue Plus Card you can get a 10% rebate on your point redemptions which increases the value of your points.

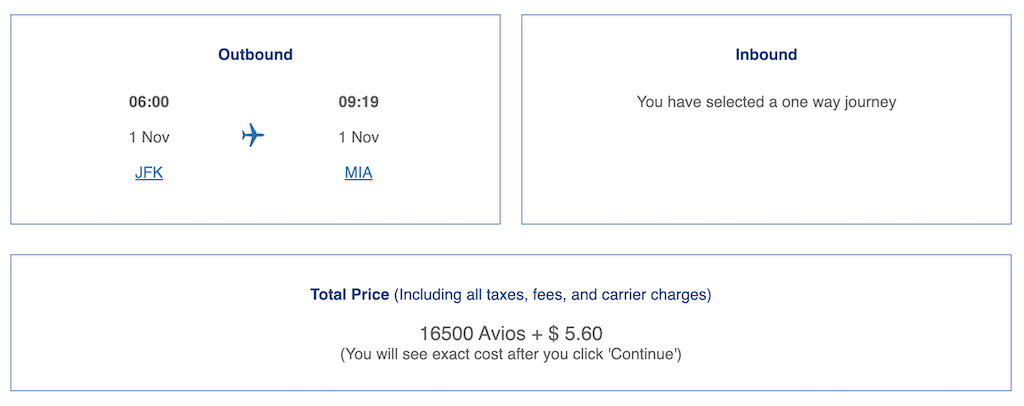

Avios (USA Domestic)

Valuation: 2.1 cents per point

Flying business class from JFK to MIA on American Airlines would cost $357. Using 16,500 Avios to cover that trip, the cents per mile comes out to about 2.1 cents per point.

The way this redemption would work is you would first transfer your Citi points to Qatar and then transfer them to British Airways where you could book American Airlines (using the British Airways site) at the above rate.

For those of you who live near an AA hub, using the Qatar-BA route for American flights can be a very easy and efficient way to get around with ThankYou Points.

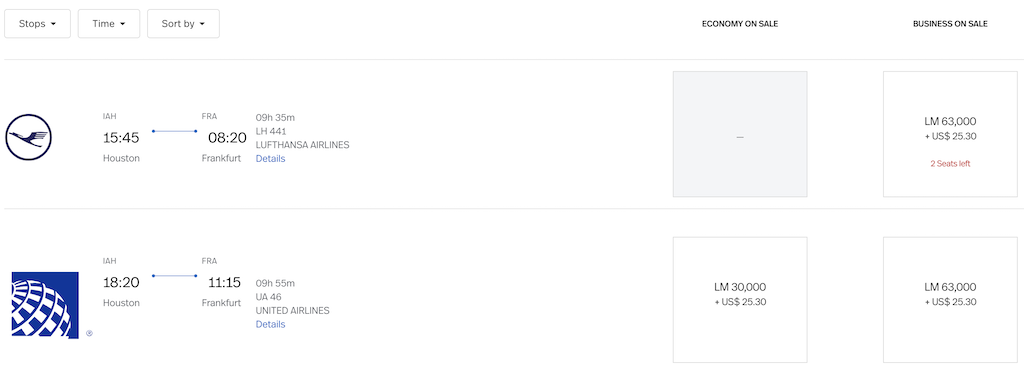

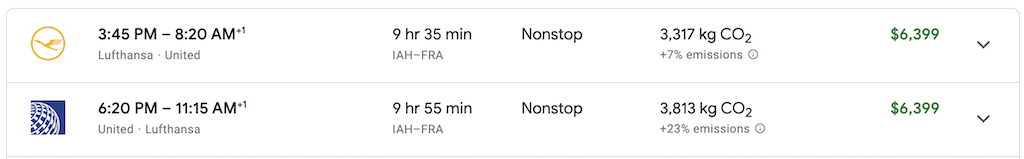

Avianca (USA-Europe)

Valuation: 10.1 cents per point

This valuation is based on business class redemptions on both Lufthansa and United using Avianca Life Miles.

For 63,000 Life Miles and only $25 in fees you could book a one-way business class flight on either United or Lufthansa from Houston to Frankfurt.

These flights are listed at $6,399, so that means that your redemption value comes out to 10.1 cents per point which is pretty amazing for business class.

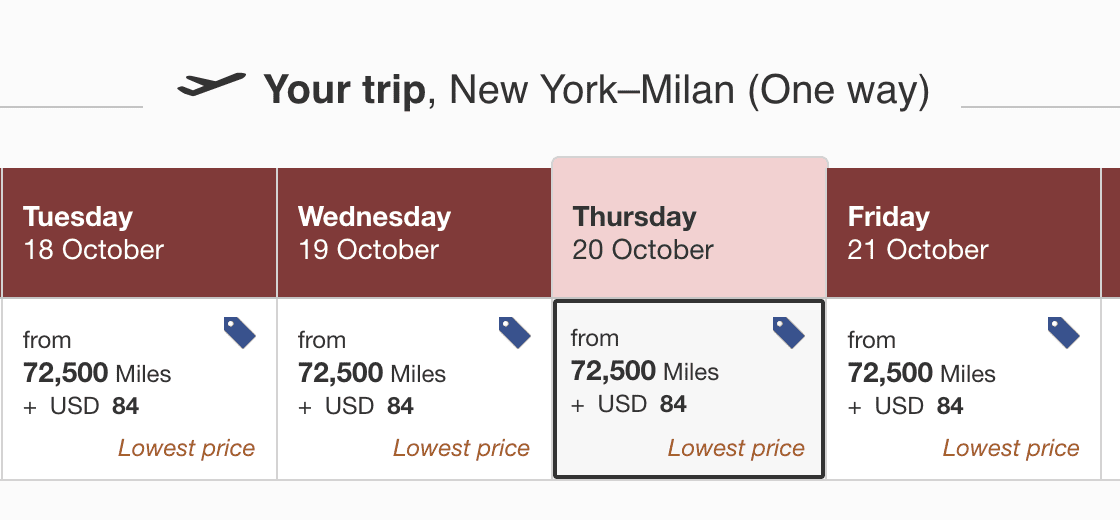

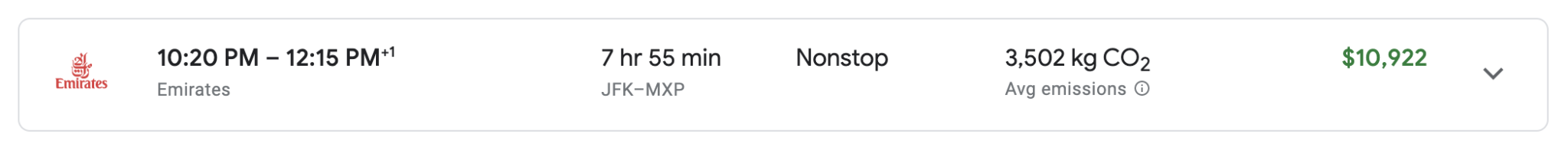

Emirates (USA-Europe)

Valuation: 15 cents per point

If you thought 10 cents per point was impressive, it’s time to bump things up a notch with first class awards.

Emirates awards can get expensive for premium cabins but they have reduced fuel surcharges so they are not nearly as expensive as they used to be.

For 72,500 miles you can fly their amazing first class from New York (JFK) to Milan, Italy (MXP) and you only have to pay $84 in fees. That flight is currently going for $10,922.

With $84 in fees the cents per mile comes out to 15 cents per mile!

Virgin Atlantic (USA-Asia)

Valuation: 27.4 cents per point

Here’s when things start to get stupid.

If you were to transfer your Citi points to Virgin Atlantic and book first class on ANA from JFK to Japan it would cost you 60,000 Virgin miles one way.

I priced this flight in October of this year for $16,574. If you assume fees of about $100 then that means that the cents per point comes out to an astonishing 27.4 cents per point.

If you want to get even crazier Citi has offered 30% transfer bonuses to Virgin Atlantic before. So if you took advantage of one of those bonuses you could transfer 47,000 points for this redemption, making the value of your points come out to 35 cents per point.

Final word

Some of these redemptions represent amazing outsized value.

Most people will want to stick to valuations that represent their actual travel savings rather than value captured from mega outsized redemptions.

That will typically be around one to three cents per point, depending on how you like to travel.

But knowing how insane the value can get with some of these programs can be a real motivating factor to help you optimize your rewards.

Citi Premier® Card: Earn 80,000 bonus ThankYou Points after you spend $4,000 in the first 3 months

Advertiser Disclosure: UponArriving has partnered with affiliate partners and may receive a commission from card issuers. UponArriving does not display all credit card offers and affiliate relationships may impact how offers are presented.

Editorial Disclosure: Opinions, reviews, analysis & recommendations are UponArriving’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.