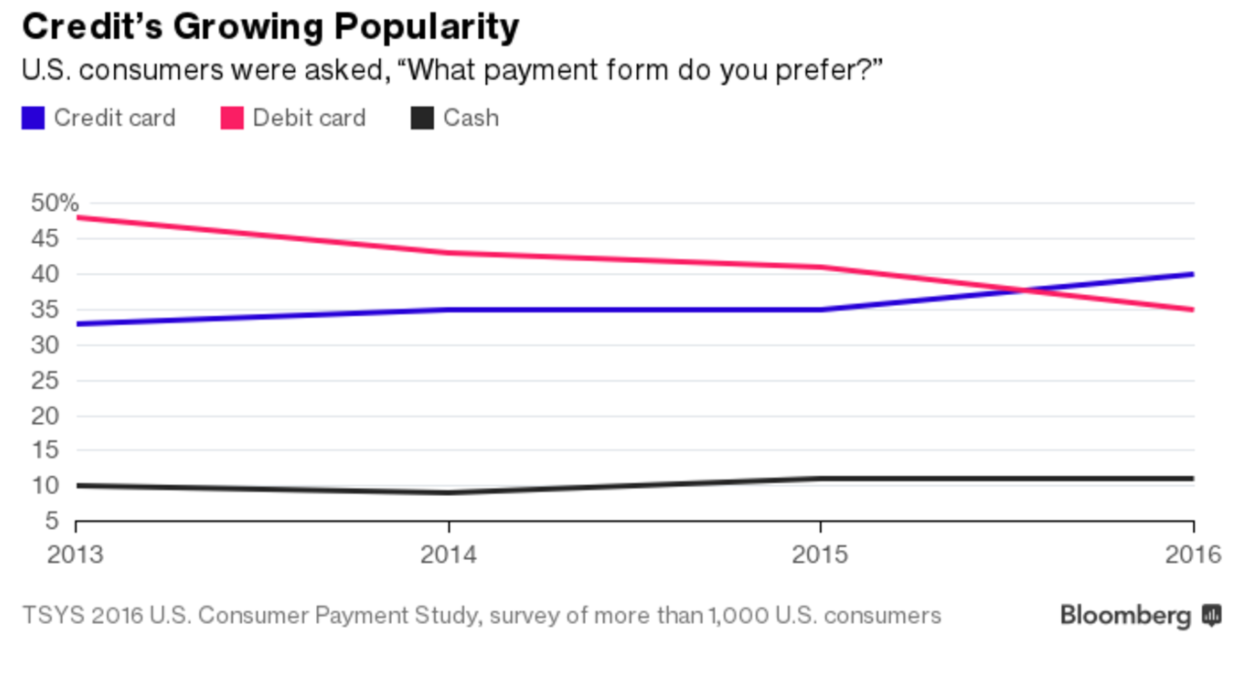

Bloomberg just published an article detailing the increase in credit card usage in the US and some of the numbers are pretty interesting, although not very surprising to me. Total System Services, Inc., or TSYS conducts an annual survey in which they measure the usage of credit versus debit. In 2016, it showed for the first time that credit card usage was preferred over debit card usage by US consumers.

This doesn’t surprise me given the huge uptick in interest in rewards cards over the past couple of years. We’ve seen some online communities and blogs related to credit card rewards explode in popularity and growth and I honestly think we’re still probably just seeing the beginning of this growth. If the economy continues to see sustained recovery or even remains stable, I think that we’ll see record growth in credit card usage over 2017 and 2018, probably at a higher pace than we’re seeing right now.

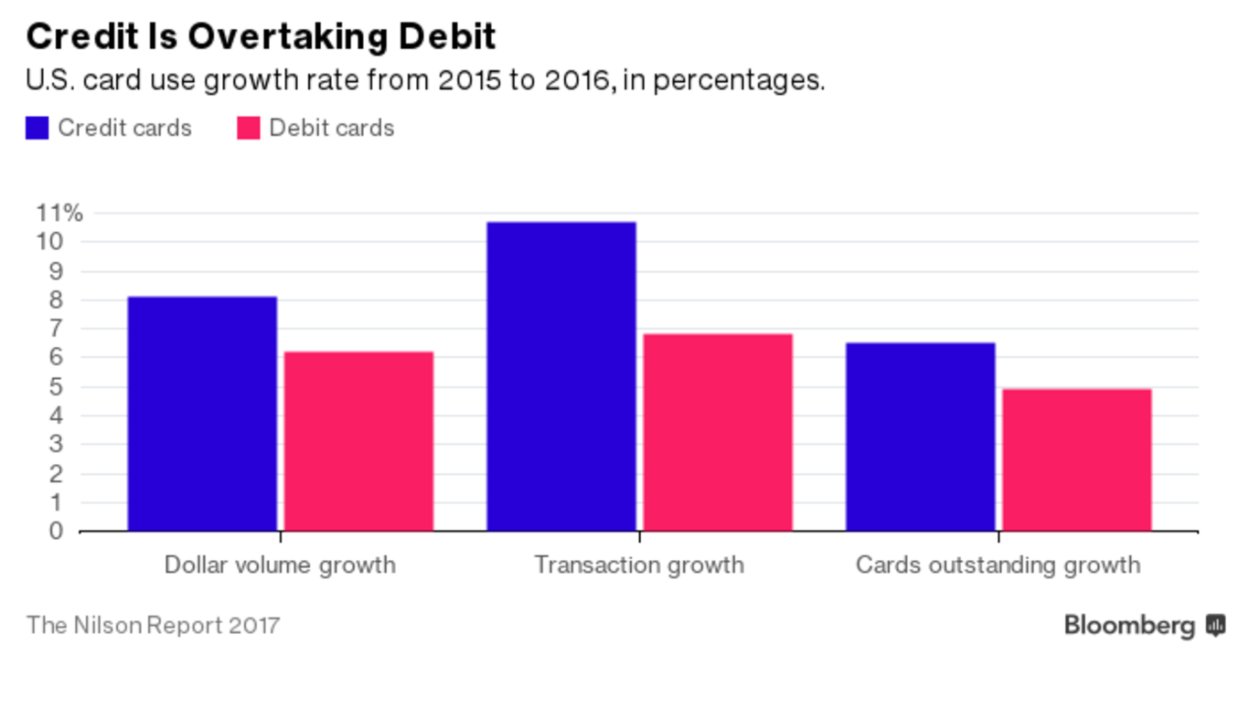

The survey further supports this by showing that credit card usage has been growing at an accelerated rate quicker than debit card usage, especially with respect to transaction growth.

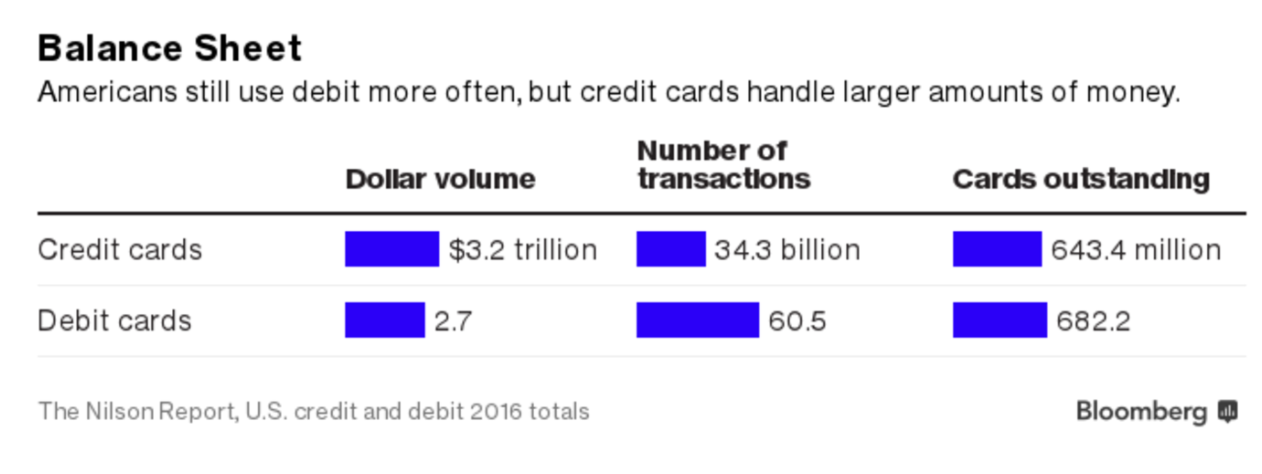

Although US consumers prefer credit card payments over debit cards and transaction growth is accelerating for credit cards, consumers still use debits cards for more transactions. Yet, credit cards still account for a larger chunk when you measure the dollar volume of purchases, since credit cards are more likely to be used for bigger purchases.

Although US consumers prefer credit card payments over debit cards and transaction growth is accelerating for credit cards, consumers still use debits cards for more transactions. Yet, credit cards still account for a larger chunk when you measure the dollar volume of purchases, since credit cards are more likely to be used for bigger purchases.

What’s the reason for all of this growth?

What’s the reason for all of this growth?

The strengthening economy is undoubtedly a significant factor. As the economy grows, lenders become more liberal with approvals and as incomes grow consumers feel more comfortable about taking on debt and likely just feel more open to credit cards in general.

Another major factor is the rapid spread of information about these valuable credit cards. More and more consumers are getting educated about credit cards and realizing the value proposition of these cards. Almost 60% of TSYS survey respondents indicated that rewards were their top concern for their credit card rewards.

Credit card companies are also catering to this growing interest. Mailers and targeted emails for credit cards have been commonplace for a while but now we’re seeing an uptick in substance offered.

We’ve seen new lucrative cards roll out over the past year like the Chase Sapphire Reserve and we’ve seen intense competition from American Express as it made changes to the Platinum Card® from American Express. Other premium cards have also recently entered the market and the heightened competition is breeding some innovative rewards cards like the Altitude Reserve that earns 3X on mobile wallet purchases.

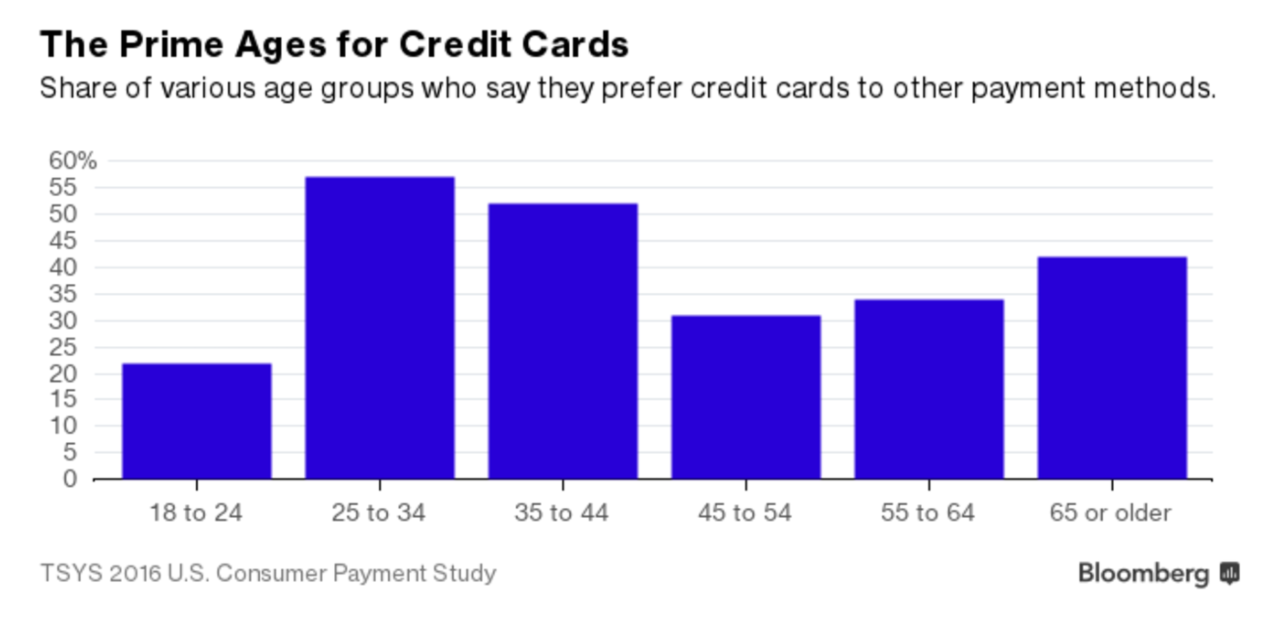

This interest in using credit cards is most pronounced for those of us between the ages of 18 to 24 (us so-called “millennials”). Again, with rising incomes and being so connected with the spread of information, I think it makes a lot of sense that this age bracket is the most open to credit cards.

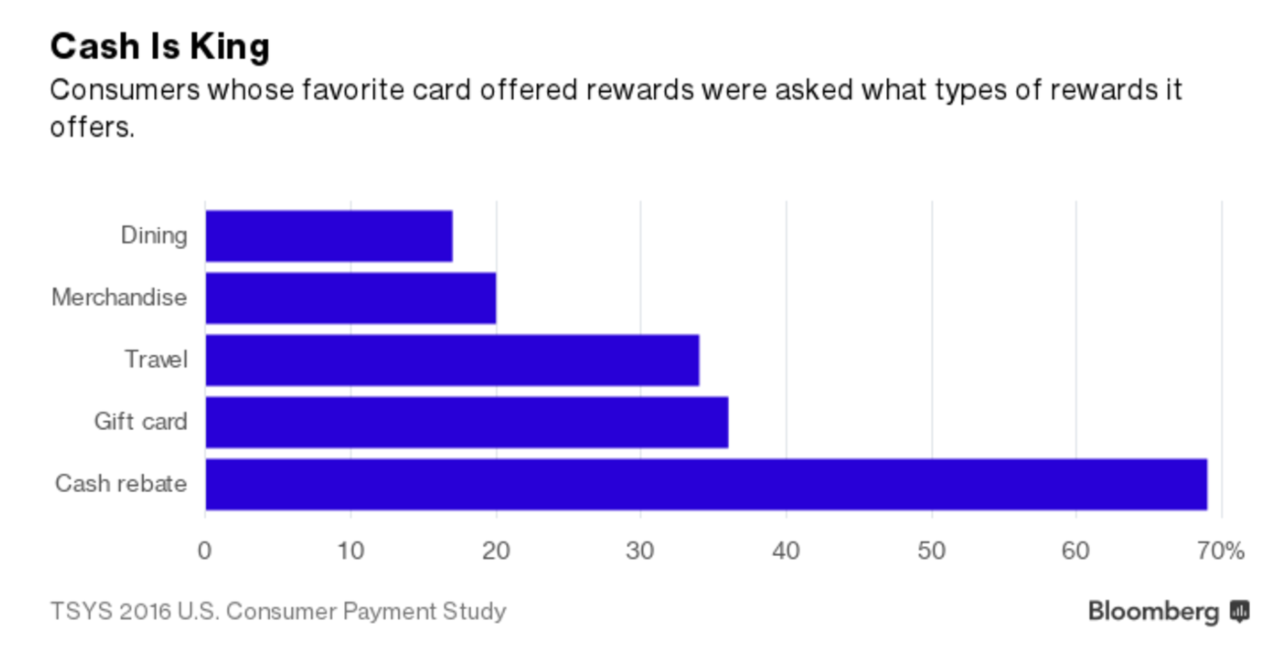

The one finding from this survey that did surprise me is that the vast majority of respondents prefer cash back for their rewards. I figured cash back would be king but I didn’t realize how far ahead it would be of the other reward categories like travel. Even gift cards rank higher than travel.

This should make us feel a little bit better about our travel perks coming to a demise due to everyone taking advantage of them. I don’t doubt that the travel rewards sector of credit card consumers is probably also seeing a lot of accelerated growth but it’s clear that the vast majority of consumers are concerned with cash back and I think we can feel little bit better that travel is still secondary to that.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.