Guide to Booking Award Flights with ANA

The reward program for ANA has some very valuable sweet spots for both economy and business class redemptions to pretty much every corner of the globe. In addition, it’s pretty

The reward program for ANA has some very valuable sweet spots for both economy and business class redemptions to pretty much every corner of the globe. In addition, it’s pretty

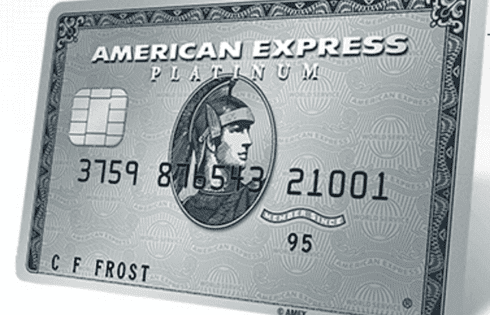

The Platinum Card® from American Express is one of the top travel cards for individuals looking for a host of travel benefits, such as premier lounges access, Global Entry, hotel and

After several disappointing (and quite drastic) devaluations over the past few years, Aeroplan miles aren’t quite the valuable currency they once were. However, there are still some valuable perks and ways

[Offers contained within this article may no longer be available] The American Express® Premier Rewards Gold Card and the Citi Thankyou Premier are two of the best travel rewards credit cards

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |