New American Express Hilton HHonors Offers (100K and 75K)

[Offers contained within this article may no longer be available] American Express has dropped some great new offers in the last week. In addition to some of the best bonuses

[Offers contained within this article may no longer be available] American Express has dropped some great new offers in the last week. In addition to some of the best bonuses

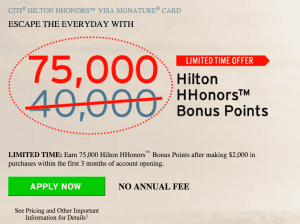

[Offers contained within this article may no longer be available] The Citi Hilton HHonors Visa Signature Card offer is back where you can earn 75,000 HHonors Points after making $2,000 in purchases within

[Offers contained within this article may no longer be available] The Citi Hilton HHonors Reserve Card is now offering a new promotion where you can earn 2 free weekend nights after

[Offers contained within this article may no longer be available] American Express is once again offering its best offer for the Hilton HHonors Surpass Card. You can get 100,000 Hilton HHonors Bonus

Right now, it’s very easy to obtain Hilton HHonors Diamond status. In fact, if you follow two easy steps you could have Hilton HHonors Diamond status within a couple of

[Offers contained within this article may no longer be available] Right now, there’s a great opportunity to earn over 150,000 Hilton HHonors points for just spending $3,000 in 3 months

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |