[Offers contained within this article may no longer be available]

American Express has dropped some great new offers in the last week. In addition to some of the best bonuses ever for the Delta Platinum and Gold card, Amex just re-introduced the 100K Surpass offer and 75K offer for the no annual fee card. These are very solid bonuses for racking up Hilton HHonors points and so here’s a look at what the two cards have to offer.

The 2 Amex Hilton Cards

1) Hilton Surpass

- Earn 100,000 Hilton HHonors points after $3,000 spend in 3 months

- Annual fee $75 (not waived first year)

2) No-Annual Fee Hilton

- Earn 75,000 Hilton HHonors points after $1,000 spend in 3 months

The Hilton Surpass

I’ve written on the Hilton Surpass 100K offer before and so I recommend taking a look at that article for a more in-depth look. However, the highlights of the Surpass include:

Valuable Sign-up bonus

- Sign-up bonus worth around $500

Bonus earning potential

- Earn 12 Hilton HHonors Bonus Points for each dollar of eligible purchases charged on your Card directly with a participating hotel or resort within the Hilton Portfolio.

- Earn 6 Hilton HHonors Bonus Points for each dollar of eligible purchases on your Card:

- at U.S. restaurants

- at U.S supermarkets

- at U.S. gas stations

- Earn 3 Hilton HHonors Bonus Points for all other eligible purchases on your Card.

These earning rates are great and Hilton often offers different kinds of promos where you can earn double the base points on Hilton stays. Those promos combined with the Surpass can be a superb way to rack up Hilton HHonors points in a hurry. For example, View From The Wing just put our an article explaining how to earn over 50 HHonors points per dollar.

Hilton HHonors Gold status

The Hilton HHonorsTMSurpass® Card offers you HHonors Gold Status. Gold status is a pretty decent benefit — you can read more about the benefits of Gold Status here but the benefits most related to this card are the following:

- 5th night free

- Complimentary breakfasts

- Potential for upgrades

Don’t forget the American Express Platinum Card also offers you complimentary gold status.

The no-annual fee HHonors card

No annual fee!

Valuable Sign-up bonus

- Sign-up bonus worth around $375

Bonus earning potential

- Earn 7 Hilton HHonors Bonus Points for each dollar of eligible purchases charged on your Card directly with a participating hotel or resort within the Hilton Portfolio.

- Earn 5 Hilton HHonors Bonus Points for each dollar of eligible purchases on your Card:

- at U.S. restaurants

- at U.S supermarkets

- at U.S. gas stations

- Earn 3 Hilton HHonors Bonus Points for all other eligible purchases on your Card.

The bonus earning potential is a little less but still very respectable.

Complimentary Silver status

- You get complimentary Silver status but you can work your way to Gold if you spend $20,000 on eligible purchases on your Card in a calendar year and you can earn HHonors Gold status through the end of the next calendar year

Silver status doesn’t offer you breakfast or upgrades so it’s not very exciting to me (though you do get complimentary internet).

Which card to apply for?

On the one hand I love no-annual fee credit cards because they allow you to age your account history without worrying about future costs. However, in this scenario, I think it all depends on your goals.

The extra 25K in HHonors points doesn’t sounds like a lot more to justify the annual fee but if your goal is two free nights at a nice hotel in a major city, 75K is probably going to be short but with the 100K offer you should be able to cover two nights (although you’ll have to contend with the annual fee). Of course, you can always rely on Hilton’s Points & Money awards if you’re short on points (assuming that option is available).

I’m a big proponent of combining Hilton cards together to quickly amass upwards of 180K Hilton HHonors points. However, remember that American Express will usually not approve you for two credit card applications at once and the max amount of credit cards you can have from Amex is probably 5.

Many do report exceptions to the “no 2 Amex credit cards at once” rule but if it were me, I’d give it a few days to a week if I were going for two credit cards or consider going with a Citi Hilton card if I wasn’t going to violate any Citi credit card rules (like having earned another Hilton bonus in past 24 months.

In order to decide whether or not to apply for one or two cards you’ll probably want to estimate how far Hilton HHonors points can get you.

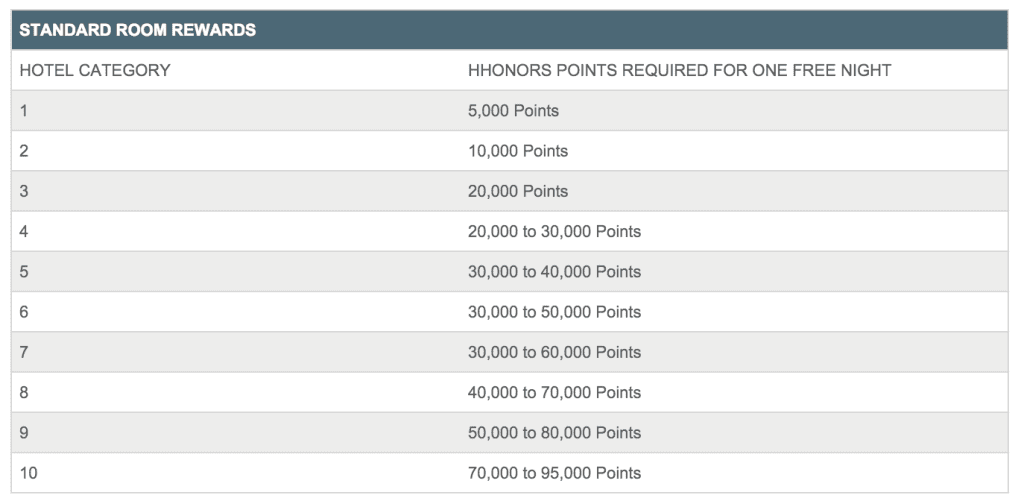

How far do Hilton points get you?

For a nice hotel in a major city, you’re probably looking at around 40,000 to 60,000 points a night. For example, if you wanted to book a Hilton hotel in the major tourist areas of Chicago (e.g., Mag Mile), it’s currently at a minimum of 50,000 for a cat 6 and 80,000 per night for South Beach, Miami at a minimum cat 9.

Note: I’d probably go with the Citi Hilton Reserve (2 free weekend nights) if I were aiming for a cat 8 or higher hotel.

So while 100K sounds like a lot, odds are you’ll probably just be able to land 2 or maybe 3 nights at a decent hotel in a major city and 1 or 2 nights at a solid hotel. However, it’s always possible if you’re really flexible to maximize the value of these points by staying on properties in places like Asia or random countries like Egypt. On some of those properties, you could squeeze a week or much longer out of the sign-up bonus.

An easy way to search for hotels based on reward points is to use Awardomatic. Just zoom in to whichever destination you’re thinking about visiting and use the tool on the top left to filter properties by point value. It won’t take long for you to get a sense of the point requirements for a given destination.

Final Word

In the end, I would probably hold off for another couple of weeks since there are rumors swirling of a possible new Amex card. I don’t think there’s going to be a new Amex premium card but who knows what might be in the works? If nothing ends up happening then I’d probably consider jumping on one or two of these cards if you think Hilton stays are in your future. Remember, Amex bonuses are once per lifetime so you might as well jump on the best offers when you can.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.