The Platinum Card® from American Express is one of the top travel cards for individuals looking for a host of travel benefits, such as premier lounges access, Global Entry, hotel and rental car status, and solid purchase protections. The Platinum Card® comes with a pretty hefty annual fee, so many potential applicants wonder if it’s worth it to apply. Here’s a review of the Platinum Card® from American Express that will shed some light on whether or not this card is for you.

Charge card vs Credit Card

I’ll start off with the basics.

The Platinum Card® from American Express is a “charge card,” which means that it must be paid off in full each month or else you face a hefty monthly fee. The benefit to a charge card is that you’re not restricted to a credit limit and so you have a little more flexibility — you just need to be able to keep yourself in check to make sure you’ll pay off your balance in full each month.

American Express will often offer you the opportunity to “pay over time,” however. This essentially turns your charge card into a hybrid credit/charge card and allows you to carry a balance. Typically, American Express will monitor your spending habits for approximately one year and then offer you this option (though sometimes it comes sooner).

In addition to being able to carry a balance, there are two benefits to the pay over time option. One, American Express does not conduct a hard pull on your credit when they check your eligibility. They run a soft-check in conjunction with their own internal credit check system. Second, American Express will usually offer you some kind of incentive and reward you with Membership Rewards for opting into pay over time.

American Express Transfer Partners

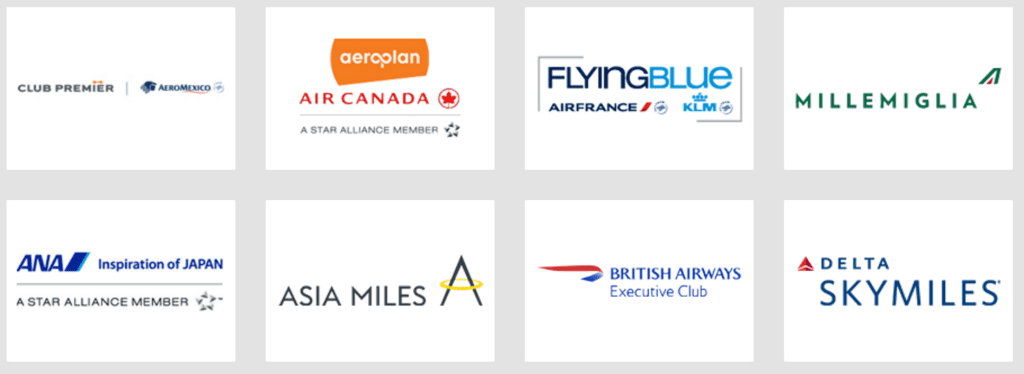

American Express cards like the Platinum Card® earn you Membership Rewards. They are generally considered one of more valuable reward currencies and these points can be transferred to several different airline and hotel partners. Below is a list of the eligible travel partners.

Airlines

These partners do not have all have the same transfer ratios as you can see below:

- Delta Skymiles

- Club Premier AeroMexico

- Aeroplan Air Canada

- Flying Blue (Air France/KLM)

- MilleMigilia Club Alitalia

- ANA

- Asia Miles

- Avios British Airways (250 points = 200 Avios)

- Emirates Skyrewards

- Hawaiin Airlines

- Iberia Plus

- JetBlue

- KrisFlyer Singapore Airlines

- Virgin America (200 points = 100 Elevate points)

- Virgin Atlantic

Hotels

- Best Western Rewards

- Choice Privileges

- Hilton HHonors (1,000 points = 1,500 HHonors points)

- SPG (Starwood Preferred Guest) (1,000 points = 333 Starpoints)

There are a few things to keep in mind about Membership Rewards:

- Bonus transfers are occasionally offered allowing you to transfer your points to partners for higher ratios. Check this thread for a history of these transfer bonuses.

- Your Membership Rewards cannot be freely transferred between you and any friend or family members

- They don’t expire as long as you remain a cardholder

Redeeming Points

If you don’t decide to transfer your Membership Rewards to other travel partners you can always utilize them for travel redemptions or purchases.

Membership Rewards can be redeemed in the following ways:

- Between .5 and 1.0 cent per point for gift cards

- 0.6 cent per point for a statement credit/charge

- 1.0 cent per point on air fare

- 0.7 cent per point on hotels, cruises, and vacation packages.

Aside from maybe using them for air fare to earn or maintain elite status, I personally do not think these are good redemption rates. I just wrote a post on booking airfare on Aeroplan (a transfer partner of Membership Rewards) and showed how you can redeem points on a round trip from the U.S. to Paris in business class with stopovers in Geneva and Brussels, with a redemption rate of over 10 cents per point. That means you could get over 5X the value when transferring your Membership Rewards to Aeroplan for that particular redemption. Compare that value to the above redemptions worth at most 1 cent per point and you can see why it’s usually discouraged to redeem in that way.

However, depending on the circumstances (no availability with travel partners, short on cash, etc.), it might make sense for you to redeem your points through the Amex travel portal, so don’t rule out the possibility entirely. Just make sure you consider all of your options before redeeming at what will usually be a sub-optimal rate.

Sign-up Bonus

There are several different sign-up offers for the Platinum Card® that appear for this card.

Here are the main offers:

- 40,000 Membership Rewards after you spend $3,000 within the first 90 days of opening your card. This is the current main public offer.

- 75,000 Membership Rewards after you spend $5,000 to $7,000 within the first 90 days of opening your card. This is a targeted offer with a pretty high spending requirement, so it’s not recommended for everyone.

- 100,000 Membership Rewards after you spend $3,000 within the first 90 days of opening your card. The best Platinum offer but it is a highly targeted offer usually only received by people who do not currently hold any Amex cards.

One bonus per lifetime

You need to know that American Express has a once per lifetime rule for receiving sign-up offers for its cards. There are some exceptions to this and you can read more about them in the American Express application rules article.

Bonus Category Earning

The Platinum Card® does not have any bonus categories for spending. This is probably the biggest weakness of the Platinum Card® compared to cards like the Citi Prestige.

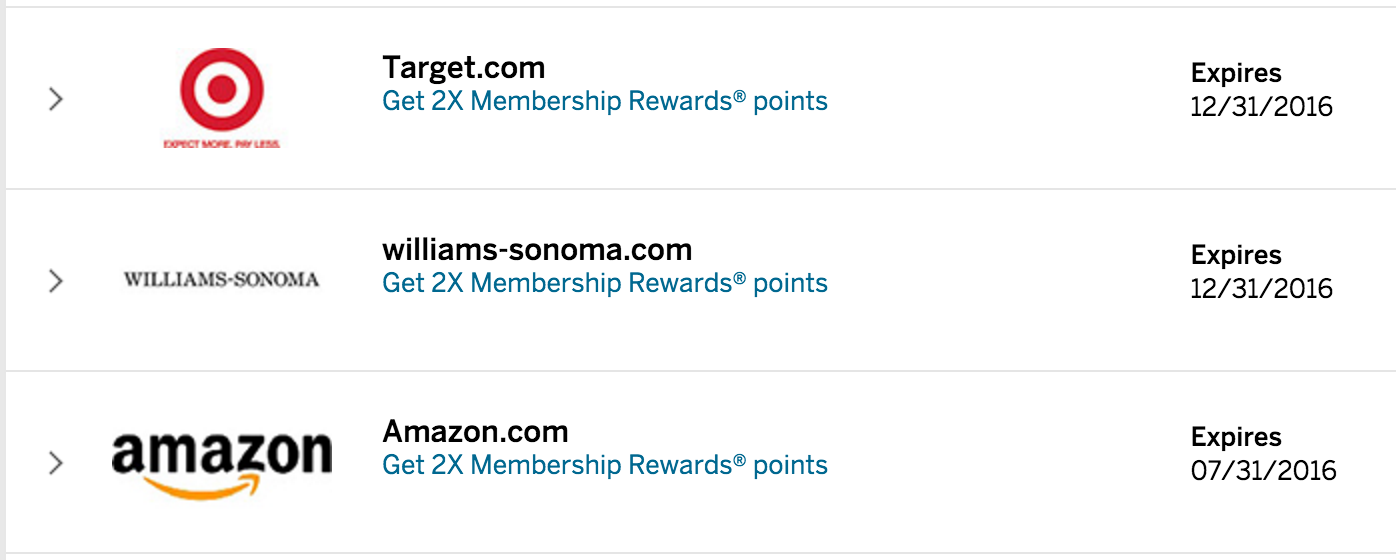

There are a couple of ways to earn bonus rates on certain categories, however. For example, you can earn 2X on purchases made through Amextravel.com. In addition, with Amex Offers, you can often earn 2X at certain retailers, such as Target, Amazon, etc.

Benefits

You can read more in-depth about the American Express Platinum Card benefits here, but here’s a run down on some of the top benefits.

Here’s a detailed breakdown of my favorite benefits of the Platinum, but in a nutshell this card confers a host of benefits to you making it worth it including:

- Priority Pass airport lounge access (worth $400 per year)

- Centurion Lounge Access (including free access for two additional guests); Delta Lounge Access (when you fly with Delta)

- $200 annual airline credit (essentially reducing the annual fee to $250)

- $100 statement credit for Global Entry/TSA Pre-Check (a Godsend that’s good for 5 years!)

- Add up to 3 authorized users for only $175 per year (for all 3)

- Gold status with Hilton and Starwood

- Free Boingo Wifi subscription (worth $120 per year)

- Rental car benefits like express check-in, free upgrades, and discounts with status.

Photo by Mighty Travels via Flickr

The Priority Pass lounge access along with Centurion lounge access are some of the most valuable benefits of the Platinum Card®. If you’re interested in relaxing in comfy lounge areas and enjoying complimentary meals and adult beverages, you should definitely look into these benefits.

The other benefits add up in value pretty quickly, too. The $200 annual airline credit, $100 statement credit for Global Entry/TSA Pre-Check, along with elite hotel status, free Boingo, and rental car status, all combine for a substantial amount of value that more than pays for the annual fee when all things are considered.

And don’t forget about the authorized user policy. For only $175 you can confer the full benefits (minus the $200 airline credit) of the Platinum Card® to up to three additional cardholders, that’s easily $1,500 worth of additional benefits for only $175!

Other Benefits

Some other highlights of the Platinum Card® include:

- Concierge Service (available 24/7)

- Cruise Privileges Program (receive credits for different cruise bookings ranging from $100 to $300)

- Save When You Fly International Business or First Class with a Companion

- Premium Roadside Assistance (towing up to 10 miles, winching, jump starts, flat tire change when Card Member has a workable spare, lockout service when key is in vehicle and delivery of up to 2 gallons of fuel)

Amex Offers

Amex Offers are promotional offers that are available to all Amex cardholders. Some of these offers will essentially provide you with free money, often giving you back $5-$15 off purchases at different online retailers. If used consistently and effectively, you can easily save yourself $100-200 a year on items you would’ve likely purchased anyway.

Foreign Transaction Fees

- No foreign transaction fees

Photo by Jesús Pérez Pacheco via Flickr

Annual Fee

- $450, not waived the first year

The annual fee is basically reduced to $250 with the annual $200 airline credit, so it’s really not quite as high as it might seem. And as seen above, the benefits this card can confer on you are far, far more valuable than $250, so always consider the return in value you are getting when looking at paying a high annual fee for a premium card like the Platinum Card®.

Travel protection

For damaged, stolen, or lost baggage, Amex may cover:

- Replacement cost of carry-on baggage up to a maximum of $3,000

- Replacement cost of checked baggage up to a maximum of $2,000 for each covered person on a Covered Trip

Car rental coverage is “excess,” which means that Amex may reimburse the Cardmember only for losses/expenses not covered by plans, such as personal auto insurance or other sources of insurance. A Cardmember must first seek payment or reimbursement and receive a determination that other plans do not provide coverage before excess coverage will reimburse the cardmember.

This excess coverage may cover:

- The cardholder for 1) the actual cost to repair the Rental Auto, 2) the wholesale Book value minus salvage and depreciation costs, or 3) the purchase invoice price of the Rental Auto minus salvage and depreciation costs.

- Certain necessary covered medical expenses incurred as a result of an accident by the Cardmember or a Passenger are payable up to a maximum of $5000 per person.

Purchase protection

The Platinum Card® has some of the best purchase protection since it protects up to $10,000 per claim — that’s much higher than many other credit cards.

Here are some of the highlights of the protections:

- Covers your new purchases for 90 days against damage or theft up to $10,000 per claim and $50,000 per account.

- Extends the time period of the U.S. manufacturer’s warranty by an additional year, on eligible warranties of five years or less.

- You can be reimbursed for eligible items that the store won’t take back within 90 days of purchase, up to $300 per item, $1,000 per year.

Final Word

The Platinum Card® from American Express can bring you exceptional value while providing you with a range of travel benefits. The lounge access to hundreds of lounges around the world, $200 annual statement credit, Global Entry, elite hotel status, and authorized user policy all are premier benefits that help set the Platinum Card® apart from many other cards.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.

First class