When flying back into the US, you’ll have to make your way through Customs which is something some people get a little nervous or stressed about even when they are not strapping kilos of a certain powdery substance to their torso….

But is there any legitimate reason for you to be nervous when making your way through customs?

Well, the honest answer is kind of.

These things can be high consequence.

But if you know what you’re doing you can avoid a lot of that stress and worry.

In this article, I’ll provide some clarity on how to handle US Customs and give you some tips so that you can relax the next time you arrive at the airport from a trip abroad.

Table of Contents

Immigration vs Customs

A lot of people get immigration and customs mixed up which is understandable because they are both : 1) under the Department of Homeland Security (DHS) and 2) a little bit scary.

However, they are ran (at the highest level) by separate but related agencies.

Immigration is administered by the U.S. Citizenship and Immigration Services (USCIS), while customs is administered by U.S. Customs and Border Protection (CBP).

The enforcement of immigration laws remains under CBP and Immigration and Customs Enforcement (ICE), which is why you see badged CBP officers running airport immigration lines.

Immigration is concerned with the status of your citizenship, where you were coming from, and what you plan on doing in the US.

Customs is more concerned with the value and nature of goods flowing in and out of the US.

One simplistic way to think about it is immigration is worried about you while customs is worried about your luggage.

Tip: Use the free app WalletFlo to help you travel the world for free by finding the best travel credit cards and promotions!

When do you deal with Customs?

Due to technology advances, the immigration and customs experience at US airports is rapidly changing.

I’ll give an overview of the general experience you can expect but just note that each airport may have a unique way of doing things, especially if they are testing out new methods.

Immigration lines and kiosks

Unless you’re arriving from an airport with Preclearance, you’ll be dealing with Immigration when you first arrive.

This is where you show your passport, scan your fingerprints, and say a little prayer so that you get back into the country without any problems.

If you have Global Entry, Mobile Passport, or some other type of membership you will head to the appropriate kiosks for those programs.

But even if you don’t have a membership with those programs you might still head to a kiosk.

Many airports are now moving to Automated Passport Control (APC) which are self-service kiosks where you can scan your passport and make declarations without filling out the traditional blue form.

After you get through Immigration, you will typically make your way through Customs which is in a separate area just beyond baggage claim.

But note that some airports combine passport control with baggage check.

So be ready for things to work a little bit differently at some airports.

Declaring or not declaring

Once you are off to baggage claim, you may see a line for people with items to declare and a separate line for people with no items to declare.

At that point, you will choose the appropriate line and if you still have your form you will hand it over to an agent at Customs.

If you have items to declare the agent may let you pass without inspection or he or she may choose to put you through an inspection.

A lot of times the agent may ask you what you have and if you simply tell them something simple like “candy and chocolate,” they will let you go on through.

If you have nothing to declare chances are you can get through without any delay but you could always be subject to a random secondary screening.

Unstaffed checkpoints

Sometimes there’s no CBP agents present at a specific checkpoint and you basically just walk on through and exit the airport unless you’re questioned or targeted for more screening.

Tip: If you have Global Entry you can get expedited entry through immigration and some airports also give you expedited access through Customs.

How to deal with US customs forms

With the way things are changing, you may not even have to fill out one of those infamous blue customs forms anymore. Instead, you might be able to handle everything electronically at a kiosk.

Even if you go the electronic route, you should still check out the information below because it will be helpful in letting you know what items need to be declared.

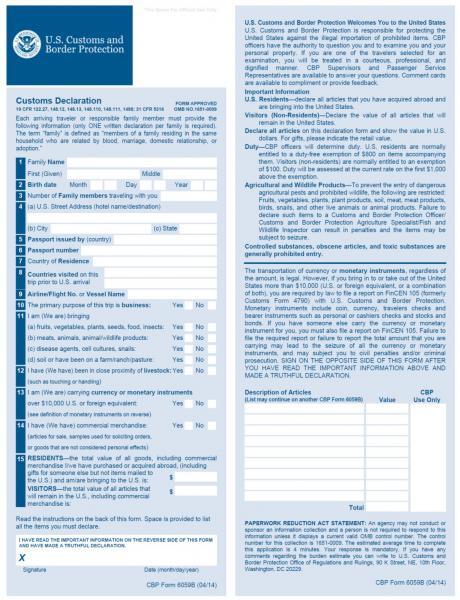

If you still have to fill out the paper forms, the average US traveler arriving at a US airport will only need to focus on the elements found on CBP Declaration Form 6059B.

The first 10 items on the form consist of basic contact information and are easy to fill out but the remaining items are a little bit more tricky.

Specifically, items 11 through 15 are the items you don’t want to mess up on.

I’ll go through the main items in detail below.

But something to keep in mind is that you can fill out this form online by typing in your responses and then print it out so that you are not stressing out over your lost pen or filling out the form via a kiosk.

Item 11 (food and agriculture items)

Item 11 is where you will declare certain types of plants and wildlife products if you are bringing them into the country.

This section has four different subsections a, b, c, and d.

- Fruits, vegetables, plants, seeds, food, insects

- Meat, animals, animal/wildlife products

- Disease agents, cell cultures, snails

- Soil or recent exposure to farms, ranches, pastures

These are all pretty obvious and self-explanatory.

When in doubt about declaring an item, you should always assume they will be defined liberally.

Why?

Well, for starters failure to declare food products can result in up to $10,000 in fines and penalties!

If you declare something and it is not allowed you will not get penalized at all.

Where things gets confusing is knowing what exactly will be allowed through Customs after you declare the item and it gets inspected.

That’s because the regulations can get super specific with some food items and be dependent on the countries they come from.

To help you out, I’ve rounded up some of the key details related to popular items you might declare.

If you have any of these items you will need to take a deeper dive to make sure you are in compliance but I will show you where to go to get that information below.

All food items

Something that is not terribly clear from the customs form is that “[y]ou must declare all food products.” The word “food” is found on 11(a) but a lot of people seem to miss it.

That’s probably because they skip over it after reading the first few items that don’t apply to them like fruits, vegetables, plants, and seeds.

I do think food should be featured more prominently but it’s definitely right there in the form.

This means that you need to declare things like:

- Bread

- Cookies, crackers, cakes

- Granola bars, cereal and other baked and processed products

- Candy and chocolate

- Cheese

- Nuts

Don’t forget, you have to declare items even if you purchased them from duty-free stores.

With that out-of-the-way, here are some key things to keep in mind when bringing in different items.

Fruits and vegetables

- Almost all fresh and frozen fruits and vegetables (whole or cut) are prohibited.

- Most dried fruits and vegetables are not allowed.

- Commercially canned fruits and vegetables are okay but not home-canned products.

Plants

- Some plants are allowed to be brought in but others will require advance permission.

- It can take up to 30 business days to process permits so this is something you need to plan well in advance.

- Make sure that your seeds or plants are not affected by any restrictions like the Endangered Species Act.

- You may nee to obtain a phytosanitary certificate.

Meats and poultry

- You can bring in some meats and poultry but you have to make sure they are not coming from countries affected with certain diseases (aka most countries).

- You will need to prove the origin of where you got the meat from which you can do with things like the packaging or your passport/boarding pass.

- Cured hams (prosciutto, Serrano ham, Iberian ham) and salami from areas within France, Germany, Italy and Spain are not allowed.

- Bringing more than 50 pounds would be considered a commercial shipment and must meet additional requirements.

Soil

- Soil from all other countries (and from Hawaii, Puerto Rico, and all U.S. territories) is prohibited from entering the United States without a permit.

Tea & Coffee

- You can bring any quantity of products composed solely of tea leaves

- You can bring unlimited quantities of roasted coffee

- You can usually bring in comb honey, royal jelly, bee bread, or propolis if intended for personal consumption

Nuts

- Nuts are allowed entry if they have been boiled, cooked, ground, oven dried, pureed, roasted, or steamed.

Milk and dairy

- Most milk and dairy items from countries with foot-and-mouth disease (FMD) are not allowed

- Solid hard or soft cheeses are allowed (as long as the cheese does not contain meat or pour like a liquid i.e. ricotta or cottage cheese)

Exposure to farms, ranches, pastures

If you’ve had exposure to farms or pastures you should proceed with the following:

- Launder all clothing worn at the farm or while in contact with animals,

- Remove any dirt or debris from shoes, equipment, or other articles before packing them,

- Shower or bathe, wash hair, clean finger nails, and clear nasal passages (blow nose), and

- Answer “yes” to question 11 on the Customs Declaration Form (Form 6059B).

To get more details on the rules for bringing in items, check out don’t pack a pest.

Item 12 (close proximity of livestock)

Item 12 is concerned if you have been in close proximity of livestock.

This could mean that you were touching or recently handling some type of cattle for example.

This is not legal advice but livestock usually includes: “cattle, sheep, horses, goats, and other domestic animals ordinarily raised or used on the farm.”

Item 13 (currency or monetary instruments)

We have a detailed article on traveling with cash which you should definitely check out.

You may be surprised to find out that you can bring into or take out of the country as much money as you would like.

When you coming back into the country your concern needs to be declaring your money if it is valued at $10,000 or more.

With Customs you need to be concerned about cash but also other things that can be considered currency or “monetary instruments.”

Monetary instruments include: “coin, currency, travelers checks and bearer instruments such as personal or cashiers checks and stocks and bonds”

If the total value of these is more than $10,000 you will have to report on FinCEN 105.

Keep in mind this amount applies to everyone on the joint declaration form if you have multiple family members.

Failure to file the required report or failure to report the total amount that you are carrying may lead to the seizure of all the currency or monetary instruments.

So if you were coming into the country with $15,000 cash money and you do not declare that it could be seized and you may never get it back.

You could also get hit with civil penalties and/or criminal prosecution.

You just don’t want to play with US Customs.

Item 14 (commercial merchandise)

Item 14 is concerned about the commercial merchandise you are bringing in that are not considered personal effects.

This could be things like articles for sale, samples to use for soliciting orders, etc.

So for example if you purchased a large number of shirts in retail packaging that is something that would be considered commercial merchandise.

Item 15 (total value of goods)

Item 15 is different depending on if you are a resident or visitor.

If you are a resident then you need to total up the total value of all goods that you have purchased or acquired abroad.

This includes things like souvenirs and gifts for other people but not items that you have mailed it to the US.

Basically, anything you bring back that you did not have when you left the United States must be “declared.”

Keep in mind that the total is based on the total amount that you and anyone else traveling with you is bringing if you are doing a joint declaration.

So if you are filling out this form for you, your spouse, and your child, you need to consider the total for all of you.

Paying the duty

You may have to pay the duty fee if the total value of the merchandise you are bringing back is above a certain threshold.

Each individual is usually granted an $800 personal exemption which means that if all of the goods you bring back for personal or household use are under that amount you don’t have to pay anything.

However, the amount of your exemption can vary based on the countries that you have visited and there are special limits on things like alcohol and tobacco.

A joint declaration can be made by family members who live in the same household and return to the United States together.

These travelers can combine their purchases to take advantage of a combined flat duty rate.

Final word

US Customs is concerned with controlling the flow of goods that come into the country and is specifically concerned with things like food, agricultural products, and money.

Considering how you can have these items seized or be penalized in a civil manner or criminal manner, you definitely want to err on the side of declaring.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.