Citi Price Rewind is an easy to use benefit offered by Citi that allows you to save money when items you’ve purchased later drop in price.

But how exactly does the benefit work and does it cover all products?

This article will show you how to use Citi Price Rewind and explain the recent changes to the terms as well as which items are not covered by the benefit.

Update: this benefit will be ending Sept 22, 2019 (as will many other Citi card benefits).

Table of Contents

What is Citi Price Rewind?

Citi Price Rewind is a program that allows you to be automatically refunded a portion of your purchase if that price of that product goes down within 60 days after your purchase.

This is also known as “price protection” and it’s offered by several other cards. The difference is that Citi has an automated process that makes your life easier (though you still have to submit the purchase to Citi).

Not purchase protection

Don’t get price protection and purchase protection confused.

Purchase protection covers you products that are stolen or damaged (like the protection offered by the Chase Sapphire cards).

Price protection is solely about reimbursing you for the price of a purchase that later drops in price. You can read more about credit card protections and perks here.

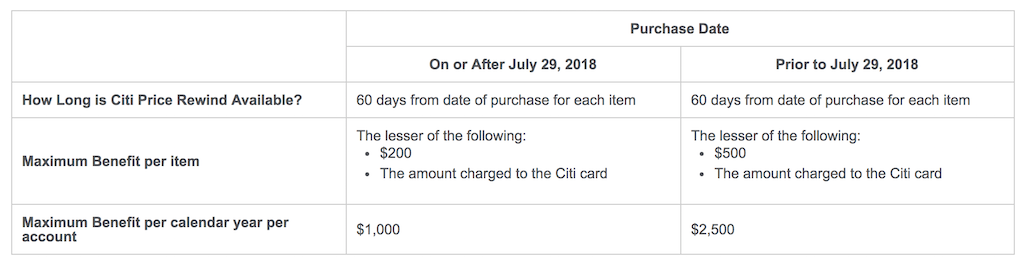

How much can you be reimbursed for?

Citi recently changed the reimbursement limits for the Citi Price Rewind and now the maximum reimbursement is for the lesser of $200 or the amount charged to the Citi card, up to a maximum of $1,000 per calendar year.

This means that if you purchase something for $500 and it drops to $250 in price, you’d only be reimbursed for $200 and not the full $250 drop in price.

(The prior limit allowed for reimbursements for the lesser of $500 or the amount charged to the Citi card, up to a maximum of $2,500 per calendar year.)

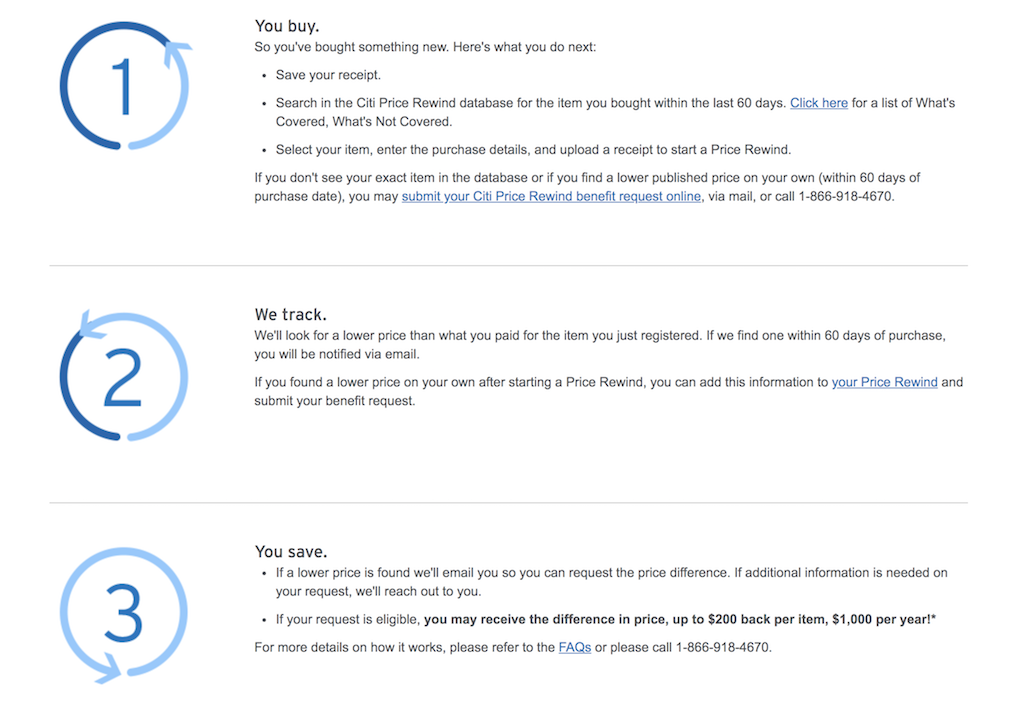

How does Citi Price Rewind work?

Citi Price Rewind is very simple.

Once you purchase an eligible product you save the receipt and then go online and search for your product. Once you’ve found your product, you submit your request for Citi to track the item.

If Citi detects a price drop for that product within 60 days, they will reimburse you for the difference of the lower price.

How to file a Citi Price Rewind claim?

Save your receipt

The process begins when you make your purchase.

You want to be sure to save your receipt because you’re going to need to upload it through the portal.

Log in

You can click here to log-in and find the Citi Price Rewind form.

If you have multiple Citi credit cards, you’ll be asked to select which card you are using for the benefit.

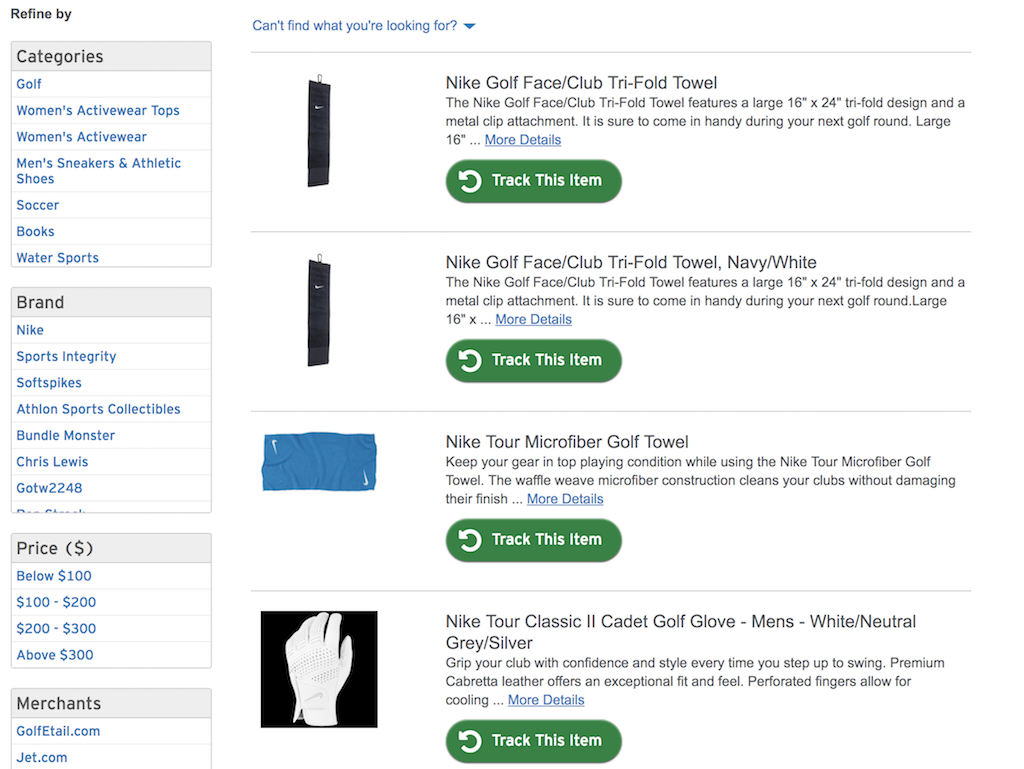

Search for your purchased item

Now that you have your receipt saved, you want to search for the item that you purchased

You can search for the product using the search bar at the top part of the screen.

If the first product name doesn’t appear then try using some other type of search criteria like the UPC Code, a more detailed product description or the model number.

After you input the name of the product, you’ll see several results pop up depending on how specific your search was.

You can filter the search results by things like categories, brands, prices, and even merchants to make your life a little bit easier.

Once you find your item, you’ll then want to click on “Track This Item.”

Your work is not quite over yet, though.

This will take you to the next screen where you’ll need to input data about the purchase such as the quantity, price, date purchased, store, and choose your reimbursement preference. You’ll also need to upload a copy of the original store receipt.

Upload your receipt and input purchase details

If you were not able to locate the product you purchased, don’t worry, you can still take advantage of this benefit.

Just log in and instead of searching for your product, you’ll begin by inputing the details for that product.

In addition to uploading the receipt, you’ll need to input:

- The product name

- Purchase price

- Date purchased

- Quantity

- Store purchased from

- Preference for reimbursement (check or statement credit)

Documenting the price drop

If your item was not found in the database then you’ll need to document the price drop.

To do that, you will need to provide the advertisement containing the lower price for your item.

Citi states the following:

The advertisement of the lower price must have been published or made available within 60 calendar days after your purchase date and must be for the same item (model number and color) by the same manufacturer for a lower price

A lot of people assume that products of the same type will work for the benefit but the products need to be exactly the same. Note that even different colors and sizes of the same product are not considered the same (though it never hurts to argue your case).

Timeline

You should note that you have up to 180 days from the date of purchase to initiate a Citi Price Rewind benefit request. Failure to initiate a benefit request within 180 days from the date of purchase will result in the denial of the benefit request.

Don’t get that confused with the 60 day limitation. The 60 day limitation applies to the window of time where you’ll be on the lookout for a drop in price while the 180 time limit is how long you have to submit your request.

Will I be notified?

Citi Price Rewind will notify you via email as well as messaging on the Citi website under “My Price Rewind” link. Included within the email will be instructions on how to initiate your benefit request.

Citi Price Rewind Phone Number

If you have questions or you would rather process your benefit coverage online you can call the help phone number at:

What purchases are not covered?

The following items are not eligible for Citi Price Rewind:

- Boats, cars, aircraft or any other motorized land, air or water vehicles and their original equipment. Tires are not eligible.

- Items that can spoil or are consumable and need to be replaced after they have been used for a period of time such as food, fuel, batteries, medications, beauty products or personal care products.

- Watches or jewelry including loose gems, precious stones, metals and pearls.

- Tickets of any kind (e.g., for airlines, sporting events, concerts or lottery).

- Travel arrangements of any kind (e.g., hotels, vacations rentals, or car rentals).

- Collectable items; including but not limited to, antiques, coins, art, sports memorabilia or stamps.

- Items purchased for resale use.

- Plants or animals, including stuffed or mounted animals or fish.

- Advice or services for a purchased item, such as product installation, labor, maintenance or repair.

- Firearms or ammunition.

A lot of people are curios about travel costs, such as airline tickets but these type of expenses are usually always excluded from programs like this.

In addition to excluded items, Citi also states that specific circumstances are not eligible for Citi Price Rewind.

These include the following circumstances:

- The lower-priced item requires a service contract, such as cell phones with a service contract.

- The lower-priced item is offered at no cost, or the lower price includes a bonus, free offer, special financing or a rebate.

- The lower-priced item is offered through a warehouse club where the merchant requires a customer to pay a membership fee.

- The lower-priced item is a going-out-of-business sale item or from an internet auction site.

- The item is returned, used, customized, altered, refurbished, or secondhand.

For purchases made before July 29, 2018, program coverage includes consumables, tires, watches, firearms, or ammunition.

Citi Price Rewind FAQ

Do I have to use a Citi card for the protection?

Yes, you have to use a Citi card to be eligible for the benefit.

So if you’re using a card like the Citi Double Cash or the Citi Costco credit card you’ll be covered.

If you split the payment with a card or multiple cards from another issuer, you’ll only be reimbursed up to the amount you spend on the Citi card (or $200).

Are purchases online and in-store eligible?

Yes, both in-store and online purchases are eligible.

Do I have to sign-up for Citi Price Rewind?

No, you are automatically eligible for the program with an eligible Citi card.

Note that Business credit cards are not eligible for the program.

What is the minimum price difference to initiate a benefit request?

There is no minimum price difference to initiate a benefit request.

Can I use Citi Price Rewind for Amazon/eBay?

So long as the product is new, you will probably be able to use the benefit. (Just note that you might have to resort to the manual price match.)

According to Reddit, it also appears that some people have had luck using Price Rewind for eBay purchases but it probably needs to be a “Buy it Now” product.

When should I start a Price Rewind?

Citi recommends that you start a Price Rewind immediately after you make a purchase.

Does Citi Price Rewind apply to Black Friday purchases?

Sources indicate that Price Rewind can be used for Black Friday purchases.

You’ll just need to make sure that you have proof of the lower price, as Citi states:

“The lower price must be published on an online retail site or in a printed or online newspaper, magazine, store circular or catalog and can be validated with the merchant. This includes special promotions such as Black Friday or door buster sales.”

How do taxes and shipping count?

Citi states that the “price comparison must be based only on sale price, not including taxes, shipping and handling, delivery costs, warranties or any other charges.”

Price protection offered by other cards

A lot of us have taken advantage of price protection for some time. However, recently, many issuers have cut down on this perk.

For example, Chase is dropping price protection from the Sapphire Reserve and Chase Ink Business Preferred in August 2018. Discover is dropping price protection as of October 31, 2018.

Why are these benefits disappearing?

The answer is technology. It has become easier than ever to track prices with automated software and apps so more people have been able to utilize these benefits, forcing some of these issuers to decrease these perks or drop them all together.

Final word

Citi Price Rewind is an easy to use perk and can save you hundreds of dollars each year.

Even with the recent devaluation (which was a major blow), the perk is still so easy to use that if you have an eligible Citi card, you might as well consider taking advantage of it.

With the way things are trending, I’m not sure if this benefit will be around forever so it’s best to take advantage of it while you can.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.