One of the biggest unexpected benefits of working on the new app WalletFlo is that users have submitted lots of credit cards and so I have discovered tons of new cards. Some of these are lucrative in certain areas while others are honestly just pure trash.

In the next few months I’m going to occasionally feature some of the stand out cards from lesser-known banks you probably have not heard much about and talk about how valuable they can be.

The first card I want to talk about is the Logix Federal Credit Union Platinum Rewards Credit Card. And its specialty is with everyday spend.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Now before going into too much detail I do want to point out that membership to Logix Federal Credit Union is limited to residents of: AZ, CA, DC, MA, MD, ME, NH, NV and VA. If you happen to fall into one of those states though this could be a pretty valuable card.

Here’s why:

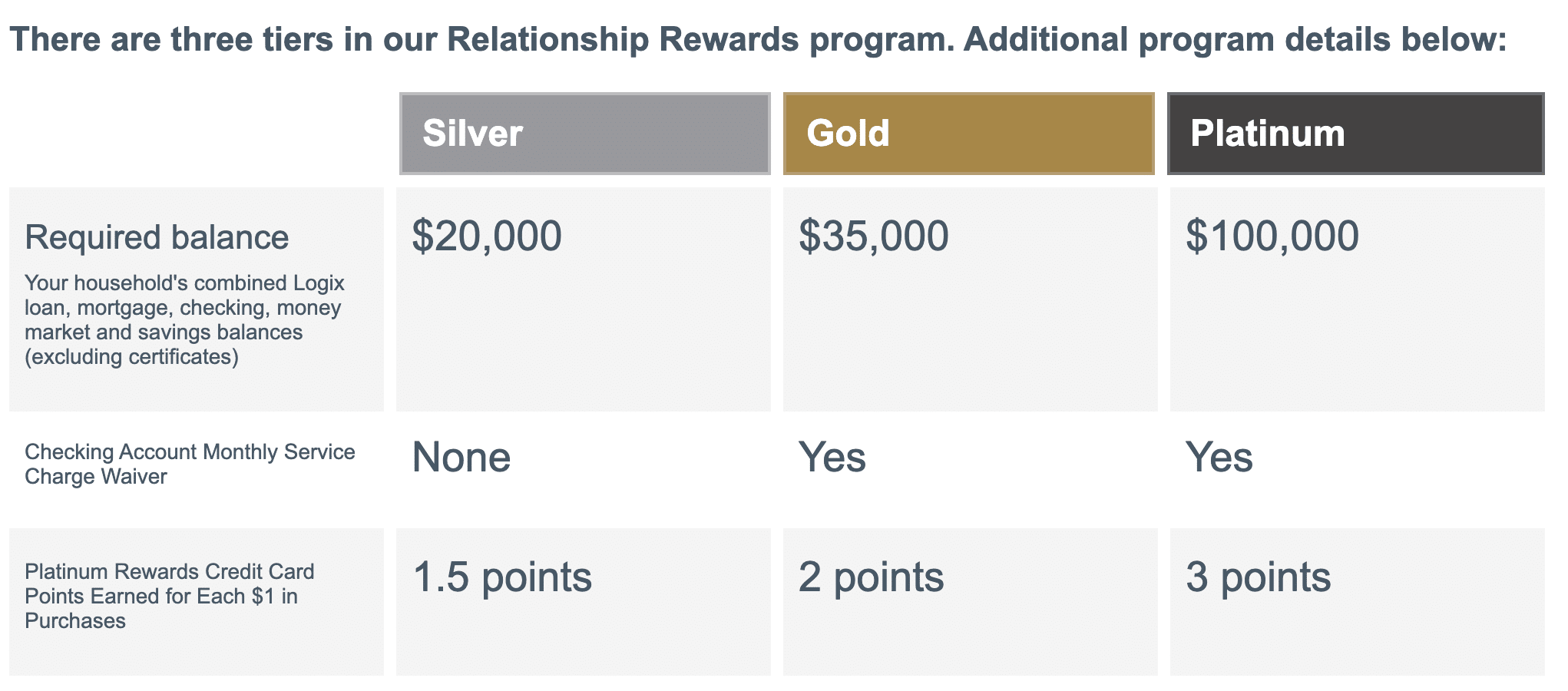

The Logix Federal Credit Union Platinum Rewards Credit Card earns 1.5X on all purchases at its basic silver level. You can redeem points for a statement credit at a rate of one cent per point so this is effectively a 1.5% cashback card. Not bad.

But if you have assets with the credit union, you can increase your earnings.

- $35,000 qualifies you for Gold

- $100,000 qualifies you for Platinum

Your assets are determined in the following way:

Your household’s combined Logix loan, mortgage, checking, money market and savings balances (excluding certificates)

Gold will allow you to earn 2X back on all purchases while Platinum allows you to earn 3X back on all purchases. I have also confirmed that there are no limits or caps to these earnings.

This means that the Logix Federal Credit Union Platinum Rewards Credit Card could be a limitless 3% back card which is not easy to find. The #1 everyday card that I champion the most is the Amex Blue Business Plus but that card only earns 2X on all purchases up to $50,000. That’s still impressive given the high value of Amex points but for high spenders, that $50K cap is an issue.

Qualifying for 3X

If you found good financing for a mortgage or perhaps even vehicles, that could get you over or close to the $100,000 mark.

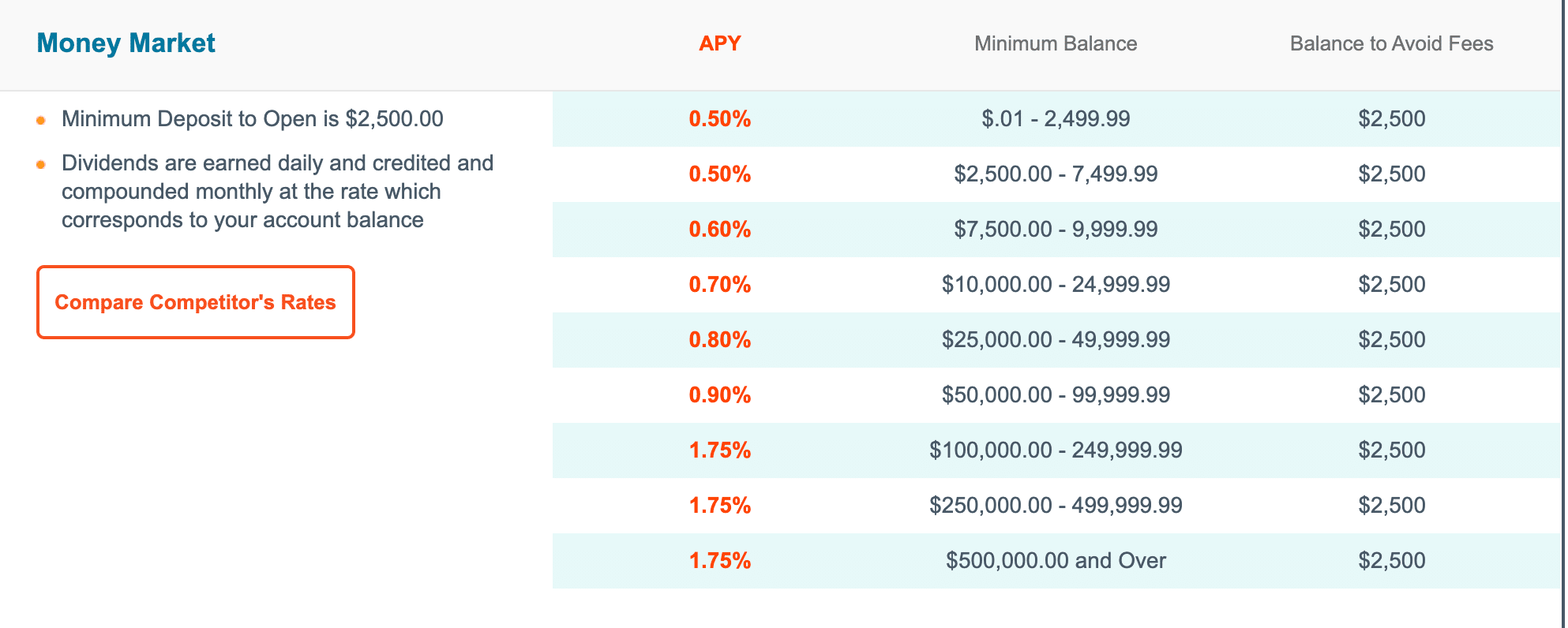

Now, admittedly I did not take a super deep dive into the rates for their mortgages and money market accounts. But I did see APYs ranging from .50% – 1.75% ($100K needed for the high end).

So if you can qualify for the higher end, that’s not horrible although you can do better with many other money market accounts out there.

The biggest drawback to me is that certificates do not count, which would have been awesome because that could be a very legitimate way to qualify for the threshold.

I definitely don’t think it is a good idea to go around chasing major requirements like this just to earn 3% back on purchases. And obviously you have to weigh the opportunity costs big-time. But for the right person banking with this credit union could mean extra earning opportunities.

If you spent $40,000 in a year and earn 2% back you would get $800 back in cash. If you were able to earn 3% back that would be an additional $400 back in your wallet. Now for some people, an additional $400 in their wallet is not that big of a deal but for many of us we enjoy all the savings we can come across, especially when they can be earned with a simple swipe of the card.

This card also illustrates how WalletFlo will help people find cards that maximize their spend. Because eventually you will be able to discover all cards in the database and pursue cards that you qualify for based on things like your location.

With just a couple of clicks, you could be on your way to putting back a few hundred bucks into your pocket each year. And that’s because WalletFlo is not going to be an affiliate-driven product like so many things out there. It will always provide you with objective data in your best interest regardless of how it is monetized.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.