The Southwest Rapid Rewards Performance Business Card is a mid-tier premium business card that offers one of the best sign-up bonuses that we’ve ever seen. But it also comes with some pretty solid additional features that offer a lot of value — keep reading to find out more about the card.

Table of Contents

Southwest Rapid Rewards Performance Business Card

The Southwest Rapid Rewards Performance Business Card comes with following features:

- Strong welcome bonus

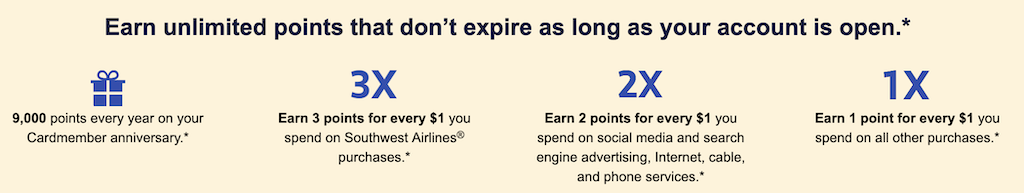

- 9,000 bonus points after your Cardmember anniversary.

- 3 points per $1 spent on Southwest Airlines purchases.

- 2 points per $1 spent on social media and search engine advertising, Internet, cable and phone services and 1 point per $1 spent on all other purchases.

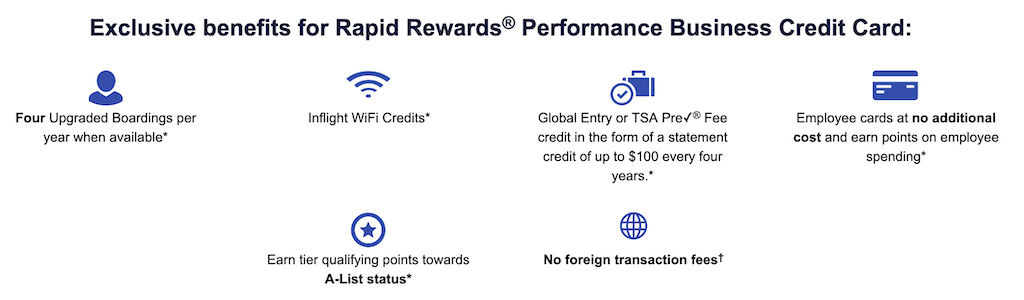

- 4 Upgraded Boardings per year when available

- Inflight WiFi Credits

- A-List credits

- Global Entry or TSA Pre-Check Fee Credit

- Employee cards added at no additional cost

- $199 Annual Fee

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Sign-up bonus

The bonus for this card has come in different forms.

The highest offer we have seen is for 80,000 Rapid Rewards after you spend $5,000 on purchases in the first 3 months your account is open.

After that, we saw an offer for 70,000 Rapid Rewards after you spend $5,000 on purchases in the first 3 months with the opportunity to earn an additional 30,000 points after you spend $25,000 on purchases in the first 6 months.

Both offers are very good offers because 70,000 points and above is extremely competitive. They can both get you pretty close to earning the coveted Southwest Companion Pass that would allow a companion to fly for free with you for up to two calendar years.

That’s about as easy as it gets and you could just jump on one of the personal Southwest cards like the Southwest Premier to quickly finish up that requirement.

One issue is that this card might not be the best option if you’re under 5/24. Unless you highly value Southwest points/the Companion Pass, a card like the Chase Ink Preferred or Chase Ink Cash might be much more valuable since they offer great bonuses and earn points you can transfer out to different transfer partners like United, Southwest, and several others.

Bonus earning

- 3 points per $1 spent on Southwest Airlines purchases

- 2 points per $1 spent on social media and search engine advertising, Internet, cable and phone services

- 1 point per $1 spent on all other purchases.

Most other Southwest credit cards only offer 2X on Southwest spending. But now you can earn 3X on all Southwest purchases. This is significant but remember that the Chase Ink Preferred earns 3X on ALL travel purchases (up to $150K) as does the Chase Sapphire Reserve.

Also, with the Southwest Rapid Rewards Performance Business Card you can earn 2X on social media and search engine advertising, Internet, cable and phone services, which is nice. However, you can earn 5X on internet, cable, and phone services with the Chase Ink Cash.

So overall, the bonus categories are strong but I’d rather use my Chase Ink Preferred and Chase Ink Cash combo to rack up more points that are also more valuable since they are Ultimate Rewards.

Tip: Check out the free app WalletFlo so that you can optimize your credit card spend by seeing the best card to use! You can also track credits, annual fees, and get notifications when you’re eligible for the best cards!

Anniversary bonus

- 9,000 bonus points after your Cardmember anniversary.

If you value Southwest points at 1.5 cents per point, then 9,000 points gives you $135 worth of Rapid Rewards each year.

This can knock the annual fee down to only an effective $64 each year which is pretty fantastic, especially considering the potential value of the upgrades I’ll talk about below.

Upgraded boarding

- 4 Upgraded Boardings per year when available

The Performance Card will offer you four upgraded boarding positions which are upgrades to Business Select boarding (A1-A15). These will be issued every anniversary year.

If you’re not aware, Southwest doesn’t offer a traditional business class or first class experience. They offer something called Business Select, which allows you to receive priority boarding.

This means you can grab the seats at the front of the airplane or within the emergency exit rows where the seats have a little more leg room or where you can grab a row with only two seats.

The amount of seats with more legroom/privacy depends on whether you’re flying on a 737-700 or 737-800. You can find out more information about the different types of seats in my Tips for Flying Southwest.

The amount of money it costs to upgrade depends on the length of the journey but you usually pay $30 to $50. So getting four upgraded boardings per year when available could be worth anywhere from $120 to $200. That’s quite a bit of value.

I know a lot of people don’t care for Southwest since there’s no true business class but I’ve always enjoyed upgrading and then grabbing one of the couple seats in the emergency exit row so Brad and I have our own row.

So I wouldn’t sleep on this benefit if you fly Southwest, but if you don’t usually fly with them, this isn’t exactly a very enticing upgrade benefit.

Note: It’s worth noting that when you upgrade you’re usually not given the other Business Select perks like a free drink.

Inflight WiFi Credits

You will receive Inflight WiFi Credits in the form of credit card statement credits for purchases of WiFi access made with your Southwest Rapid Rewards Performance Business Card. Inflight WiFi Credits are limited to a total of 365 $8 credits per year for all WiFi transactions on the overall business card account.

Getting $8 credits every day of the year is a sweet deal if you do a lot of flying on Southwest, though you would eventually get free wifi with A-List as shown below.

A-List credits

You’ll earn 1,500 tier qualifying points (TQPs) for each $10,000 in purchases up to $100,000 in purchases annually which equal 15,000 TQP. TQPs can be used to count toward qualification for Rapid Rewards A-List or A-List Preferred status.

You need 35,000 tier qualifying points or 25 qualifying one-way flights per calendar year to qualify for A-List Status. A-List Members enjoy:

- Priority boarding

- Priority check-in and security lane access

- 25% more Rapid Rewards points earned on each flight (A-List Preferred receives a 100% bonus)

- Free same-day standby

- Dedicated A-List Member phone line

Global Entry or TSA Pre-Check Fee Credit

- Up to a $100 Global Entry or TSA Pre-Check Fee Credit (good every four years).

Authorized users

- Employee cards added at no additional cost, earn points on employee spending.

Annual fee

- $199 Annual Fee

This is the highest annual fee we’ve seen for a Southwest business card but you’ve already seen the value of the perks and how they can easily offset the $199 annual fee, even with minimal use.

Foreign transaction fees

No foreign transaction fees

Eligibility

You might be wondering if you’re eligible for this card if you had or have the Southwest Premier business card. It appears that you might still be eligible based on the language found on the landing page which states:

This new Cardmember bonus offer is not available to either (i) current Cardmembers of this business credit card, or (ii) previous Cardmembers of this business credit card who received a new Cardmember bonus for this business credit card within the last 24 months.

Tip: Use WalletFlo for all your credit card needs. It’s free and will help you optimize your rewards and savings!

Final word

Overall, the Southwest Rapid Rewards Performance Business Card is a strong contender with the following highlights:

- Super strong sign-up bonus

- Good bonus earning

- Valuable benefits the offset the annual fee

The biggest issue with jumping on the card now is that you might be losing out on time to enjoy the Companion Pass. Also, many people will get more value from other Chase cards that are also subject to the Chase 5/24 rule like the Chase Ink Preferred or Chase Ink Cash.

Cover photo by BriYYZ via Flickr.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.