Amex Membership Rewards vs Ultimate Rewards [2021]

Offers contained within this article maybe expired. Amex Membership Rewards vs Ultimate Rewards — which program is better and offers more value? This is a very difficult question to answer

Offers contained within this article maybe expired. Amex Membership Rewards vs Ultimate Rewards — which program is better and offers more value? This is a very difficult question to answer

Offers contained within this article maybe expired. So you’re thinking about picking up an American Express card with a 50,000 point bonus or maybe you already earned a good 50,000

Hello, if you landed on this page from my recent email please disregard. We experienced a glitch in our email system but it has been fixed. Sorry about the inconvenience!

Offers contained within this article maybe expired. American Express and Expedia have linked up offering Expedia users a new way to use their Membership Rewards. You can link now an

Offers contained within this article maybe expired. This is the fourth installment for Maximizing Membership Rewards for Business Class. These articles will show you some great ways to utilize your American Express

Offers contained within this article maybe expired. This is the third installment for Maximizing Membership Rewards for Business Class. These articles will show you some great ways to utilize your American Express

The Chase Sapphire Reserve is the newest benefits card to hit the market and consumers are going crazy over this card (and rightfully so). It’s a bit of a super-card,

Offers contained within this article maybe expired. American Express Membership Rewards are extremely valuable and are probably my favorite rewards program for a number of reasons. The Membership Rewards program

Offers contained within this article maybe expired. Right now many Amex customers still have their Membership Rewards frozen after taking advantage of the recent 100K Platinum Card offer that leaked

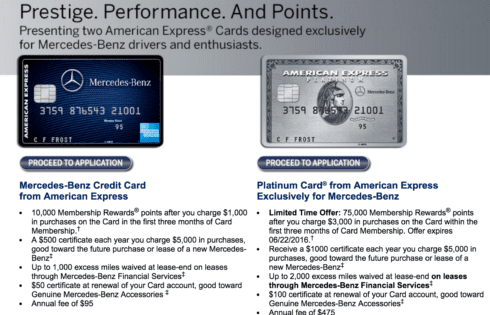

Offers contained within this article maybe expired. Right now, American Express is offering a fantastic sign-up bonus of 75,000 Membership Rewards when you spend $3,000 within the first three months

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |