The Chase Southwest Business Card 60,000 offer is one of the most valuable travel credit cards with its high value potential. It’s one of the best cards you can get if you’re aiming for the Southwest Companion Pass and it might the only way to get that pass for many people.

This article will show you how valuable the Southwest Business credit card 60K offer can be and how it stacks up with other Southwest cards like the Premier, Plus, and Priority cards.

Update: Some offers are no longer available — click here for the latest deals!

Chase Southwest Business Card 60,000 Offer

- 60,000 Rapid Rewards after spending $3,000 in the first 3 months

- 6,000 anniversary points

- Earn 1,500 Tier-Qualifying Points for every $10,000 in purchases, up to 15,000 Tier-Qualifying Points each calendar year

- Best sign-up bonus: 50,000 Rapid Rewards

- $99 Annual fee

- No foreign transaction fees

Earning 60,000 Rapid Rewards after $3,000 spend in three months is a fantastic offer.

That’s $900 worth of Rapid Rewards if you value them at 1.5 cents per point. This card in on par with the Premier in that it comes with no foreign transaction fees and 1,500 Tier-Qualifying Points for every $10,000 in purchases.

So for people who plan to fly Southwest (domestically or internationally), this is a terrific business credit card offer, especially if you can shoot for the Companion Pass.

Learn more about this credit card.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

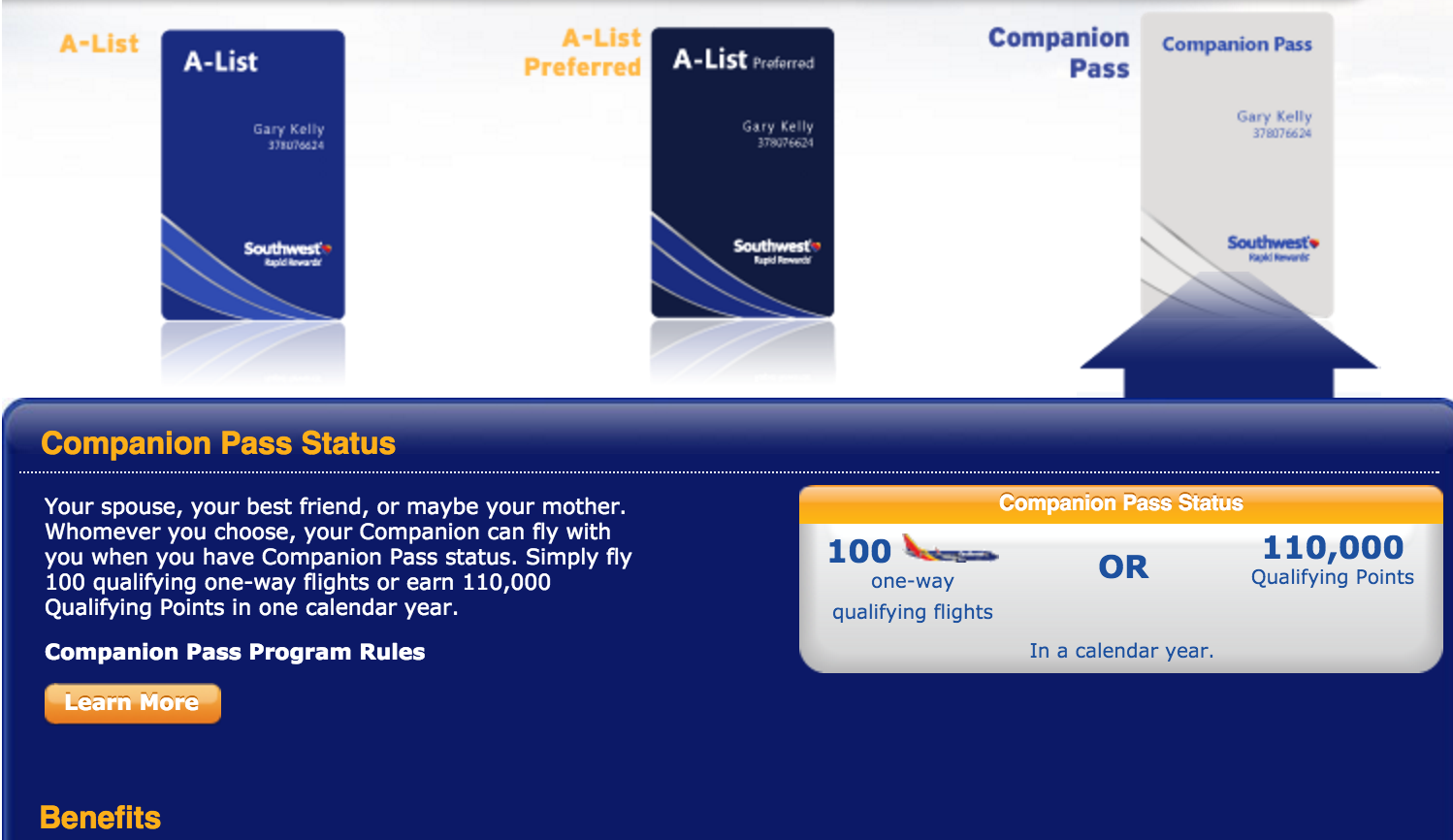

The Southwest Companion Pass

The Southwest business credit card is one of the most valuable co-branded business credit cards because for many people it’s the key to unlocking the prized Southwest Companion Pass.

You need to fly 100 one-way qualifying flights or earn 110,000 Rapid Rewards to get it but points earned from the Chase Southwest cards count towards that 110,000 requirement, so it’s very obtainable — even for people who don’t regularly fly.

The Companion Pass will allow a partner to fly for free with you for up to two calendar years. It’s easily one of the most valuable travel perks available is perfect for couples and could be worth over $3,000 if you play your cards right.

But beyond the monetary value, the Companion Pass and these Southwest cards just make it easy to get around and explore the US and the Caribbean/Mexico. Flights are so cheap that your points can go really far and getting that second ticket free, just makes it incredibly easy to constantly be on the go.

If you and a companion are interested in exploring a lot of new places then the Companion Pass is one of the best moves that you can probably make.

Also, don’t forget that Southwest will soon be flying to Hawaii and that prospect offers a lot of value potential for the Companion Pass!

Southwest Business Select

Southwest doesn’t have a true business class cabin with wider seats and better service. Instead, all seats on the plane are economy and the best you can do is find a seat with a little bit more legroom or space.

So what are Business Select fares?

These fares are the most expensive fares offered by Southwest and they offer you the ability to board the plane first with boarding passes at A1 to A15. Since Southwest doesn’t have assigned seats, being able to board the plane first means you’ll get a front row seat or a seat with extra legroom.

It’s worth noting the Southwest Business Card does not come with any Business Select privileges.

However, you can upgrade to Business Select for a much lower price upon check-in and one of the cards discussed below (the Priority) comes with Business Select upgrades.

To find out more about Business Select fares click here.

Chase Southwest application rules

Chase recently implemented a policy that no longer allows applicants to get approved for more than one personal Southwest credit card. So that means that you couldn’t get the Southwest Airlines Rapid Rewards Premier Card and the Southwest Airlines Rapid Rewards Plus Card.

However, this rule does not apply to business credit cards! So you can pick up one Southwest personal card and the business in one day, making it easier than ever to obtain the Companion Pass.

It’s worth noting that the Chase Southwest cards are also subject to the Chase 5/24 Rule, which you can read more about here.

Personal Southwest credit cards

Southwest offers three personal credit cards which are Visa cards issued by Chase. As stated, you can only get one of these at a time due to the new rule, so you’ll want to make sure that you’re getting the Southwest card that’s best for you.

Southwest Airlines Rapid Rewards Plus Card

- 40,000 points after you spend $1,000 on purchases in the first 3 months

- 2 points per $1 spent on Southwest purchases and Rapid Rewards Hotel and Car Rental Partner purchases

- 3,000 anniversary points

- $69 Annual fee

This is the basic Southwest card. It’s got a nice sign-up bonus of 40,000 points after you spend $1,000 on purchases in the first 3 months and a low annual fee of $69. If you value Rapid Rewards at 1.5 cents per point, that bonus is worth $600, which is very nice.

The anniversary bonus would be valued at $45 which helps to offset the $69 annual fee

Learn more about this credit card.

Southwest Airlines Rapid Rewards Premier Card

- 40,000 points after you spend $1,000 on purchases in the first 3 months

- 2 points per $1 spent on Southwest purchases and Rapid Rewards Hotel and Car Rental Partner purchases

- 6,000 anniversary points

- Earn 1,500 Tier-Qualifying Points for every $10,000 in purchases, up to 15,000 Tier-Qualifying Points each calendar year

- $99 Annual fee

- No foreign transaction fees

The Premier Card is a better credit card option for people who travel a lot. For one, it comes with no foreign transaction fees so it’s actually worth bringing along on international trips (Southwest does fly to international destinations).

It also provides you with 1,500 Tier-Qualifying Points for every $10,000 in purchases, which can help you achieve A-List status in a hurry.

Learn more about this credit card.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

Southwest Airlines Priority Card

- 40,000 points after you spend $1,000 on purchases in the first 3 months

- Bonus spending:

- 2X Rapid Rewards on Southwest purchases

- 2X Rapid Rewards on hotel and car rental partner purchases.

- 1X Rapid Rewards on all other purchases

- $75 Southwest annual travel credit

- 7,500 anniversary points each year

- Four Upgraded Boardings per year when available.

- 20% back on in-flight drinks, WiFi, messaging, and movies

- No foreign transaction fees

- Earn tier qualifying points towards A-list Status

- $149 annual fee applied to your first billing statement

This is the newest member to the Southwest family. It’s Southwest’s “premium” version of a credit card though it doesn’t come with lounge access (or a high annual fee). I’m actually really big on this card because of the $75 travel credit, 7,500 point anniversary, 4 upgrades to Business Select, and the in-flight discount.

Those perks make it very easy to justify the $149 annual fee and it’s very easy to recoup the value for this card. For that reason, I think this is a great card to get or even upgrade to if you already have a Southwest credit card.

Learn more about this credit card.

| Features | Southwest Priority Credit Card | Southwest Premier Credit Card | Southwest Plus Credit Card |

|---|---|---|---|

| Sign-up Bonus | 40K for $1K spend in 3 months | 40K for $1K spend in 3 months | 40K for $1K spend in 3 months |

| Bonus Earning | 2X on Southwest, hotel and car rentals | 2X on Southwest, hotel and car rentals | 2X on Southwest, hotel and car rentals |

| Anniversary Bonus | 7500 Rapid Rewards | 6000 Rapid Rewards | 3000 Rapid Rewards |

| Travel Credit | $75 Southwest annual travel credit | None | None |

| Upgrades | Four Upgraded Boardings per year when available. | None | None |

| In-flight Discount | 20% back on in-flight drinks, WiFi, messaging, and movies | None | None |

| Foreign Transaction Fees | None | None | 3% |

| Points towards A-list Status | 1,500 TQP for each $10K in purchases up to $100K | 1,500 TQP for each $10K in purchases up to $100K | None |

| Annual Fee | $149 | $99 | $69 |

50,000 point offers

These personal Southwest credit cards often offer 50,000 point offers and have even had 60,000 point offers go out from time to time. With the increased bonuses, come increased spend requirements, though.

Still, sometimes it’s worth it to wait around for the 50K or 60K offers so that you’ll be able to instantly hit the number of Rapid Rewards required for the Companion Pass.

The big issue is timing. You don’t want to earn these sign-up bonuses toward the end of year because that would limit you to just over one year with the Companion Pass.

But if you check out my article on the Companion Pass, you’ll see how to earn it at just the right time so that you can utilize the benefit for the longest amount of time possible.

Do you really want or need a Southwest card?

The Southwest credit cards are very popular and I do think they are good cards. But far to often people overlook other credit cards that might serve them a little bit better.

For example, I’d usually rather go for a business card like the Chase Ink Preferred if I were just trying to earn the most amount of points. That card comes with an 80,000 point sign-up bonus after you spend $5,000 in the first three months and 3X on the first $150,000 spent in combined purchases on:

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases with social media sites and search engines

So the earning potential is much stronger there since you’d be earning 3X on Southwest purchases (they count as travel) versus the 2X you’d be earning with the Southwest card.

But you can also get much more value form your points by transferring them to many airlines which include:

- Aer Lingus

- British Airways Executive Club

- Flying Blue (Air France/KLM)

- Iberia Airways

- JetBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

So as you can see, you can still move your points to Southwest if that’s what you’d like to do, so the Ink Preferred allows for a lot of flexibility.

Learn more about this credit card.

Southwest Tips

If you’re going to be flying Southwest you probably want to know special tips like which type of aircraft has best seats with extra legroom?

I’ve put together an article on 24 tips for flying Southwest that tell you everything you need to know about Southwest.

Final word

The Southwest Business Credit Card really is the key for getting the Companion Pass for a lot of people. The 60,000 sign-up bonus is very and it’s worth pursuing when it’s available. I’d highly recommend this card to anyone who has a need to fly Southwest and an interest in going for the Companion Pass.

Cover photo by Thomas Hawk via Flickr.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.