Amex Membership Rewards vs Ultimate Rewards [2021]

Offers contained within this article maybe expired. Amex Membership Rewards vs Ultimate Rewards — which program is better and offers more value? This is a very difficult question to answer

Offers contained within this article maybe expired. Amex Membership Rewards vs Ultimate Rewards — which program is better and offers more value? This is a very difficult question to answer

The Chase Travel Portal can be one of the best ways to utilize your hard-earned reward points. But how exactly does the Chase Travel Portal work and is it worth using? This

The Chase Sapphire Preferred is one of the flagship credit cards offered by Chase. The card has a lot going for it including a great welcome bonus, decent bonus categories,

One of the biggest reasons I enjoy earning miles and points is that it offers me the opportunity to fly on some amazing aspirational first class products. I’ve been able

A lot of people pick up cards like the Chase Sapphirre Preferred and quickly find themselves with 60,000 Chase Ultimate Rewards. But what are the best ways to maximize 60,000

Each rewards program has its own set of rules and restrictions for transferring points. If you’re relying on pooling points with a spouse or family member, it’s critical that you

Update: Some offers are no longer available — click here for the latest deals! With the recent launch of the Chase Sapphire Reserve and recent changes to the benefits of the

The Chase Sapphire Reserve is the newest benefits card to hit the market and consumers are going crazy over this card (and rightfully so). It’s a bit of a super-card,

Chase Ultimate Rewards adding Flying Blue is great news for a lot of people. I’ll run down some of the benefits and highlight some of the best redemptions for Flying

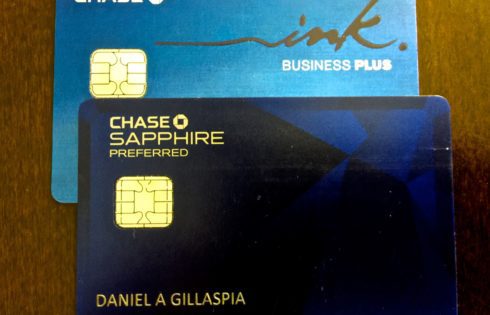

The Chase Sapphire Preferred® and the Chase Ink Plus® are two premier credit cards offered by Chase that offer some of the best sign-up bonuses, earning potential, and benefits that

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |