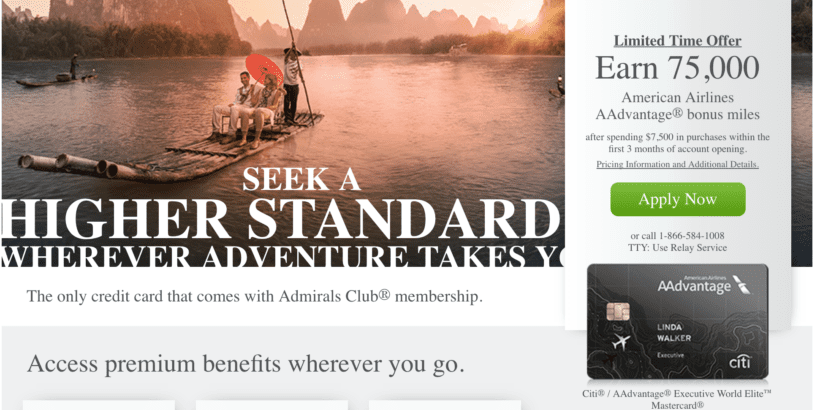

Citi is now offering a 75,000 mile sign-up bonus for the the Citi® / AAdvantage® Executive World Elite MasterCard® after you spend $7,500 in the first 3 months. The standard public offer for this card is 50,000 miles after spending $5,000 in the first three months, so this offer comes with more of a spending burden, but it still might be worth it.

Update: Some offers are no longer available — click here for the latest deals!

The offer

- 75,000 miles sign-up bonus after you spend $7,500 in the first 3 months

- Admirals Club access (free for authorized users)

- Priority check-in, airport screening, and early boarding on domestic flights (where available)

- First checked bag free on domestic American Airlines itineraries for you and up to eight travel companions.

- Earn 10,000 Elite Qualifying Miles (EQMs) after spending $40,000 in eligible purchases that post to the cardmember’s account during a calendar year

- Reduced mileage awards

- TSA Pre-Check/Global Entry $100 credit

- 2X on every American Airlines purchase

- Subject to the Citi 24 month rule

You apply for the card here:

The sign-up bonus

The 75,000 sign-up bonus is solid, although I’ve seen this card offer a 100,000 mile sign-up bonus before. If you just wanted the miles, you might consider going for the Citi® / AAdvantage® Platinum Select® World Elite MasterCard®, which you can often find offering 60,000 or 50,000 miles.

The Platinum Select comes in both a personal and a business version, so it’s possible to earn up to 120,000 AAdvantage miles just from those two cards. What’s more, the annual fee is typically waived for the first year, so you can net all of those miles without even paying a cent.

There’s also the AAdvantage® Aviator™ Red World Elite Mastercard® that’s issued from Barclayard. It comes with an annual fee of $95 (not waived) but it provides you with 50,000 miles after your first purchase, making it one of the most worthwhile sign-up bonuses available.

So if you just want AA miles, I’d check out other options which can prove to be much cheaper. However, if you’re into other benefits, this card might be the better option.

Admiral Club access

After the Citi Prestige® Card announced that it was dropping Admiral Club access, the Executive card increased in value since it became the go-to card for Admiral Club access.

This card comes with Admiral Club access that has a great guest policy. Immediate family members (spouse or domestic partner and children under eighteen (18) years of age) or up to two (2) guests traveling with the primary cardmember or Authorized User may be admitted for free when accompanied by the primary cardmember or Authorized User.

This is great because not only can the authorized user get access to Admiral Clubs when the primary cardholder is not around but the authorized user is even allowed to bring in up to two guests. This is pretty exceptional considering that you can add up to 10 authorized users free of charge.

The drawback is that authorized users aren’t given full access to Admiral Club membership. For example, the Authorized User access benefit does not provide:

- Access privileges to the Arrivals Lounge,

- Access privileges to Flagship Lounge facilities or

- Access privileges to other airline lounges or clubs with which American Airlines may have reciprocal lounge or club access privileges, including lounges operated by members of the oneworld alliance

For many, the liberal authorized user and guest policy make this card worthwhile, even with its $450 annual fee and restrictions for authorized users.

Other benefits

The other benefits of the card are pretty standard. Don’t forget that you can obtain many of these benefits, such as priority check-in and boarding even when you go with a cheaper card like the Citi Platinum Select.

EQMs

Earning 10,000 MQMs for $40,000 spend is great for those working to climb their way up the American elite ranks. 10,000 miles will almost get you halfway to the 25,000 EQMs needed for Gold status.

Final word

If you’re interested in Admiral Club access this credit card is a great option. If you’re just trying to supplement your AAdvantage miles, I’d make sure to look at the other options first since they have no annual fee, since you could earn a significant amount of AA miles without incurring the $450 fee.

Daniel Gillaspia is the Founder of UponArriving.com and the credit card app, WalletFlo. He is a former attorney turned travel expert covering destinations along with TSA, airline, and hotel policies. Since 2014, his content has been featured in publications such as National Geographic, Smithsonian Magazine, and CNBC. Read my bio.