New Targeted Marriott 100K Offer

This article contains an expired offer. A new targeted offer for the Marriott Rewards Credit Card is making its way around via email and it’s offering an upgraded sign-up bonus

This article contains an expired offer. A new targeted offer for the Marriott Rewards Credit Card is making its way around via email and it’s offering an upgraded sign-up bonus

Although the three free nights offer for the Ritz-Carlton Rewards Card unofficially expired a few months ago there were still a couple of links that still took applicants to the

Offers contained within this article maybe expired. Amex is just full of surprises these days, and via View from the Wing, they just announced a new wave of changes for

Offers contained within this article maybe expired. Amex just announced a number of big changes to The Platinum Card® from American Express. The biggest two changes were the increased annual

Offers contained within this article maybe expired. Back in October of 2016, American Express announced enhancements to both the personal and business version of the Platinum Card, including earning 5X

[This article may contain expired offers] American Express is offering a new sign-up bonus of the American Express Blue for Business Credit Card. This is a lesser-known credit card but

Yesterday, Hyatt announced that it will be offering “Explorist” elite status to cardholders of the Chase Hyatt Credit Card who spent $50,000 in 2016 and this will also be offered going

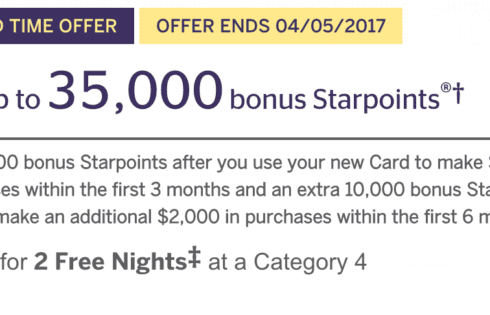

The 35,000 sign-up bonuses for both the personal SPG card and the business SPG have returned, despite the doubts that many people had given the recent merger between Marriott and

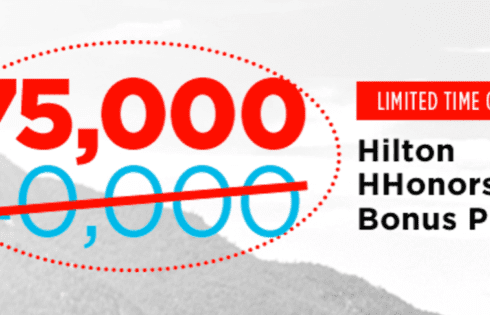

The Citi Hilton HHonors Visa Signature Card offer is back where you can earn 75,000 Honors Points after making $2,000 in purchases within the first 3 months of account opening. Here’s a look

There are two great offers out (one public and one targeted) for the United MileagePlus Explorer Card. These offers can be accessed by using the link below or by going

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |